Question

You're saving for retirement. You think you need an income of $80,000 per year for 30 years after retirement and you have 40 years

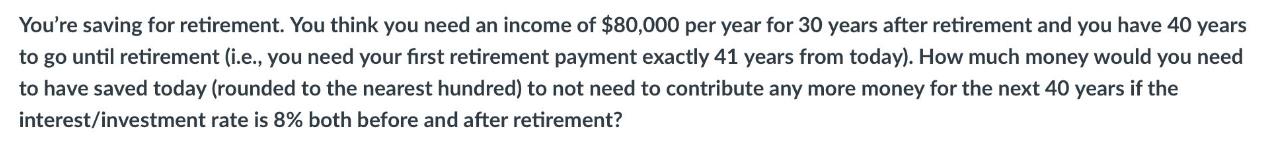

You're saving for retirement. You think you need an income of $80,000 per year for 30 years after retirement and you have 40 years to go until retirement (i.e., you need your first retirement payment exactly 41 years from today). How much money would you need to have saved today (rounded to the nearest hundred) to not need to contribute any more money for the next 40 years if the interest/investment rate is 8% both before and after retirement?

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate how much money you would need to have saved today to generate an income of 80000 per ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting a Global Perspective

Authors: Michel Lebas, Herve Stolowy, Yuan Ding

4th edition

978-1408066621, 1408066629, 1408076861, 978-1408076866

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App