Imran owns a business which operates from rented premises. He has a 10 -year lease on the

Question:

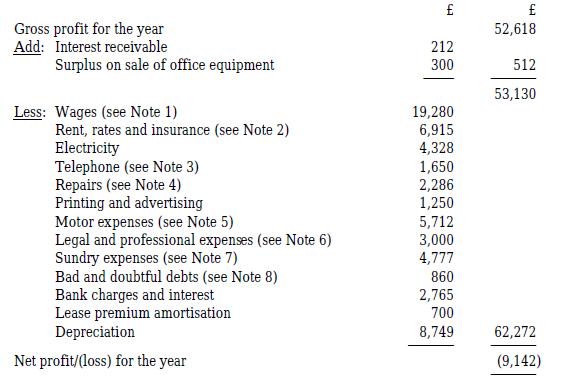

Imran owns a business which operates from rented premises. He has a 10 -year lease on the premises and paid a premium of £7,000 in order to obtain the lease. His income statement for the year to 31 December 2017 is as follows:

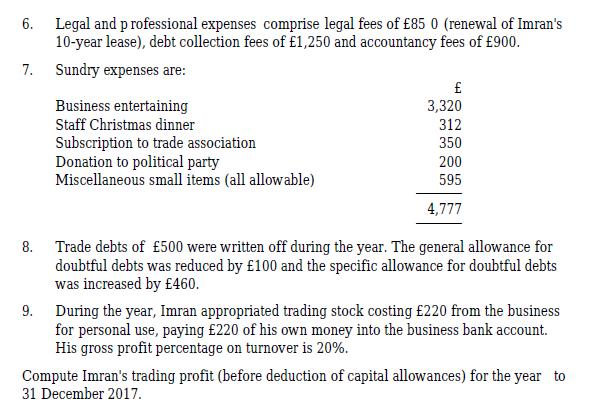

Notes:

1. Wages include £5,800 for Imran's wife (who works part-time for the business) and

£1,000 for his son (a student who does not work for the business at all). Also included in wages are Imran's personal income tax and personal National Insurance contributions totalling £3,524.

2. Insurance includes Imran's private medical insurance premium of £405.

3. It has been agreed that one-sixth of telephone costs relate to private use.

4. Repairs include £750 for the cost of essential repairs to a newly -acquired secondhand forklift truck which could not be used until the repairs had been carried out.

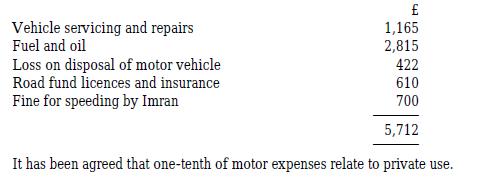

5. Motor expenses are as follows:

Step by Step Answer: