The DuPont formula defines the net return on shareholders equity as a function of the following components:

Question:

The DuPont formula defines the net return on shareholders’ equity as a function of the following components:

• Operating margin

• Asset turnover

• Interest burden

• Financial leverage

• Income tax rate

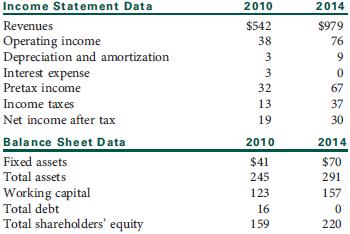

Using only the data in the table shown below:

a. Calculate each of the five components listed above for 2010 and 2014, and calculate the return on equity (ROE) for 2010 and 2014, using all of the five components. Show calculations.

b. Briefly discuss the impact of the changes in asset turnover and financial leverage on the change in ROE from 2010 to 2014.

Asset TurnoverAsset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investment Analysis and Portfolio Management

ISBN: 978-0538482387

10th Edition

Authors: Frank K. Reilly, Keith C. Brown

Question Posted: