Madrid Jewelry Company reported the following summarized balance sheet at December 31, 2018: Assets Current assets..................................................................... $

Question:

Madrid Jewelry Company reported the following summarized balance sheet at December 31, 2018:

Assets

Current assets..................................................................... $ 33,400

Property and equipment, net ............................................ 106,600

Total assets......................................................................... $140,000

Liabilities and Equity

Liabilities ............................................................................. $ 37,000

Stockholders’ equity:

$0.80 cumulative preferred stock, $10 par,

400 shares issued.................................................................. 4,000

Common stock, $9 par, 6,500 shares issued.................... 58,500

Paid-in capital in excess of par—common ...................... 18,500

Retained earnings................................................................ 22,000

Total liabilities and equity............................................... $140,000

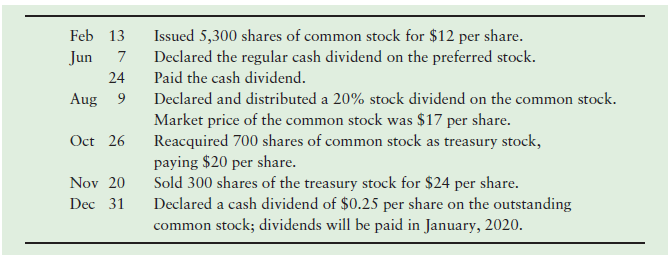

During 2019, Madrid Jewelry completed these transactions that affected stockholders’ equity:

Requirements

1. Journalize Madrid Jewelry’s transactions. Explanations are not required.

2. Prepare the company’s stockholders’ equity section of the balance sheet at December 31, 2019. Net income for 2019 was $30,000.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.