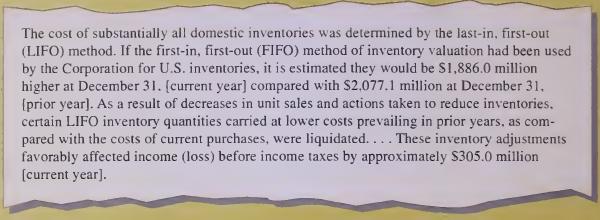

Several years ago, General Motors reported the following in its inventory note: In the current year, GM

Question:

Several years ago, General Motors reported the following in its inventory note:

In the current year, GM recorded a small pretax operating profit of S22.8 million.

Required: 1. Compute the amount of pretax operating profit (loss) that GM would have reported had it not reduced inventory quantities during the current year. 2. Compute the amount of pretax operating profit (loss) for the current year that GM would have reported had it employed FIFO accounting in both years. 3. What is the normal relationship between pretax operating profit computed using LIFO and FIFO when costs are rising? Why is this relationship not in evidence in this case?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: