In 2018, Cabell Mapp passed away in Belle Haven, Virginia. Pursuant to his will, a testamentary trust

Question:

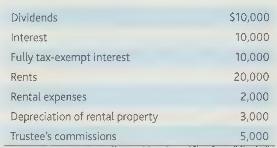

In 2018, Cabell Mapp passed away in Belle Haven, Virginia. Pursuant to his will, a testamentary trust was established. The trust instrument requires that \(\$ 10,000\) a year be paid to the University of Virginia. The balance of the income may, in the trustee's discretion, be accumulated or distributed to Sarah Mapp. Expenses are allocable against income and the trust instrument requires a reserve for depreciation. During the taxable year, the trustee contributes \(\$ 10,000\) to the University of Virginia, and in his discretion distributes \(\$ 15,000\) of income to Sarah Mapp. The trust has the following items of income and expenses for the taxable year.

a. Determine trust accounting income.

b. Determine DNI as an income ceiling.

c. Determine DNI as a deduction ceiling.

d. Determine the trust taxable income.

e. Determine DNI as a qualitative yardstick.

f. Determine Sarah Mapp's Schedule K-1 amounts.

g. Has any wastage occurred in connection with the charitable deduction?

Could this wastage have been prevented?

Step by Step Answer:

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback