Dellow and Coucom are in partnership in a business which has three retail departments, Television, Computing and

Question:

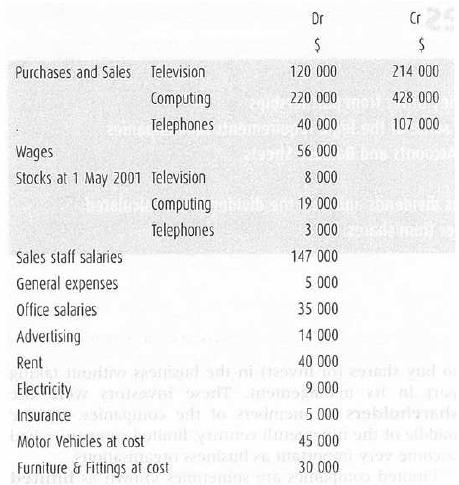

Dellow and Coucom are in partnership in a business which has three retail departments, Television, Computing and Telephones. The following balances. were extracted from the business accounts at 30 April 2002.

Notes

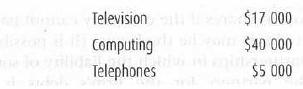

The following must now be taken into consideration. Stocks at 30 April 2002:

Stock taking is computerised and is based solely on sales and purchases no physical stock check has been taken.

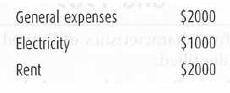

Accruals at 30 April 2002:

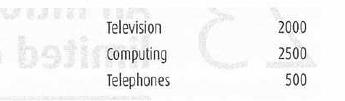

Number of sales staff employed:

Commission is paid to sales staff at 1% of Sales.

Depreciation is charged to Motor Vehicles and Furniture & Fittings at 20% per annum on cost.

Floor space (square metres):

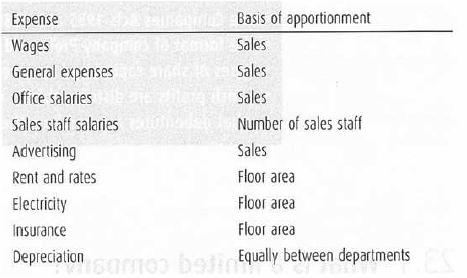

Expenses are apportioned as follows:

Dellow and Coucom share profits in the ratio of their Capital accounts, which at 1 May 2001 were: Dellow $60 000, Coucom $40 000.

Interest on capital is payable at 1% of opening capital. Cash drawings for the year were Dellow, $15 000 and Coucom, $4000.

Interest is chargeable on drawings at 2% of total drawings for the year. Coucom is paid a Partnership salary of $7600. During the year Coucom took from stock for her own use a Television costing $1000. No entries were made for this in the accounts.

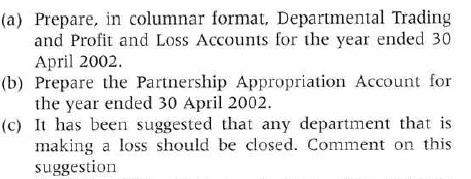

(a) Prepare, in columnar format, Departmental Trading and Profit and Loss Accounts for the year ended 30 April 2002.

(a) Prepare, in columnar format, Departmental Trading and Profit and Loss Accounts for the year ended 30 April 2002.

(b) Prepare the Partnership Appropriation Account for the year ended 30 April 2002.

(c) It has been suggested that any department that is making a loss should be closed. Comment on this suggestion

Step by Step Answer: