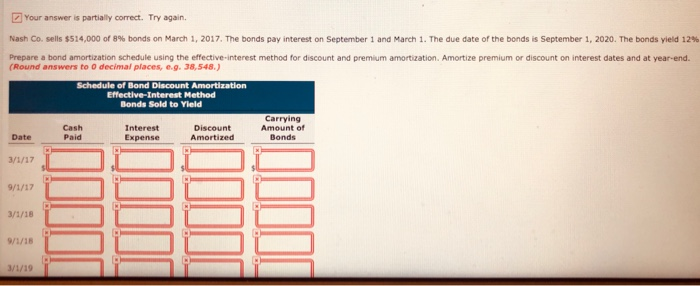

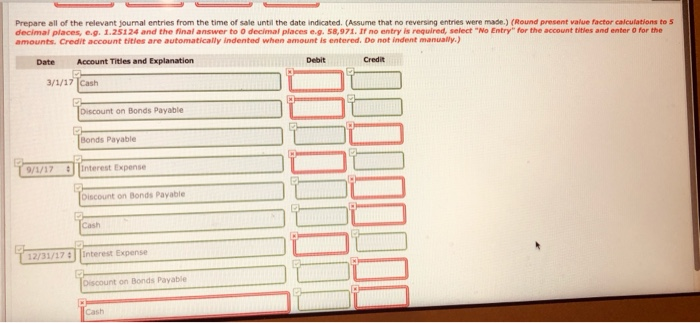

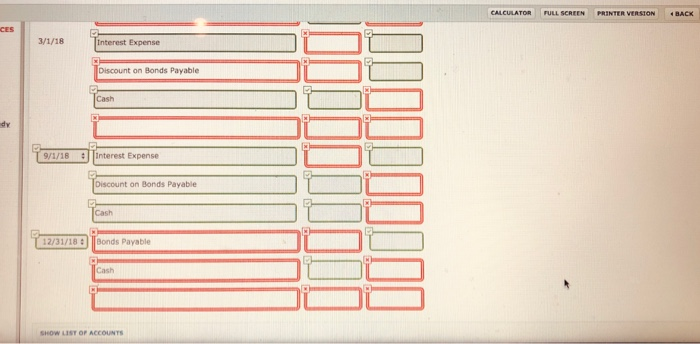

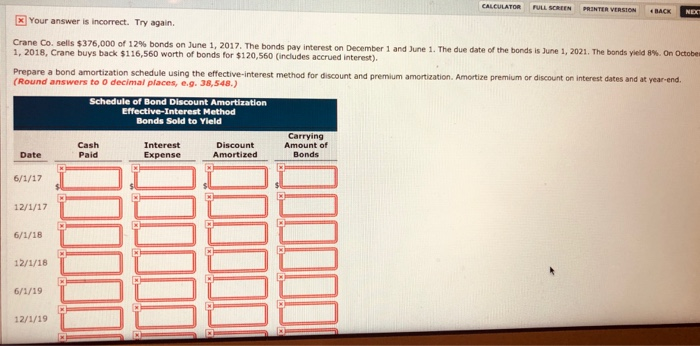

Your answer is partially correct. Try again. Nash Co sells $514,000 of 8% bonds on March 1, 2017. The bonds pay interest on September 1 and March 1. The due date of the bonds is September 1, 2020. The bonds yield 12% Prepare a bond amortization schedule using the effective interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to decimal places, e.g. 38.548.) Schedule of Bond Discount Amortization Effective-Interest Method Bonds Sold to Yleld Cash Paid Interest Expense Carrying Amount of Date Discount Amortized 3/1/17 9/1/17 3/1/18 9/1/18 3/1/19 Prepare all of the relevant journal entries from the time of sale until the date indicated. (Assume that no reversing entries were made) (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to decimal places e.g. 58,971. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Credit account tities are automatically indented when amount is entered. Do not indent manually.) Debit Date Account Titles and Explanation 3/1/17 Cash Discount on Bonds Payable Bonds Payable Interest Expense Discount on Bonds Payable 12/31/17 Interest Expense Discount on Bonds Payable Toast CALCULATOR FULL SCREEN PRINTER VERSION 3/1/18 Discount on Bonds Payable JE 9/1/18 interest Expense Oddddddddol Discount on Bonds Payable 12/31/18 Bonds Payable SHOW LIST OF ACCOUNTS CALCULATOR FULL SCREEN PRINTER VERSION BACK NEX x Your answer is incorrect. Try again. Crane Co. sells $376,000 of 12% bonds on June 1, 2017. The bonds pay interest on December 1 and June 1. The due date of the bonds is June 1, 2021. The bonds yield 8%. On Octobe 1. 2018, Crane buys back $116,560 worth of bonds for $120,560 (includes accrued interest). Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to decimal places,.g. 38,548.) Schedule of Bond Discount Amortization Effective-Interest Method Bonds Sold to Yleld Carrying Amount of Discount Interest Expense 6/1/17 12/1/17 6/1/18 12/1/18 6/1/19 12/1/19 Weate Accounting (ACCT 3103 and 3113 6/1/20 12/1/20 6/1/21 Difference due to rounding Prepare all of the relevant journal entries from the time of sale until the date indicated. Give entries through December 1, 2019. (Assume that no reversing entries were made) (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually) decimal places eg. 58,971. I ne entry is required, select "No Entry for Date Account Tities and Explanation Debit 6/1/17 Credit CALCULATOR FULL SCREEN 12/31/17 (To record interest expense and premium amortization) (To record buy back of bonds) RCES CALCULATOR FULL tudy 6/11 Click if you would like to Show Work for this question: Open Show Work