When your supervisor reviews the audit working papers for Maylo Supply Company (see problem 5-45), he concludes

Question:

When your supervisor reviews the audit working papers for Maylo Supply Company (see problem 5-45), he concludes that difference estimation may not have been the most appropriate statistical method. He believes that ratio estimation may be preferable for the circumstances.

Required :

a. Would the Alpha and Beta risks he different for ratio estimation than difference estimation? Explain reasons for your answer.

b. Calculate the sample size required using ratio estimation, assuming there is no basis for changing the expected error or standard deviation. Explain why your answer is the same as or different from the one you determined for difference estimation.

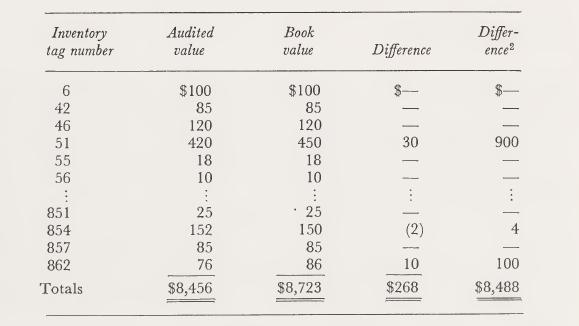

c. Calculate the confidence limits for ratio estimation using the same sample results that were used for difference estimation. The 82 items containing no errors had a total book value of \($5,269\). The sum of the squared book values for the 82 items was \($676,888\). The audited and recorded values for the eighteen differences are as follows:

d. Is the population acceptable or not acceptable? Explain the reason for the difference in confidence limits using ratio and difference estimation.

Problem 5-45:

You are doing the audit of Maylo Supply Company. You plan to check quantities, prices, and extensions on a selected random sample of inventory tags, and to evaluate your results by using difference estimation. You will have to foot the client’s inventory listing, because this method depends on having a known book value.

A brief summary of the procedures Maylo is following in counting its physical inventory follows:

(1) The general manager and the warehouse foreman supervise the inventory taking.

(2) Two-man teams perform the counts, using two-part inventory tags.

(3) The general manager and the foreman place the tags, prenumbered, on the inventory items.

(4) One member of the two-man team counts each item and the other verifies it. They mark each portion of the tag with the agreed-upon quantity.

(5) After counting is completed, the general manager and the foreman remove the upper part of each tag and assure themselves that all items were counted and that counts appear reasonable. If appropriate, recounts are made. The lower portion is sent to the accounting department for pricing.

(6) On receiving the inventory tags, the client’s accounting department prepares a list showing the tag number, identification data, quantity, and unit price. These sheets are extended, footed, and totaled to determine the total inventory value.

In prior years, your firm observed the inventory and tested compilation and pricing in several separate steps. Various minor errors were always found. These errors have always been considered immaterial, in part because they were often offsetting. About 5% of the inventory items were usually tested.

This year, in terms of your overall audit objectives, you believe that a misstatement of \($4,000\) in the client’s book amount of \($86,857\) of inventory would represent a material error. The audit tests are considered highly important, and expansion of sample size would be difficult.

To assist in determining an appropriate sample size, you analyze last year’s results. Last year’s sample of 50 tags, not randomly chosen, showed eight differences in quantities, three differences in pricing, and none in extensions. (The calculated standard deviation of these 50 items was 16.0.) Realizing the twin dangers that last year’s sample was not random and that such a small number of observed differences might lead to a poor estimate of the standard deviation, you wish to be certain that you select a sample large enough to provide an adequate number of differences for reliable and usable results.

You determine in advance that the client has 868 inventory items this year. These are not identified by inventory codes, but each item will correspond with an inventory tag prenumbered from 1 to 868.

Required:

a. Determine an appropriate sample size, assuming a Beta risk of 10% and an Alpha risk of 20%.

b. Ignoring your answer in

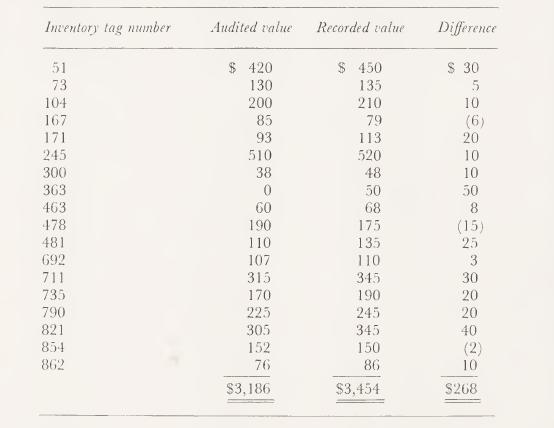

a, assume you have selected a sample of 100 items randomly. For each of the sample items, appropriate audit tests are performed to make sure the physical count is correct, pricing is accurate in accordance with company policy and prior years, and the extensions of unit price and quantity are correct. The results have been summarized as follows:

There were eighteen differences, making up the net difference of \($268\). The recorded total of the client’s inventory sheets is \($86,857\).

Express the results of the audit tests in terms of confidence intervals, using a Beta risk of 10%.

c.What should you conclude about the inventory ?

Step by Step Answer:

Applications Of Statistical Sampling To Auditing

ISBN: 9780130391568

1st Edition

Authors: Alvin A. Arens, James K. Loebbecke