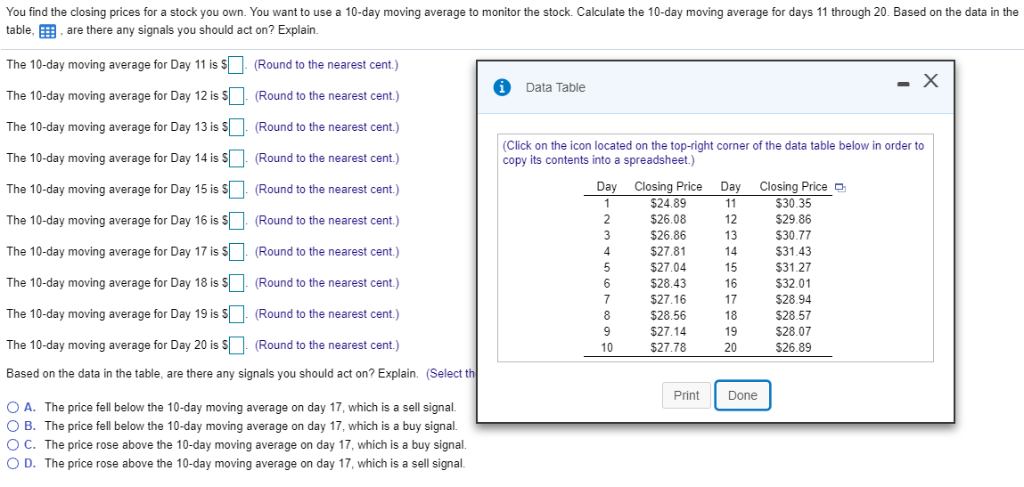

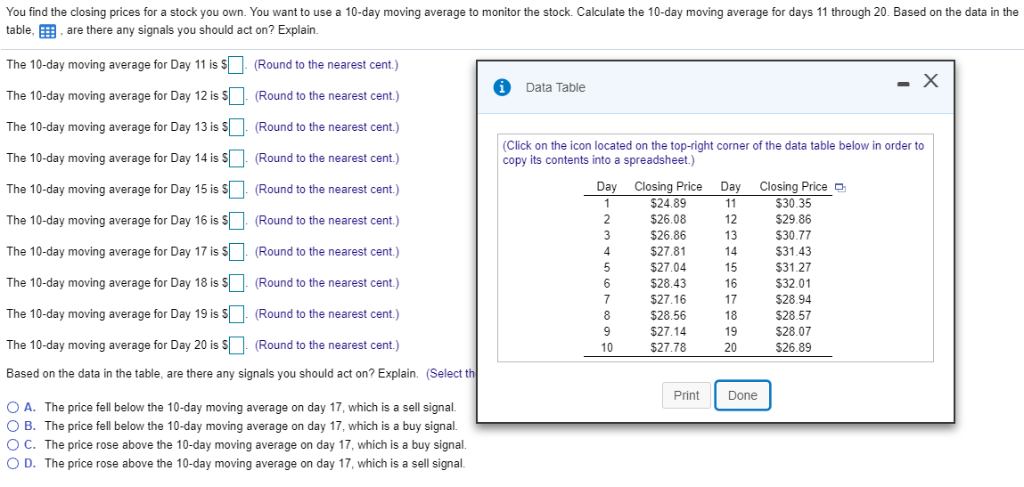

You find the closing prices for a stock you own. You want to use a 10-day moving average to monitor the stock. Calculate the 10-day moving average for days 11 through 20. Based on the data in the table, EEB. are there any signals you should act on? Explain. The 10-day moving average for Day 11(Round to the nearest cent.) The 10-day moving average for Day 12 is S Round to the nearest cent) The 10-day moving average for Day 13 is Round to the nearest cent.) The 10-day moving average for Day 14 is s (Round to the nearest cent) The 10-day moving average for Day 15 is (Round to the nearest cent.) The 10-day moving average for Day 16 is S(Round to the nearest cent) The 10-day moving average for Day 17 is SRound to the nearest cent) The 10-day moving average for Day 1 is (Round to the nearest cent.) The 10-day moving average for Day 19 is S (Round to the nearest cent.) Data Table Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Day Closing Price Day Closing Price $24.89 26.08 $26.86 $27.81 $27.04 $28.43 27.16 $28.56 $27.14 $27.78 12 13 14 15 16 17 18 19 20 $30.35 $29.86 $30.77 $31.43 $31.27 $32.01 $28.94 28.57 28.07 26.89 6 The 10-day moving average for Day 20 is s (Round to the nearest cent) 10 Based on the data in the table, are there any signals you should act on? Explain. (Select t Print Done O A. The price fell below the 10-day moving average on day 17, which is a sell signal. O B. The price fell below the 10-day moving average on day 17, which is a buy signal O C. The price rose above the 10-day moving average on day 17, which is a buy signal O D. The price rose above the 10-day moving average on day 17, which is a sell signal. You find the closing prices for a stock you own. You want to use a 10-day moving average to monitor the stock. Calculate the 10-day moving average for days 11 through 20. Based on the data in the table, EEB. are there any signals you should act on? Explain. The 10-day moving average for Day 11(Round to the nearest cent.) The 10-day moving average for Day 12 is S Round to the nearest cent) The 10-day moving average for Day 13 is Round to the nearest cent.) The 10-day moving average for Day 14 is s (Round to the nearest cent) The 10-day moving average for Day 15 is (Round to the nearest cent.) The 10-day moving average for Day 16 is S(Round to the nearest cent) The 10-day moving average for Day 17 is SRound to the nearest cent) The 10-day moving average for Day 1 is (Round to the nearest cent.) The 10-day moving average for Day 19 is S (Round to the nearest cent.) Data Table Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Day Closing Price Day Closing Price $24.89 26.08 $26.86 $27.81 $27.04 $28.43 27.16 $28.56 $27.14 $27.78 12 13 14 15 16 17 18 19 20 $30.35 $29.86 $30.77 $31.43 $31.27 $32.01 $28.94 28.57 28.07 26.89 6 The 10-day moving average for Day 20 is s (Round to the nearest cent) 10 Based on the data in the table, are there any signals you should act on? Explain. (Select t Print Done O A. The price fell below the 10-day moving average on day 17, which is a sell signal. O B. The price fell below the 10-day moving average on day 17, which is a buy signal O C. The price rose above the 10-day moving average on day 17, which is a buy signal O D. The price rose above the 10-day moving average on day 17, which is a sell signal