On March 31, 2016, Big Boats Company entered into a contract with Vacations Unlimited to produce a

Question:

On March 31, 2016, Big Boats Company entered into a contract with Vacations Unlimited to produce a state-of-the-art cruise ship, to 1x? completed within three years. Big Boats estimated the total cost of building the ship at $300 million. The contract price was $400 million. The ship was completed on February 15, 2019-

a. What tax accounting method must Big Boats use for the contract? Why?

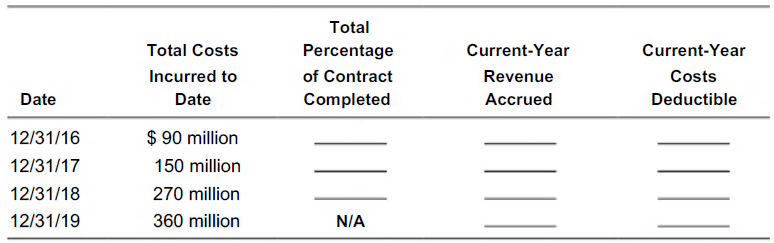

b. Using the financial data provided relating to the contract’s performance, complete the following schedule:

c. What are the consequences of the total cost of $360 million exceeding the estimated total cost of $300 million?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted: