Debra acquired the following new assets during 2019. Determine Debra?s cost recovery deductions for the current year.

Question:

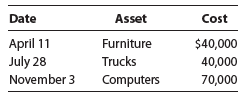

Debra acquired the following new assets during 2019.

Determine Debra?s cost recovery deductions for the current year. Debra does not elect immediate expensing under ? 179. She does not claim any available additional first-year depreciation.

Transcribed Image Text:

Date Asset Cost April 11 July 28 Furniture $40,000 Trucks 40,000 November 3 Computers 70,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 58% (12 reviews)

The midquarter convention must be used because the cost ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2020 Comprehensive

ISBN: 9780357109144

43rd Edition

Authors: David M. Maloney, William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

Debra acquired the following new assets during 2015. Date Asset Cost April 11........Furniture.............$40,000 July 28............Trucks..................40,000 November...

-

Debra acquired the following new assets during 2017: Date _________________ Asset ____________ Cost April 11 .................. Furniture .............. $40,000 July 28 ..................... Trucks...

-

Debra acquired the following new assets during 2017. Determine Debras cost recovery deductions for the current year. Debra does not elect immediate expensing under § 179. She does not claim any...

-

On October 1, 2017, Sharp Company (based in Denver, Colorado) entered into a forward contract to sell 100,000 rubles in four months (on January 31, 2018) and receive $39,000 in U.S. dollars. Exchange...

-

What are some of the other techniques that can be employed to produce particulate material?

-

The price elasticity of demand for health care is often thought of as a measure of ex post moral hazard , which roughly captures the extent of overuse of medical care. Health insurance causes the...

-

Determining the Future Value of Education. Jenny Lopez estimates that as a result of completing her masters degree, she will earn an additional $8,000 a year for the next 40 years. a. What would be...

-

Suppose researchers were experimenting with how much more satisfied consumers are with a new and improved version of some existing product. How might the researchers design a placebo within an...

-

E Ch. 19 Homework Question 4 of 5 - /2 LUCILLETTIVE Oriole Inc. produces and sets three products. Unit data concerning each product is shown below. Selling price Direct labor costs Other variable...

-

The citys Crimes Analysis unit has submitted the following data requests. Provide the SQL statements to satisfy these requests. Test the statements and show the query results. 1. Show the average...

-

Juan acquires a new 5-year class asset on March 14, 2019, for $200,000. This is the only asset Juan acquired during the year. He does not elect immediate expensing under 179. He does not claim any...

-

On August 2, 2019, Wendy purchased a new office building for $3.8 million. On October 1, 2019, she began to rent out office space in the building. On July 15, 2023, Wendy sold the office building. a....

-

Describe the three layers of inventory that are typically involved in a periods production under the FIFO accounting method. In what special situation are there only two layers?

-

3. Consider the following data for two catalysts, A and B. The temperature is 25 C and the reaction occurs at standard conditions. a. Make a Tafel plot and determine the Tafel slope. Estimate the...

-

How consumption can be helpful in facilitating the construction of your identity? Explain the ways in which the symbolic meanings, connected with your consumption choices are important to you? Is...

-

Cataumet Boats, Inc. Jaime Giancola had just completed the first half of her MBA program and wanted to work on a project during the summer that would give her some practical experience applying what...

-

Your task is to check the internet and the?Common Vulnerabilities and Exposures (CVE) List?for networked IoT or?IoMT?devices with publicly known problems identified in the past six months.?? Select...

-

The first quarter tax return needs to be filed for Prevosti Farms and Sugarhouse by April 15, 2021. For the taxes, assume the second February payroll amounts were duplicated for the March 5 and March...

-

In Exercises give a parametrization for the curve. y = x (x - 4), x 2

-

Experiment: Tossing four coins Event: Getting three heads Identify the sample space of the probability experiment and determine the number of outcomes in the event. Draw a tree diagram when...

-

Robin Corporation would like to transfer excess cash to its sole shareholder, Adam, who is also an employee. Adam is in the 28% tax bracket, and Robin is in the 34% bracket. Because Adams...

-

Your client, Raptor Corporation, declares a dividend permitting its common shareholders to elect to receive 9 shares of cumulative preferred stock or 3 additional shares of Raptor common stock for...

-

Jacob Corcoran bought 10,000 shares of Grebe Corporation stock two years ago for $24,000. Last year, Jacob received a nontaxable stock dividend of 2,000 shares in Grebe. In the current tax year,...

-

thumbs up if correct A stock paying no dividends is priced at $154. Over the next 3-months you expect the stock torpeither be up 10% or down 10%. The risk-free rate is 1% per annum compounded...

-

Question 17 2 pts Activities between affiliated entities, such as a company and its management, must be disclosed in the financial statements of a corporation as O significant relationships O segment...

-

Marchetti Company, a U.S.-based importer of wines and spirits, placed an order with a French supplier for 1,000 cases of wine at a price of 200 euros per case. The total purchase price is 200,000...

Study smarter with the SolutionInn App