The draft financial statements of Plum Ple for year ended 31 December 20X4 include the following: On

Question:

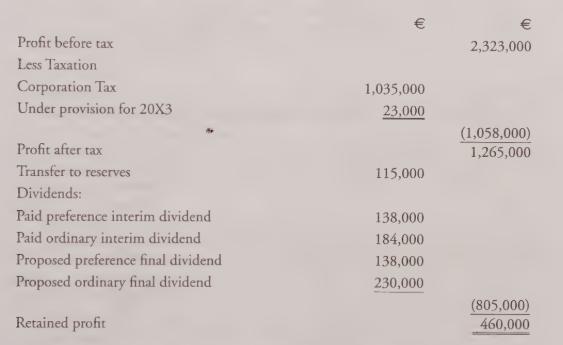

The draft financial statements of Plum Ple for year ended 31 December 20X4 include the following:

On 1 January 20X4 the issued share capital of Plum Plc was 4,600,000 6% preference shares of €1 each and 4,140,000 ordinary shares of €1 each. The proposed dividends were approved by the shareholders during the year ended 31 December 20X4.

Requirement Calculate the EPS (on basic and fully diluted basis) in respect of the year ended 31 December 20X4 for each of the following circumstances. (Each of the four circumstances

(a) to

(d) is to be dealt with separately.)

(a) On the basis that there was no change in the issued share capital of the company during the year ended 31 December 20X4.

(b) On the basis that the company made a bonus issue on 1 October 20X4 of one ordinary share for every four shares in issue at 30 September 20X4.

(c) On the basis that the company made a rights issue of €1 ordinary shares on 1 October 20X4 in the proportion of 1 for every 5 shares held, at a price of €1.20.

The middle market price for the shares on the last day of quotation cum rights was €1.80 per share.

(d) On the basis that the company made no new issue of shares during the year ended 31 December 20X4 but on that date it had in issue €1,150,000 10% convertible loan stock 20X8 — 20Y1.

This loan stock will be convertible into ordinary €1 shares as follows:

20X8 90 €1 shares for €100 nominal value loan stock 20X9 85 €1 shares for €100 nominal value loan stock 20Y0 80 €1 shares for €100 nominal value loan stock 20Y1 75 €1 shares for €100 nominal value loan stock Assume tax at 50%.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9780903854726

2nd Edition

Authors: Ciaran Connolly