Question:

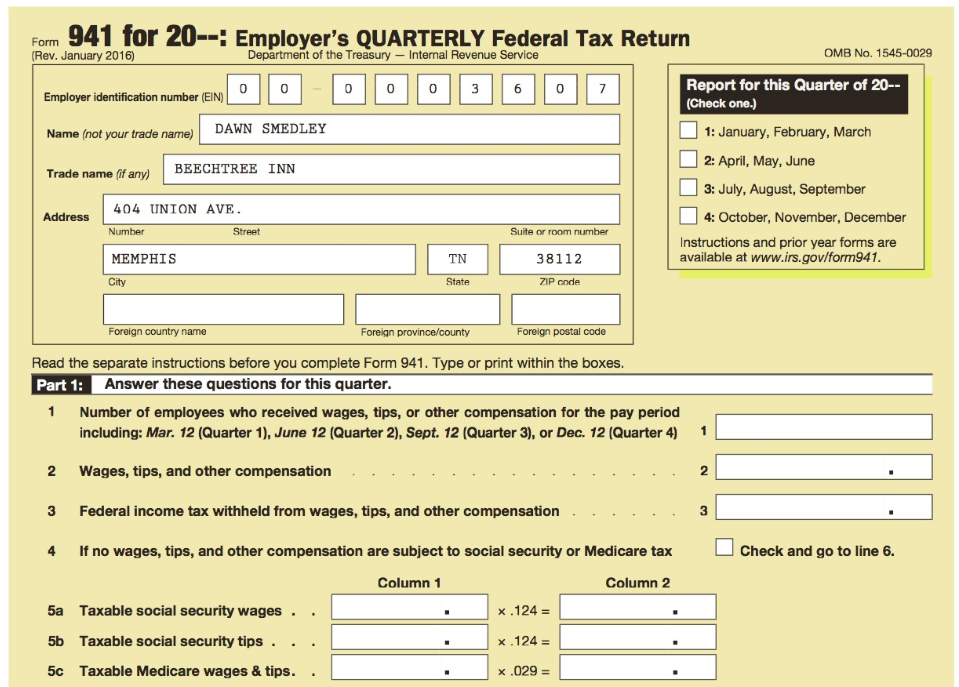

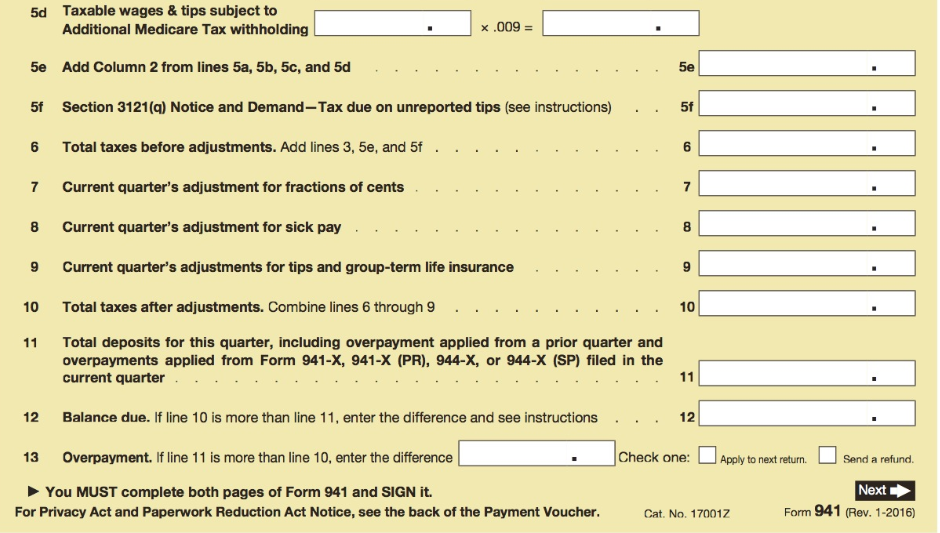

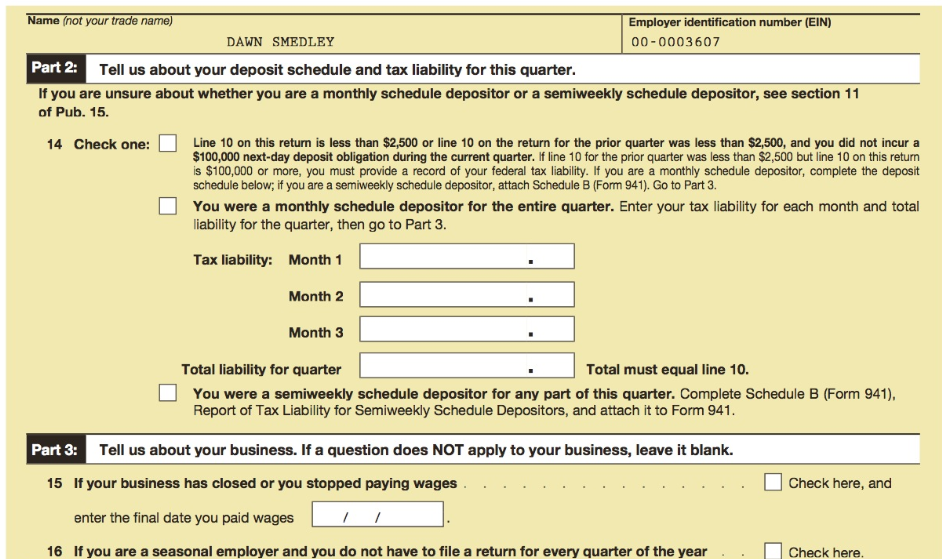

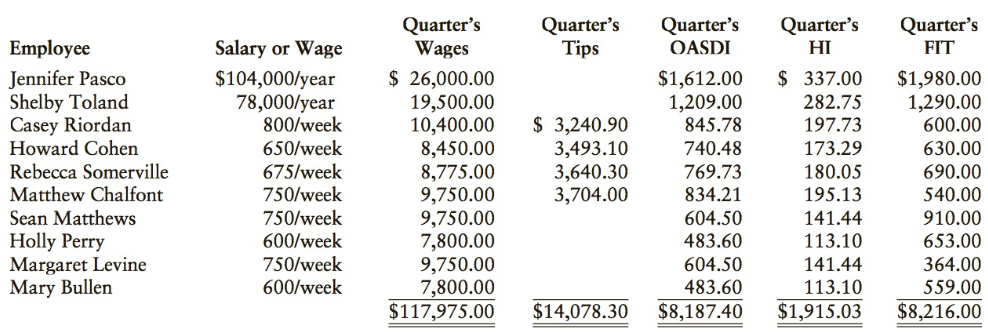

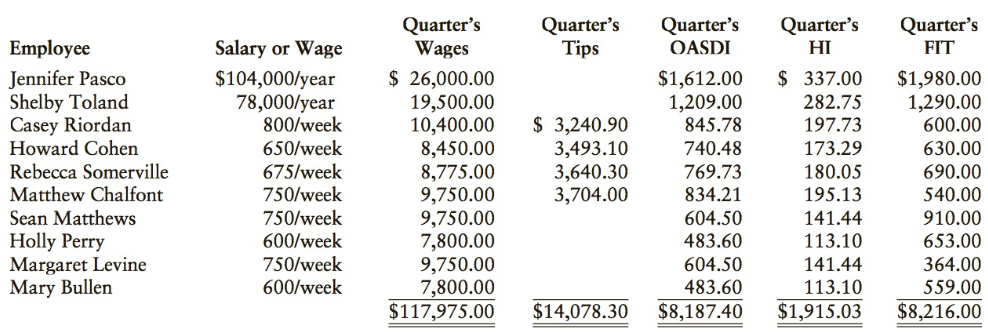

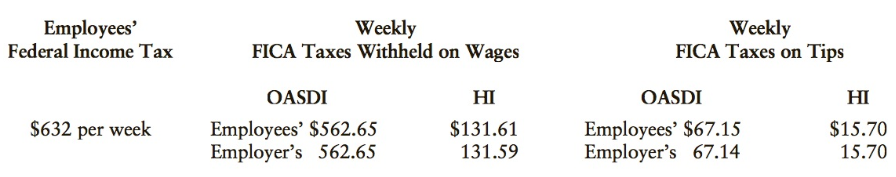

During the third calendar quarter of 20--, the Beechtree Inn, owned by Dawn Smedley, employed the persons listed below. Also given are the employees€™ salaries or wages and the amount of tips reported to the owner. The tips were reported by the 10th of each month. The federal income tax and FICA tax to be withheld from the tips were estimated by the owner and withheld equally over the 13 weekly pay periods. The employer€™s portion of FICA tax on the tips was estimated as the same amount.

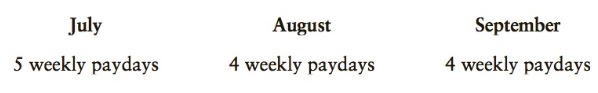

Employees are paid weekly on Friday. The following paydays occurred during this quarter:

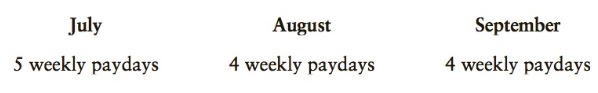

Taxes withheld for the 13 paydays in the third quarter follow:

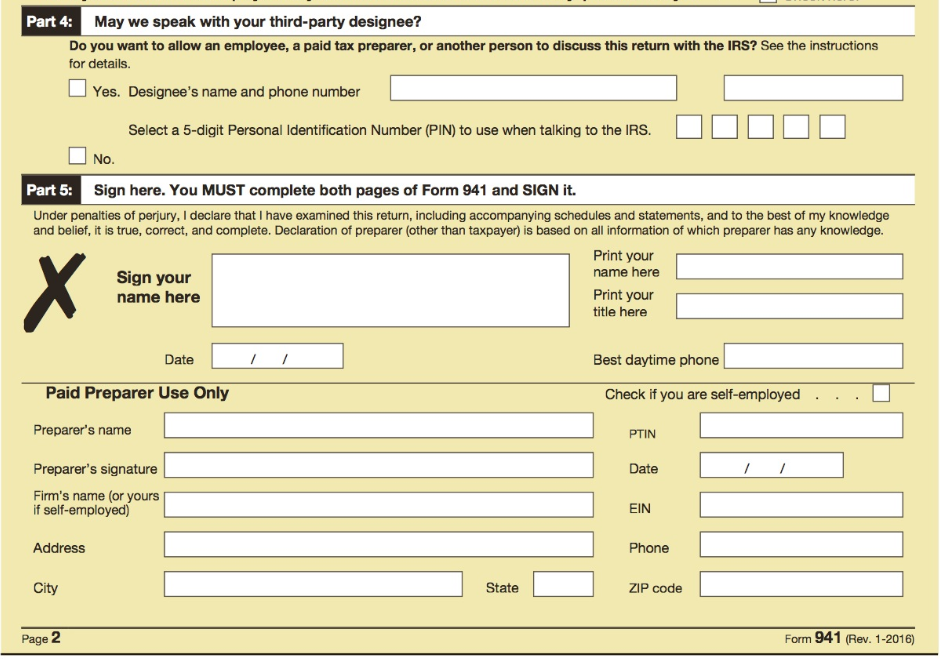

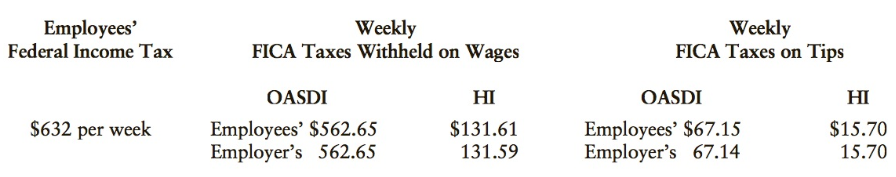

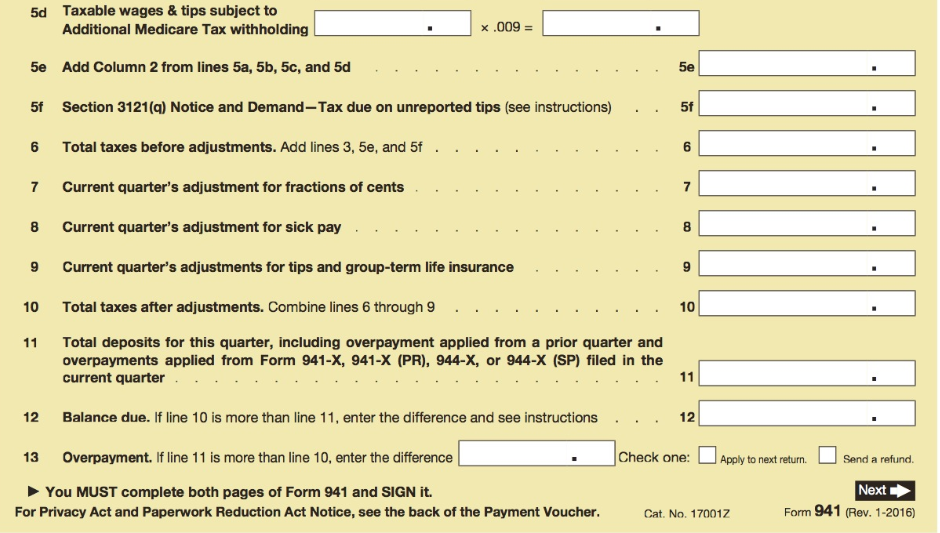

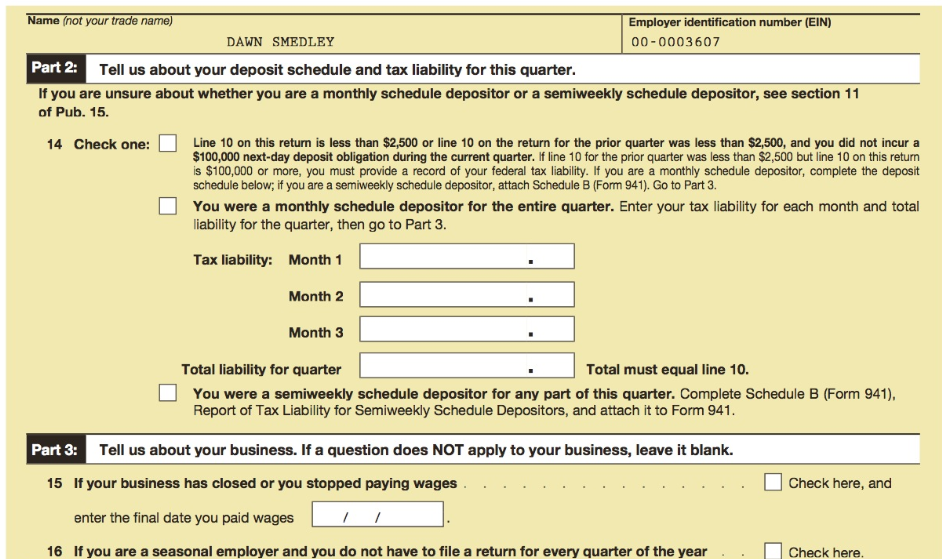

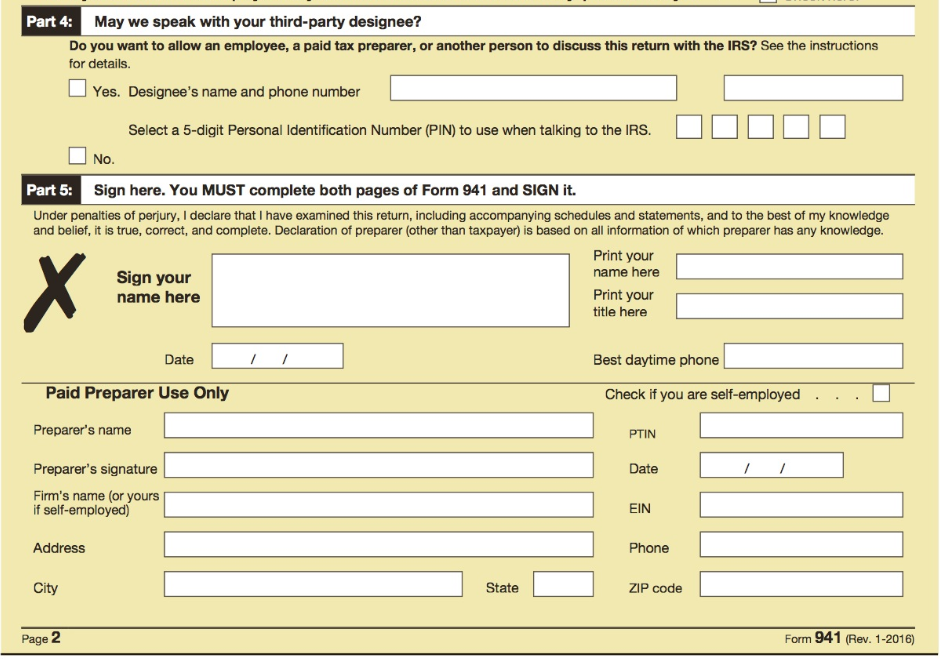

Based on the information given, complete Form 941 on the following pages for Dawn Smedley. Phone number: (901) 555-7959

Based on the information given, complete Form 941 on the following pages for Dawn Smedley. Phone number: (901) 555-7959

Transcribed Image Text:

Quarter's НI Quarter's Quarter's Wages Quarter's Tips Quarter's OASDI Salary or Wage $104,000/year 78,000/year Employee Jennifer Pasco Shelby Toland Casey Riordan FIT $ 337.00 $ 26,000.00 $1,980.00 1,290.00 600.00 $1,612.00 1,209.00 845.78 740.48 769.73 834.21 19,500.00 10,400.00 8,450.00 8,775.00 9,750.00 9,750.00 7,800.00 9,750.00 7,800.00 $117,975.00 282.75 $ 3,240.90 800/week 197.73 Howard Cohen Rebecca Somerville Matthew Chalfont 650/week 675/week 3,493.10 3,640.30 3,704.00 173.29 630.00 180.05 690.00 750/week 195.13 540.00 Sean Matthews Holly Perry Margaret Levine Mary Bullen 750/week 600/week 750/week 600/week 604.50 483.60 141.44 113.10 910.00 653.00 604.50 141.44 364.00 559.00 483.60 113.10 $14,078.30 $8,187.40 $1,915.03 $8,216.00 July August September 5 weekly paydays 4 weekly paydays 4 weekly paydays

Based on the information given, complete Form 941 on the following pages for Dawn Smedley. Phone number: (901) 555-7959

Based on the information given, complete Form 941 on the following pages for Dawn Smedley. Phone number: (901) 555-7959