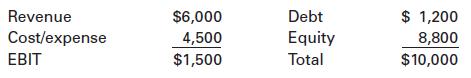

7. Balfour Corp. has the following operating results and capital structure ($000). The firm is contemplating a

Question:

7. Balfour Corp. has the following operating results and capital structure ($000).

The firm is contemplating a capital restructuring to 60% debt. Its stock is currently selling for book value at $25 per share. The interest rate is 9% and combined state and federal taxes are 42%.

a. Calculate EPS under the current and proposed capital structures.

b. Calculate the DFL under both structures.

c. Use the DFLs to forecast the resulting EPS under each structure if operating profit falls off by 5%, 10%, or 25%.

d. Comment on the desirability of the proposed structure versus the current one as a function of the volatility of the business.

e. Is stock price likely to be increased by a change to the proposed capital structure?

Discuss briefly.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: