Answered step by step

Verified Expert Solution

Question

1 Approved Answer

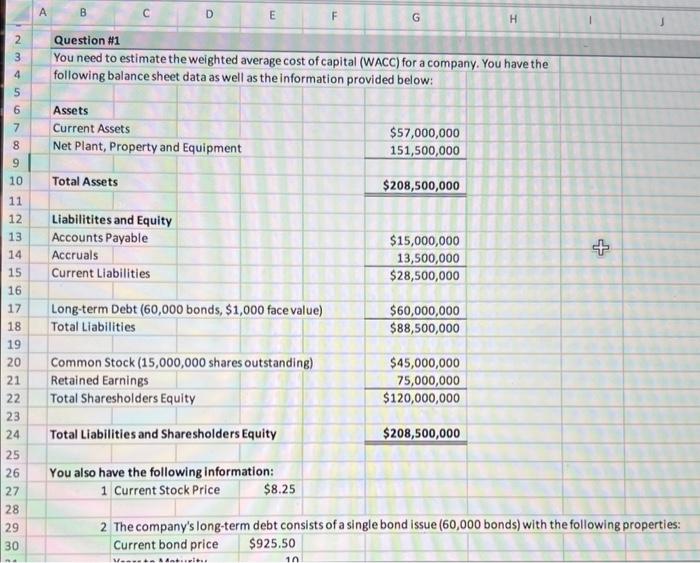

You need to estimate the weighted average cost of capital (WACC) for a company. You have the following balance sheet data as well as the

| You need to estimate the weighted average cost of capital (WACC) for a company. You have the | ||||||||

| following balance sheet data as well as the information provided below: | ||||||||

| Assets | ||||||||

| Current Assets | $57,000,000 | |||||||

| Net Plant, Property and Equipment | 151,500,000 | |||||||

| Total Assets | $208,500,000 | |||||||

| Liabilitites and Equity | ||||||||

| Accounts Payable | $15,000,000 | |||||||

| Accruals | 13,500,000 | |||||||

| Current Liabilities | $28,500,000 | |||||||

| Long-term Debt (60,000 bonds, $1,000 face value) | $60,000,000 | |||||||

| Total Liabilities | $88,500,000 | |||||||

| Common Stock (15,000,000 shares outstanding) | $45,000,000 | |||||||

| Retained Earnings | 75,000,000 | |||||||

| Total Sharesholders Equity | $120,000,000 | |||||||

| Total Liabilities and Sharesholders Equity | $208,500,000 | |||||||

| You also have the following information: | ||||||||

| 1 | Current Stock Price | $8.25 | ||||||

| 2 | The company's long-term debt consists of a single bond issue (60,000 bonds) with the following properties: | |||||||

| Current bond price | $925.50 | |||||||

| Years to Maturity | 10 | |||||||

| Coupon Rate | 5.50% | |||||||

| Payments | semi-annual | |||||||

| 3 | The company's Beta = | 1.25 | ||||||

| 4 | The company plans to change its capital structure within the next 6 months | |||||||

| The Proposed D/E ratio = | 50% | |||||||

| *Note - you are given the D/E ratio, not the D/(D+E) ratio. See hint below | ||||||||

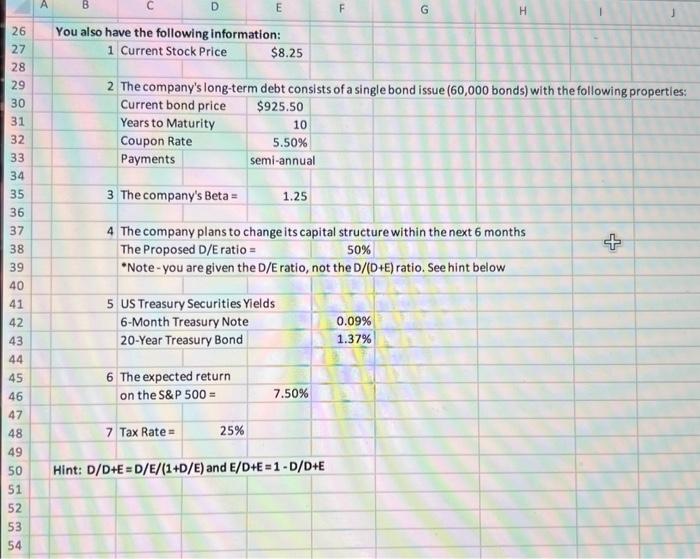

| 5 | US Treasury Securities Yields | |||||||

| 6-Month Treasury Note | 0.09% | |||||||

| 20-Year Treasury Bond | 1.37% | |||||||

| 6 | The expected return | |||||||

| on the S&P 500 = | 7.50% | |||||||

| 7 | Tax Rate = | 25% | ||||||

| Hint: D/D+E = D/E/(1+D/E) and E/D+E = 1 - D/D+E |

| |||||||

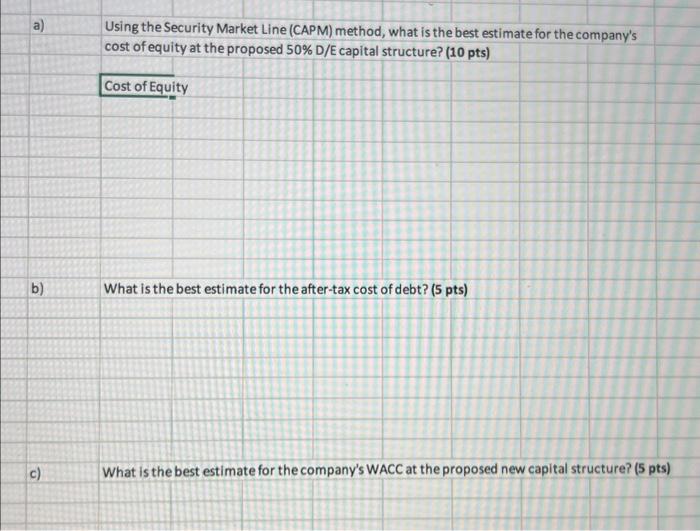

| a) | Using the Security Market Line (CAPM) method, what is the best estimate for the company's | ||

| cost of equity at the proposed 50% D/E capital structure | |||

| b) | What is the best estimate for the after-tax cost of debt? |

| c) | What is the best estimate for the company's WACC at the proposed new capital structure? |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started