22. The All Good Company is considering two mutually exclusive capital budgeting projects. Each of these projects

Question:

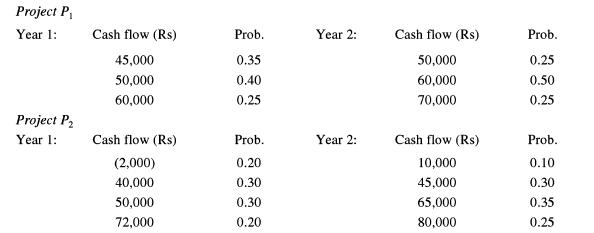

22. The All Good Company is considering two mutually exclusive capital budgeting projects. Each of these projects has a life of two years, and costs Rs 80,000. The cash flow data for the two projects are as follows:

(a) Calculate the expected value of the annual cash flow for each of the projects.

(b) Using variability of the cash flows as the criterion, calculate the risk-adjusted NPV of each project. Use a 14% discount rate for the more risky project and a 12% discount rate for the less risky project.

(

c) Determine the internal rate of return for each of the projects.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: