Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You just had your 24th birthday today and have accepted a position at CDI.com. Your salary will be paid annually with the first year's

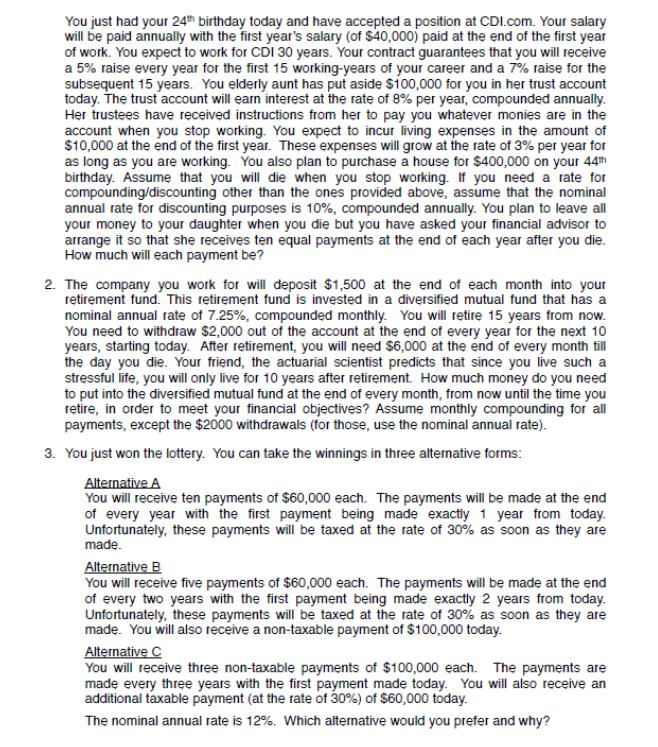

You just had your 24th birthday today and have accepted a position at CDI.com. Your salary will be paid annually with the first year's salary (of $40,000) paid at the end of the first year of work. You expect to work for CDI 30 years. Your contract guarantees that you will receive a 5% raise every year for the first 15 working-years of your career and a 7% raise for the subsequent 15 years. You elderly aunt has put aside $100,000 for you in her trust account today. The trust account will earn interest at the rate of 8% per year, compounded annually. Her trustees have received instructions from her to pay you whatever monies are in the account when you stop working. You expect to incur living expenses in the amount of $10,000 at the end of the first year. These expenses will grow at the rate of 3% per year for as long as you are working. You also plan to purchase a house for $400,000 on your 44th birthday. Assume that you will die when you stop working. If you need a rate for compounding/discounting other than the ones provided above, assume that the nominal annual rate for discounting purposes is 10%, compounded annually. You plan to leave all your money to your daughter when you die but you have asked your financial advisor to arrange it so that she receives ten equal payments at the end of each year after you die. How much will each payment be? 2. The company you work for will deposit $1,500 at the end of each month into your retirement fund. This retirement fund is invested in a diversified mutual fund that has a nominal annual rate of 7.25%, compounded monthly. You will retire 15 years from now. You need to withdraw $2,000 out of the account at the end of every year for the next 10 years, starting today. After retirement, you will need $6,000 at the end of every month till the day you die. Your friend, the actuarial scientist predicts that since you live such a stressful life, you will only live for 10 years after retirement. How much money do you need to put into the diversified mutual fund at the end of every month, from now until the time you retire, in order to meet your financial objectives? Assume monthly compounding for all payments, except the $2000 withdrawals (for those, use the nominal annual rate). 3. You just won the lottery. You can take the winnings in three alternative forms: Alternative A You will receive ten payments of $60,000 each. The payments will be made at the end of every year with the first payment being made exactly 1 year from today. Unfortunately, these payments will be taxed at the rate of 30% as soon as they are made. Alternative B You will receive five payments of $60,000 each. The payments will be made at the end of every two years with the first payment being made exactly 2 years from today. Unfortunately, these payments will be taxed at the rate of 30% as soon as they are made. You will also receive a non-taxable payment of $100,000 today. Alternative C You will receive three non-taxable payments of $100,000 each. The payments are made every three years with the first payment made today. You will also receive an additional taxable payment (at the rate of 30%) of $60,000 today. The nominal annual rate is 12%. Which alternative would you prefer and why?

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Lets analyze each of the three alternatives to determine which one is the most favorable considering ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started