Go back

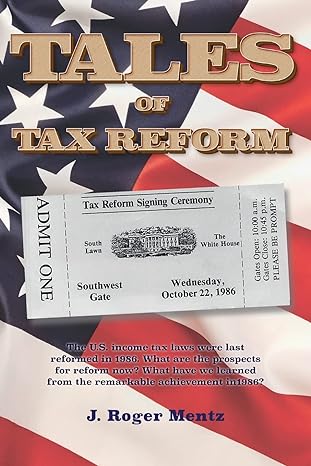

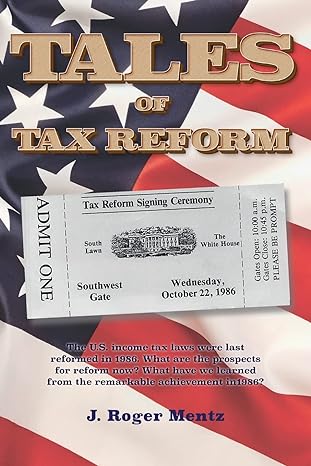

Tales Of Tax Reform The US Income Tax Laws Were Last Reformed In 1986 What Are The Prospects For Reform Now What Have We Learned From The Remarkable Achievement In1986(1st Edition)

Authors:

J. Roger Mentz

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $25.99

Savings: $25.99(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Tales Of Tax Reform The US Income Tax Laws Were Last Reformed In 1986 What Are The Prospects For Reform Now What Have We Learned From The Remarkable Achievement In1986

Price:

$9.99

/month

Book details

ISBN: 151729911X, 978-1517299118

Book publisher: CreateSpace Independent Publishing Platform (October 15, 2015)

Get your hands on the best-selling book Tales Of Tax Reform The US Income Tax Laws Were Last Reformed In 1986 What Are The Prospects For Reform Now What Have We Learned From The Remarkable Achievement In1986 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: . Politicians of all stripes are calling for tax reform. It sounds great: lower the tax rates, get rid of all of the “special interest” provisions, make our tax law simple, fair and an engine for economic growth. Some pundits even suggest that tax reform is “low-hanging fruit” that can easily be accomplished. But is this so? How would we know whether it will be that easy and straightforward? One way of learning about what a legislative tax reform process would entail is to explore what happened in 1986, when fundamental tax reform was enacted by Congress and signed into law by President Reagan. This book investigates how this legislative success was accomplished, and what lessons can be learned for those government officials who seek to enact tax reform today. This book is written by J. Roger Mentz, the Treasury Department Assistant Secretary for Tax Policy from December 1985 through July 1987. Mr. Mentz was the point person for the Reagan Administration on tax reform, which was the number one legislative priority for President Reagan in his second Administration. These “tales” or stories describe what really happened in the tax reform legislative process and what elements would need to come together for a successful reformation of the Internal Revenue Code today. This is not a technical book. Rather, it draws on experiences of 30 years ago to provide a blueprint for tax reform in the near future. This book is a “must read” for anyone who may be engaged in the legislative process of tax reform. It is a “should read” for any political candidate or staff if that candidate intends to take a position on tax reform. It is a “great read” for anyone who would enjoy the inside story, told from the perspective of the United States Treasury Department, on how the Tax Reform Act of 1986 became law after being pronounced dead numerous times.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Rodney Eaford

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."