Question

Zhuoli Company had 2,000,000 shares of common stock outstanding on December 31, 2018. On July 1, 2019, Zhuoli issued an additional 500,000 shares for

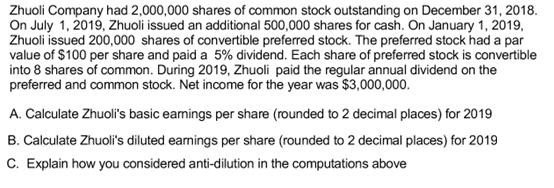

Zhuoli Company had 2,000,000 shares of common stock outstanding on December 31, 2018. On July 1, 2019, Zhuoli issued an additional 500,000 shares for cash. On January 1, 2019, Zhuoli issued 200,000 shares of convertible preferred stock. The preferred stock had a par value of $100 per share and paid a 5% dividend. Each share of preferred stock is convertible into 8 shares of common. During 2019, Zhuoli paid the regular annual dividend on the preferred and common stock. Net income for the year was $3,000,000. A. Calculate Zhuolil's basic earnings per share (rounded to 2 decimal places) for 2019 B. Calculate Zhuoli's diluted eamings per share (rounded to 2 decimal places) for 2019 C. Explain how you considered anti-dilution in the computations above

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Earl K. Stice, James D. Stice

19th edition

1133957919, 978-1285632988, 1285632982, 978-0357691229, 978-1133957911

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App