Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been approached by the President of Socks Manufacturing Limited to assist them in completing their financial statements for the year ended December

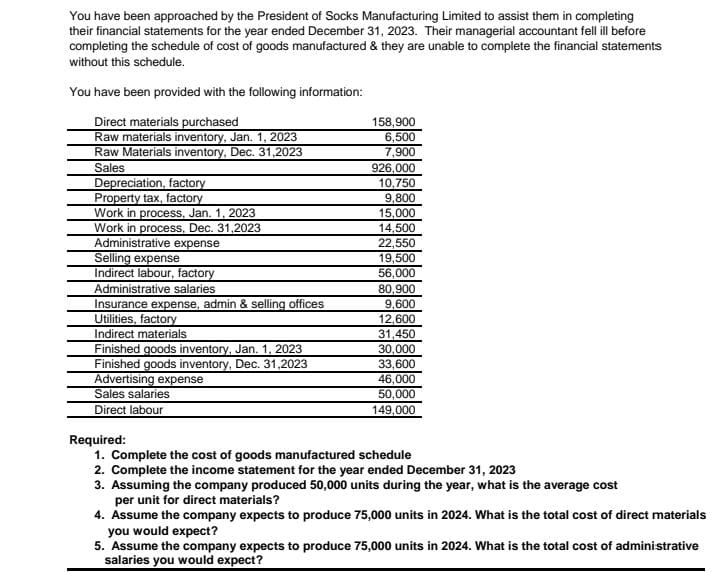

You have been approached by the President of Socks Manufacturing Limited to assist them in completing their financial statements for the year ended December 31, 2023. Their managerial accountant fell ill before completing the schedule of cost of goods manufactured & they are unable to complete the financial statements without this schedule. You have been provided with the following information: Direct materials purchased 158,900 Raw materials inventory, Jan. 1, 2023 6,500 Raw Materials inventory, Dec. 31,2023 7,900 Sales 926,000 Depreciation, factory 10,750 Property tax, factory 9,800 Work in process, Jan. 1, 2023 15,000 Work in process, Dec. 31,2023 14,500 Administrative expense 22,550 Selling expense 19,500 Indirect labour, factory 56,000 Administrative salaries 80,900 Insurance expense, admin & selling offices 9,600 Utilities, factory 12,600 Indirect materials 31,450 Finished goods inventory, Jan. 1, 2023 30,000 Finished goods inventory, Dec. 31,2023 33,600 Advertising expense 46,000 Sales salaries 50,000 Direct labour 149,000 Required: 1. Complete the cost of goods manufactured schedule 2. Complete the income statement for the year ended December 31, 2023 3. Assuming the company produced 50,000 units during the year, what is the average cost per unit for direct materials? 4. Assume the company expects to produce 75,000 units in 2024. What is the total cost of direct materials you would expect? 5. Assume the company expects to produce 75,000 units in 2024. What is the total cost of administrative salaries you would expect?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started