Newstar Company has four manufacturing subsidiaries: A, B, C, and D. Each subsidiary keeps a separate set

Question:

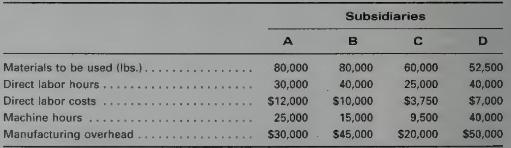

Newstar Company has four manufacturing subsidiaries: A, B, C, and D. Each subsidiary keeps a separate set of accounting records. Manufacturing cost forecasts for 2000 for each subsidiary are:

The predetermined overhead rates for each subsidiary are based on the following:

\footnotetext{

A: Machine hours B: Direct !abor costs C: Materials to be used D: Direct labor hours }

1. Compute the predetermined overhead rate to be used in $2(\%(\%)$ by each subsidiary:

2. If Subsidiary B actually had $\$ 8,000$ of direct labor costs and $\$ 37,500$ of manufacturing overhead, will overhead be over- or underapplied and by how much?

3. If Subsidiary C used 66,000 pounds of materials in 2000 , what will be the applied manufacturing overhead?

4. Interpretive Question: Identify the two most commonly used methods to dis pose of under- or overapplied manufacturing overhead. What is the major advantage of each method?

Step by Step Answer:

Survey Of Accounting

ISBN: 9780538846172

1st Edition

Authors: James D. Stice, W. Steve Albrecht, Earl Kay Stice, K. Fred Skousen