Question

Zeta Corp. purchased a machine for $1,500 million. The machine has a functional life of 10 years with no salvage value. According to Canada Revenue

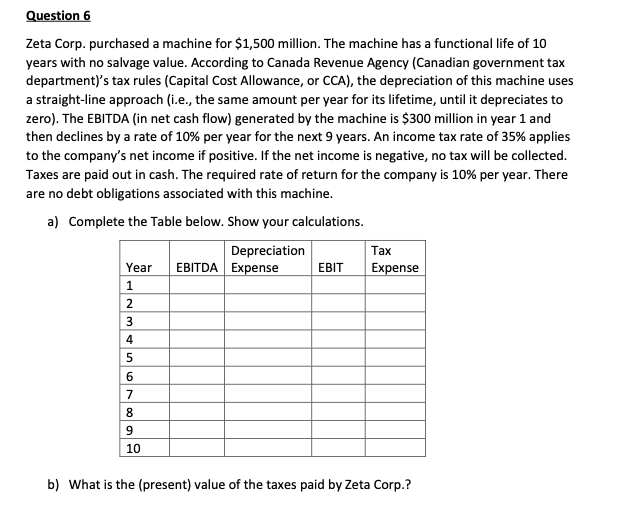

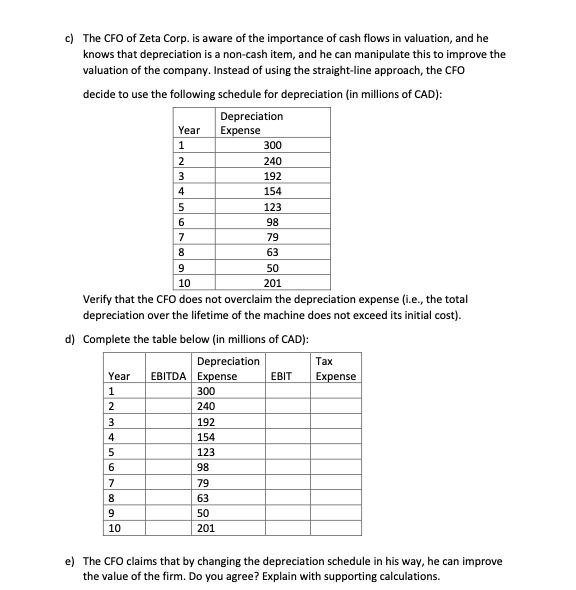

Zeta Corp. purchased a machine for $1,500 million. The machine has a functional life of 10 years with no salvage value. According to Canada Revenue Agency (Canadian government tax department)s tax rules (Capital Cost Allowance, or CCA), the depreciation of this machine uses a straight-line approach (i.e., the same amount per year for its lifetime, until it depreciates to zero). The EBITDA (in net cash flow) generated by the machine is $300 million in year 1 and then declines by a rate of 10% per year for the next 9 years. An income tax rate of 35% applies to the companys net income if positive. If the net income is negative, no tax will be collected. Taxes are paid out in cash. The required rate of return for the company is 10% per year. There are no debt obligations associated with this machine.

a) Complete the Table below. Show your calculations.

b) What is the (present) value of the taxes paid by Zeta Corp.?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started