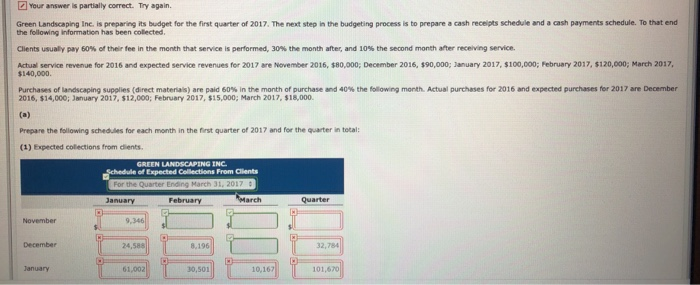

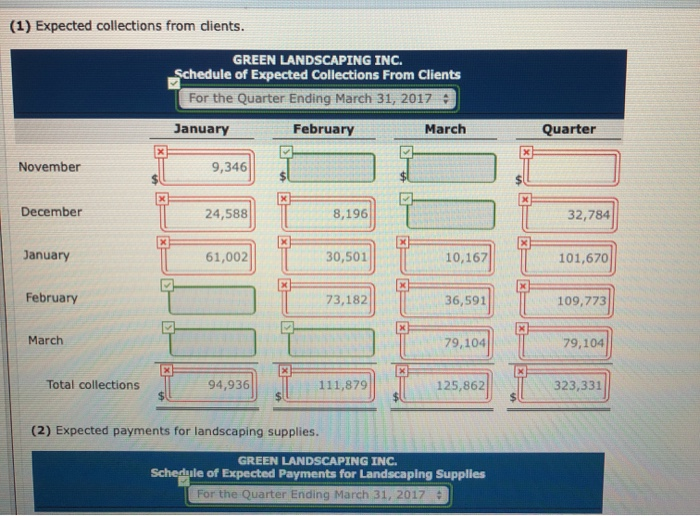

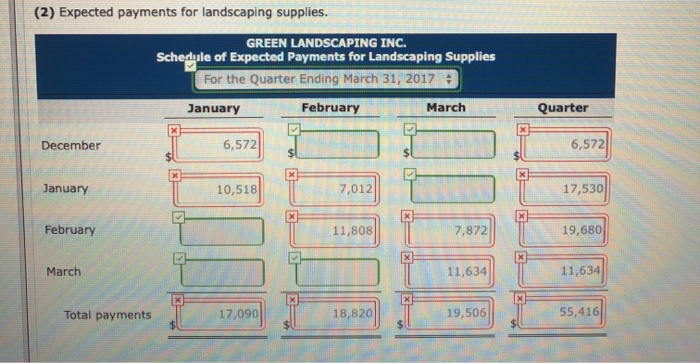

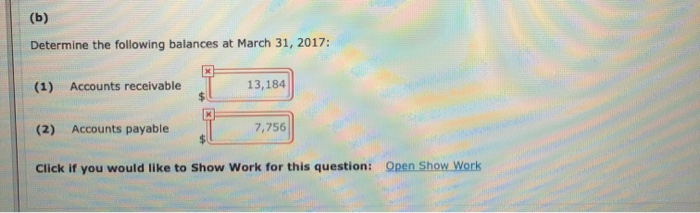

Your answer is partially correct. Try again. Green Landscaping Inc. is preparing its budget for the first quarter of 2017. The next step in the budgeting process is to prepare a cash receipts schedule and a cash payments schedule. To that end the following information has been collected Clients usually pay 60% of their fee in the month that service is performed, 30% the month after, and 10% the second month after receiving service Actual service revenue for 2016 and expected service revenues for 2017 are November 2016, 580,000: December 2016, 390,000; January 2017, $100,000; February 2017, $120,000; March 2017, $140,000 Purchases of landscaping supplies (direct materiais) are paid 60% in the month of purchase and 40% the following month. Actual purchases for 2016 and expected purchases for 2017 are December 2016, $14,000; January 2017 $12,000; February 2017, $15,000; March 2017, $18,000 Prepare the following schedules for each month in the first quarter of 2017 and for the quarter in total: (1) Expected collections from dients. GREEN LANDSCAPING INC Schedule of Expected Collections From Clients For the Quarter Ending March 31, 2017 March November December January 101,670 (1) Expected collections from clients. GREEN LANDSCAPING INC. Schedule of Expected Collections From Clients For the Quarter Ending March 31, 2017 , January February March Quarter November 9,346 su December 24,588 32,784 January 61,002 30,501 10,167 101,670 February 36,591 109,773 March 79,104 Total collections 9,929 79,104 125,862 94,936 L 111,879 879 323,331 323,331 (2) Expected payments for landscaping supplies. GREEN LANDSCAPING INC. Schedule of Expected Payments for Landscaping Supplies For the Quarter Ending March 31, 2017 (2) Expected payments for landscaping supplies. GREEN LANDSCAPING INC. Schedule of Expected Payments for Landscaping Supplies For the Quarter Ending March 31, 2017 January February March Quarter December 6,572 1 TS 6,572|| . 1 January 10,518 7,012 11 17,530 February 00 19,680 March . 11,634 11,634 TI X Total payments 17,00 15,520) 19,50 55,4167 (b) Determine the following balances at March 31, 2017: (1) Accounts receivable 13,184 (2) Accounts payable (2) Accounts payable 2,756) 7,756 Click if you would like to Show Work for this question: Open Show Work