Answered step by step

Verified Expert Solution

Question

1 Approved Answer

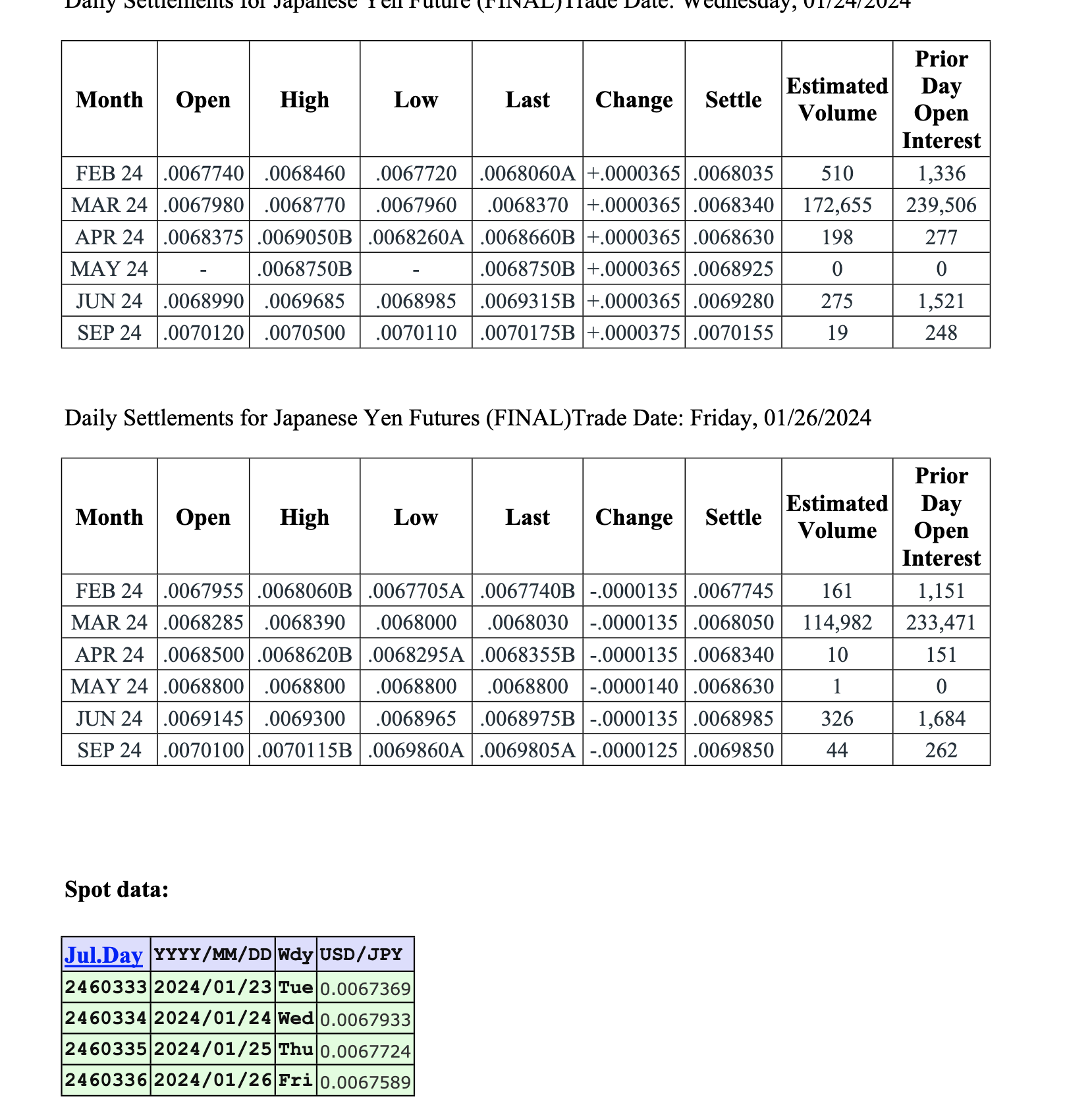

You have to make a 9 0 , 0 0 0 , 0 0 0 payment in Japanese Yen on the close of business day,

You have to make a payment in Japanese Yen on the close of business

day, Friday, January You decide to hedge your risk with futures contracts.

Assume that you enter into the futures position at the close of day on Tuesday,

January Futures and spot data are provided in the file HWdata.doc. The

contract size is yen.

a Describe the position you decide to enter long or short

b Describe the contract what month, and what quantity

c Document the gain or loss due to marking to market every day that your position

is open.

d What is the total cost in US$ after you have closed out your futures positions, and

made your payment?

e What would have been the total cost in US$ if you had not hedged? Did you

benefit from hedging?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started