Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You currently hold a $50,000 investment in Telus stock. It has 9% expected return and 18% volatility. A market index fund is available with

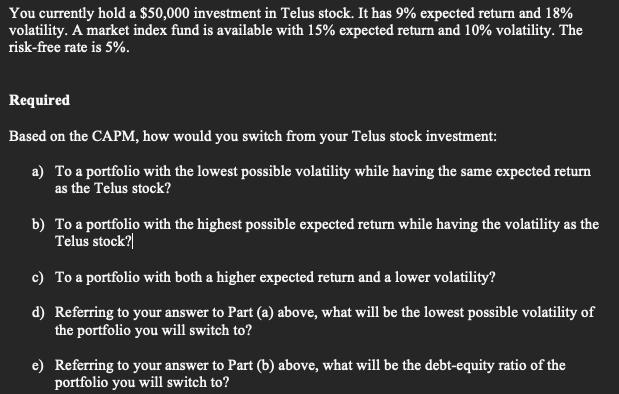

You currently hold a $50,000 investment in Telus stock. It has 9% expected return and 18% volatility. A market index fund is available with 15% expected return and 10% volatility. The risk-free rate is 5%. Required Based on the CAPM, how would you switch from your Telus stock investment: a) To a portfolio with the lowest possible volatility while having the same expected return as the Telus stock? b) To a portfolio with the highest possible expected return while having the volatility as the Telus stock? c) To a portfolio with both a higher expected return and a lower volatility? d) Referring to your answer to Part (a) above, what will be the lowest possible volatility of the portfolio you will switch to? e) Referring to your answer to Part (b) above, what will be the debt-equity ratio of the portfolio you will switch to?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer the questions based on the Capital Asset Pricing Model CAPM we need to calculate the required variables using the given information Given data Telus Stock Expected Return Telus 9 Volatility ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started