Answered step by step

Verified Expert Solution

Question

1 Approved Answer

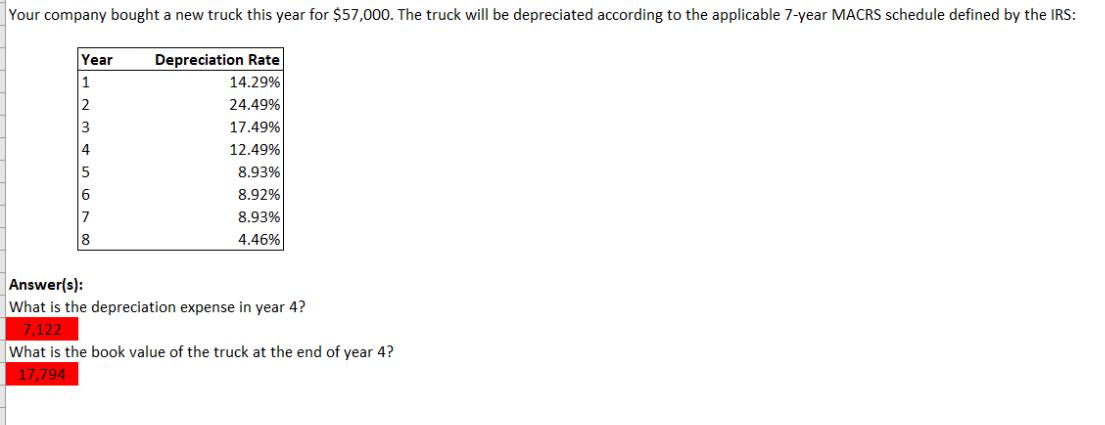

Your company bought a new truck this year for $57,000. The truck will be depreciated according to the applicable 7-year MACRS schedule defined by

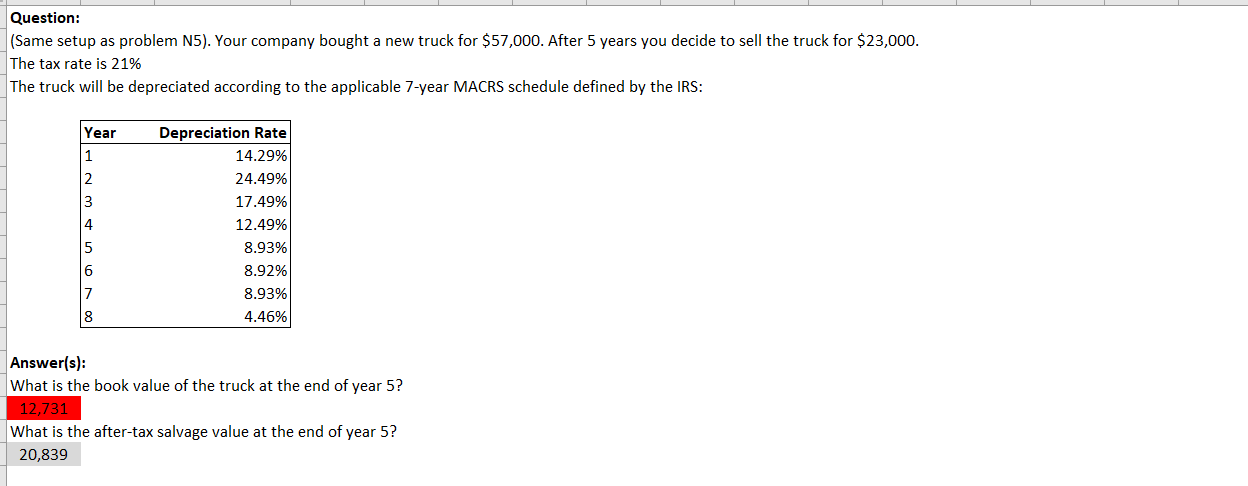

Your company bought a new truck this year for $57,000. The truck will be depreciated according to the applicable 7-year MACRS schedule defined by the IRS: Depreciation Rate 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% Year 1 2 3 4 5 6 Answer(s): What is the depreciation expense in year 4? 7,122 What is the book value of the truck at the end of year 4? 17,794 Question: (Same setup as problem N5). Your company bought a new truck for $57,000. After 5 years you decide to sell the truck for $23,000. The tax rate is 21% The truck will be depreciated according to the applicable 7-year MACRS schedule defined by the IRS: Year 1 Depreciation Rate 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% Answer(s): What is the book value of the truck at the end of year 5? 12,731 What is the after-tax salvage value at the end of year 5? 20,839

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer For the first set of questions Depreciation Expense in Year 4 To find the depreciation expense in year 4 we need to use the MACRS depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started