Question

You own 5,000 shares of Megatronics, Incorporated (MTRN) stock. You purchased the stock 2 years ago at $119 per share and it has risen rapidly

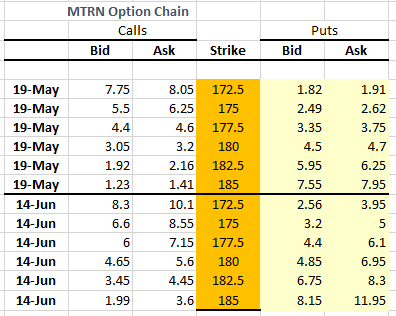

You own 5,000 shares of Megatronics, Incorporated (MTRN) stock. You purchased the stock 2 years ago at $119 per share and it has risen rapidly to $178 per share, far surpassing your original price target of $150. Despite slowing growth, your outlook for MTRN is still favorable. Though you believe MTRNs upside is now limited, due to slower expected growth, it has begun paying a substantial dividend, and you believe MTRN should continue to rise, though slowly. You are, however, concerned that MTRN may fall substantially over the next month if the 1st quarter earnings fail to meet expectations when announced on April 30. The Option Chain for MTRN is presented below

These were the first Questions asked

a. What options strategy would you employ in this situation? b. What Positions do you take to implement your strategy (ie., which contract(s) (long/short, calls/puts, expiration date(s), strike price(s))? c. How many Contracts would you need to fully hedge your existing position? How much will it cost you to employ the strategy?

Im guessing you need to know this first info to answer the next question

1. At expiration MTRN is at 180. Assume you would like to continue to hold the stock.

a. What Happens with the options? b. What would the payoff to your option strategy be? c. What would the profit or loss from your option strategy be? d. What is your ending wealth? What would it have been without hedging?

MTRN Option Chain Calls Puts Ask Bid Ask Strike Bid 1.82 2.49 3.35 4.5 19-May 19-May 19-May 19-May 19-May 19-May 14-Jun 14-Jun 14-Jun 14-Jun 7.75 5.5 4.4 3.05 1.92 1.23 8.3 6.6 1.91 2.62 3.75 4.7 6.25 7.95 8.05 6.25 4.6 3.2 2.16 1.41 10.1 8.55 7.15 5.6 4.45 3.6 172.5 175 177.5 180 182.5 185 172.5 175 177.5 180 182.5 185 5.95 7.55 2.56 3.95 3.2 4.4 4.85 6.75 8.15 4.65 3.45 1.99 5 6.1 6.95 8.3 11.95 14-Jun 14-JunStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started