Melissa (who is not a Scottish taxpayer) owns a house which she lets to tenants. The house

Question:

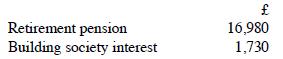

Melissa (who is not a Scottish taxpayer) owns a house which she lets to tenants. The house was let throughout 2020-21 and rents received during the year were £7,200. Her deductible expenditure for the year was £900. She had property losses brought forward from 2019-20 of £6,550. Her other income in 2020-21 was as follows:

Compute Melissa's income tax liability for the year. How would this differ for a Scottish taxpayer?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: