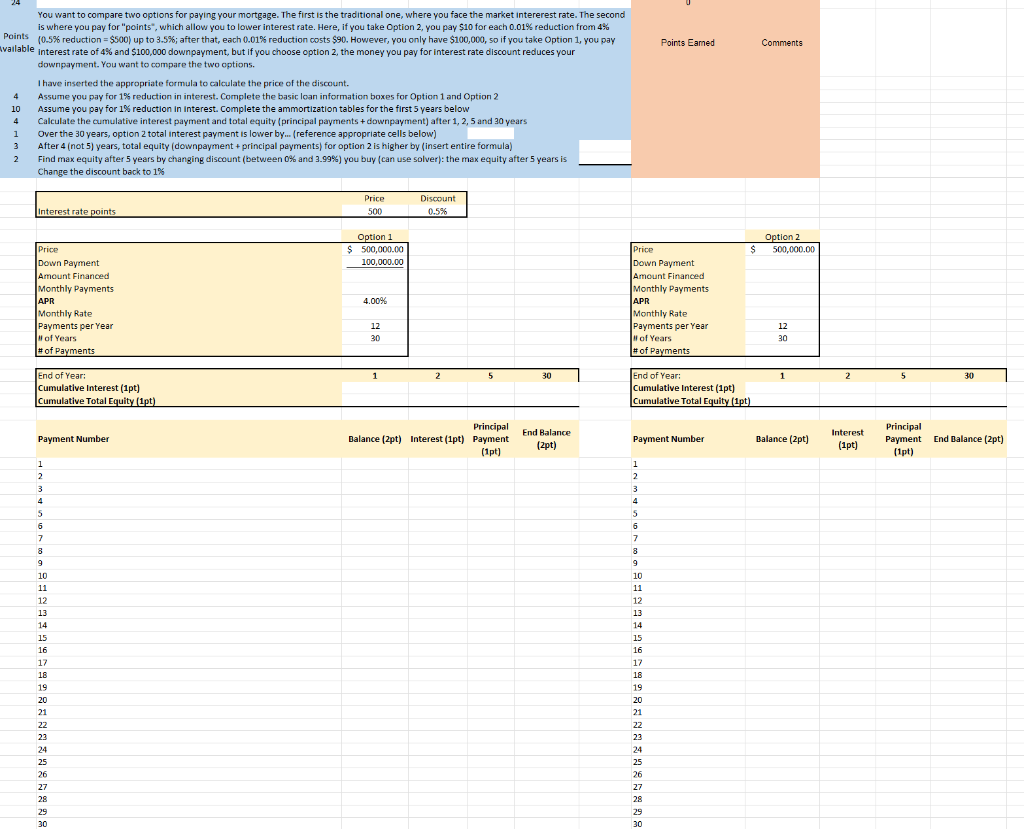

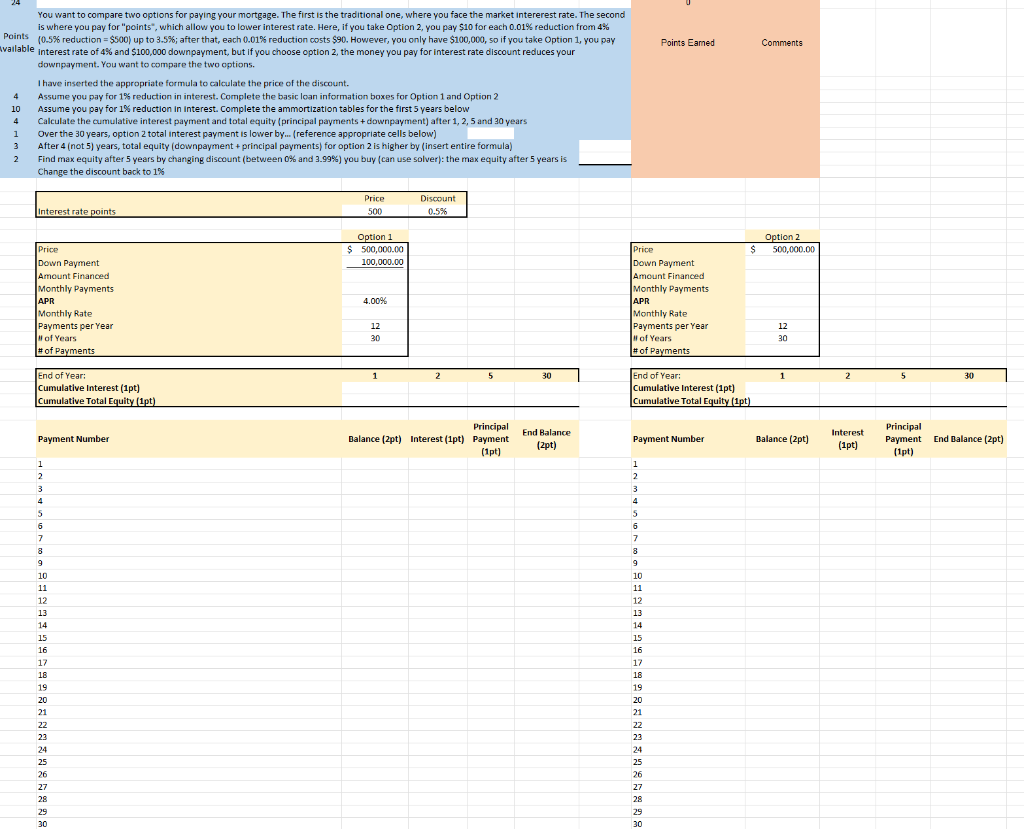

You want to compare two options for paying your mortgage. The first is the traditional one, where you face the market intererest rate. The secono is where you pay for "points", which allow you to lower interest rate. Here, if you take Option 2, you pay $10 for each 0.01% reduction from 4% (0.5% reduction =$500) up to 3.5%; after that, each 0.01% reduction costs $90. However, you only have $100,000, so if you take Option 1 , you pay interest rate of 4% and $100,000 downpayment, but if you choose option 2 , the money you pay for interest rate discount reduces your downpayment. You want to compare the two options. I have inserted the appropriate formula to calculate the price of the discount. Assume you pay for 1% reduction in interest. Complete the basic loan information boxes for Option 1 and Option 2 Assume you pay for 1% reduction in interest. Complete the ammortization tables for the first 5 years below Calculate the cumulative interest payment and total equity (principal payments + downpayment) after 1, 2, 5 and 30 years Over the 30 years, option 2 total interest payment is lower by... (reference appropriate cells below) After 4 (not 5) years, total equity (downpayment + principal payments) for option 2 is higher by (insert entire formula) Find max equity after 5 years by changing discount (between 0\% and 3.99\%) you buy (can use solver): the max equity after 5 years is Change the discount back to 1% You want to compare two options for paying your mortgage. The first is the traditional one, where you face the market intererest rate. The secono is where you pay for "points", which allow you to lower interest rate. Here, if you take Option 2, you pay $10 for each 0.01% reduction from 4% (0.5% reduction =$500) up to 3.5%; after that, each 0.01% reduction costs $90. However, you only have $100,000, so if you take Option 1 , you pay interest rate of 4% and $100,000 downpayment, but if you choose option 2 , the money you pay for interest rate discount reduces your downpayment. You want to compare the two options. I have inserted the appropriate formula to calculate the price of the discount. Assume you pay for 1% reduction in interest. Complete the basic loan information boxes for Option 1 and Option 2 Assume you pay for 1% reduction in interest. Complete the ammortization tables for the first 5 years below Calculate the cumulative interest payment and total equity (principal payments + downpayment) after 1, 2, 5 and 30 years Over the 30 years, option 2 total interest payment is lower by... (reference appropriate cells below) After 4 (not 5) years, total equity (downpayment + principal payments) for option 2 is higher by (insert entire formula) Find max equity after 5 years by changing discount (between 0\% and 3.99\%) you buy (can use solver): the max equity after 5 years is Change the discount back to 1%