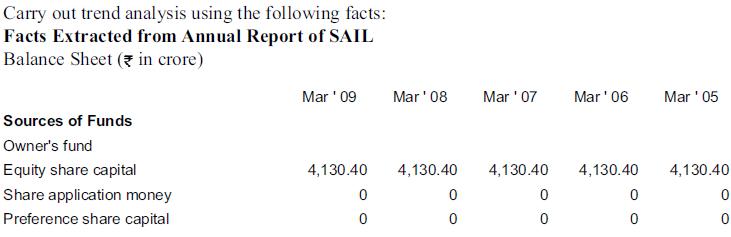

![]()

![]() New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

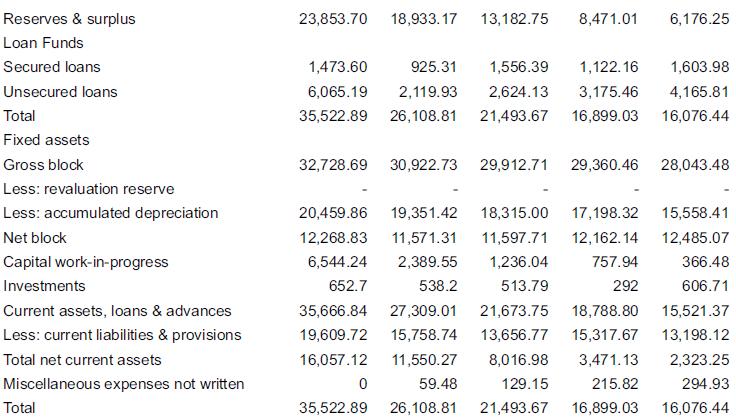

![]()

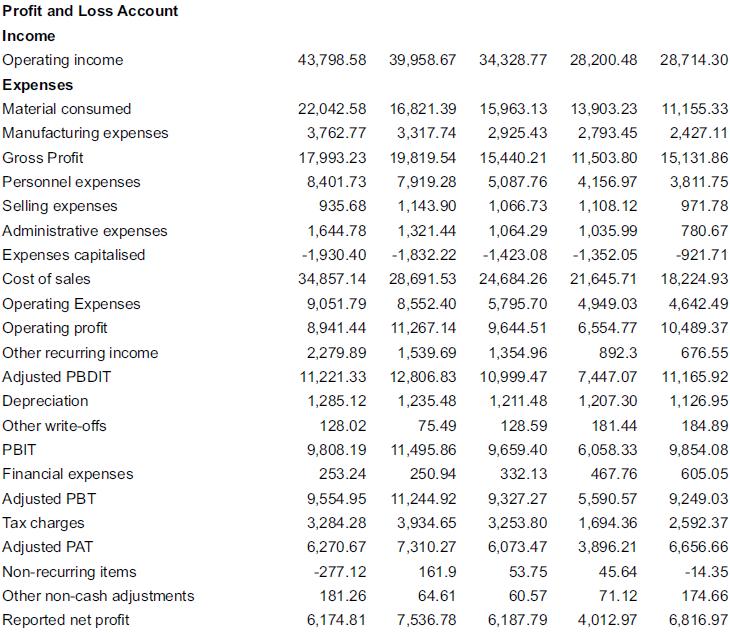

![]()