Use portfolio attribution analysis to assess the active strategies of two managers with the same alpha: Active

Question:

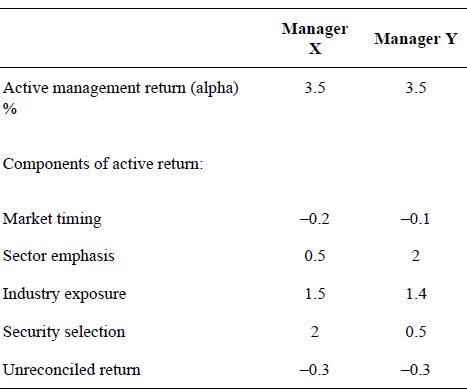

Use portfolio attribution analysis to assess the active strategies of two managers with the same alpha:

Transcribed Image Text:

Active management return (alpha) % Components of active return: Market timing Sector emphasis Industry exposure Security selection Unreconciled return Manager X 3.5 -0.2 0.5 1.5 2 -0.3 Manager Y 3.5 -0.1 2 1.4 0.5 -0.3

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

Key Observations Same Alpha Different Sources This is a crucial takeaway Although both managers achieved the same alpha their active strategies diverg...View the full answer

Answered By

Mugdha Sisodiya

My self Mugdha Sisodiya from Chhattisgarh India. I have completed my Bachelors degree in 2015 and My Master in Commerce degree in 2016. I am having expertise in Management, Cost and Finance Accounts. Further I have completed my Chartered Accountant and working as a Professional.

Since 2012 I am providing home tutions.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

The Theory And Practice Of Investment Management

ISBN: 9780470929902

2nd Edition

Authors: Frank J Fabozzi, Harry M Markowitz

Question Posted:

Students also viewed these Business questions

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

To illustrate for the Investment Committee of the profit-sharing plan to which you are a consultant on some of the issues that arise in measuring performance, you have identified three U.S....

-

1. How strong are the competitive forces confronting J. Crew in the market for specialty retail? Do a [Michael Porter] five-forces analysis to support your answer. (see chapter 3 in the textfor...

-

A chemical processing plant has a network of pipes that are used to transfer liquid chemical products from one part of the plant to another. The following pipe network has pipe flow capacities in...

-

Financial data for Preston Company are shown below. For Year Ending December 31, 2012 Cash on December 31, 2012$184,800 Cash flow from operations (158,400) a. Compute the ratio of cash to monthly...

-

PP Ltd acquired 65% of the ordinary share capital of QQ Ltd on 1 January 2017. There are no preference shares. The statements of comprehensive income of the two companies for the year to 31 December...

-

Machine Part Suppliers Your company buys machine parts from three different suppliers. Make a tree diagram that shows the three suppliers and whether the parts they supply are defective. Graphical...

-

Following are the income statement and balance sheet for Medtronic PLC. Consolidated Statement of Income, 12 Months Ended ($ millions) April 26, 2019 Net Sales $30,557 Costs and expenses Cost of...

-

Consolidated Balance Sheet Working Paper, Bargain Purchase On December 31, 2012, Paxon Corporation acquired all of the outstanding common stock of Saxon Company for $2.88 billion cash. The balance...

-

Consider three companies, A, B, and C. Suppose that a common stock analyst estimates that the market risk premium is 5% and the risk-free rate is 4.63%. The analyst estimated the beta for each...

-

Construct a graph showing combinations of breadth and depth to produce constant information ratio (IR) with an alpha of 3% and a tracking error of 4%.

-

Marks Consulting experienced the following transactions for Year 1, its first year of operations, and Year 2. Assume that all transactions involve the receipt or payment of cash. Transactions for...

-

Skinovations needs to put together a Production schedule for next week and has asked its marketing team to give its forecasts for next week's sales. The team has used two different forecasting...

-

If a potential leader viewed her least preferred co-worker in favorable terms, how would Fiedler's Model describes this leader?

-

You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company s financial statements,...

-

For our first discussion you should locate a research article in which a quantitative study is reported. This article should not be a theoretical article or a methods article, but should describe...

-

A box is separated by a partition which divides its volume in the ration of 3:1. the larger portion of the box contains 1000 molecules of Ne gas; the smalled portion contains 100 molecules of He gas....

-

When Jerry Garcia was alive he bought a house for $500,000 and made a $100,000 down payment. He obtained a 30-year loan for the remaining amount. Payments were made monthly. The nominal annual...

-

a. Show that the expansion of q(x) in ascending powers of x can be approximated to 10 2x + Bx 2 + Cx 3 where B and C are constants to be found. b. Find the percentage error made in using the series...

-

Discuss the advantages and disadvantages of just-intime supply relationships from an o r ganizational buyers point of view. Are the advantages and disadvantages merely reversed from the sellers point...

-

Explain why a customer might be willing to work more cooperatively with a small number of suppliers rather than pitting suppliers in a competition against each other. Give an example that illustrates...

-

Would a tool manufacturer need a different marketing strategy for a big retail chain like Home Depot than for a single hardware store run by its owner? Discuss your answer.

-

Problem 12.6A (Algo) Liquidation of a partnership LO P5 Kendra, Cogley, and Mel share income and loss in a 3.21 ratio (in ratio form: Kendra, 3/6: Cogley, 2/6; and Mel, 1/6), The partners have...

-

Melody Property Limited owns a right to use land together with a building from 2000 to 2046, and the carrying amount of the property was $5 million with a revaluation surplus of $2 million at the end...

-

Famas Llamas has a weighted average cost of capital of 9.1 percent. The companys cost of equity is 12.6 percent, and its cost of debt is 7.2 percent. The tax rate is 25 percent. What is the companys...

Study smarter with the SolutionInn App