California Orchards reports the following sales data for the year ended December 31. The company incurred the

Question:

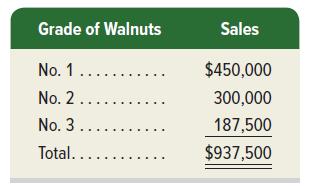

California Orchards reports the following sales data for the year ended December 31.

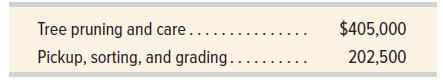

The company incurred the following joint costs for the year.

Required

1. Use the value basis to allocate joint costs to the three grades of walnuts.

2. Compute gross profit for each of the three grades of walnuts.

Transcribed Image Text:

Grade of Walnuts Sales No. 1.... No. 2..... No. 3..... $450,000 300,000 187,500 Total...... $937,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 64% (14 reviews)

Part 1 Preliminary calculation Allocation ...View the full answer

Answered By

Lamya S

Highly creative, resourceful and dedicated High School Teacher with a good fluency in English (IELTS- 7.5 band scorer) and an excellent record of successful classroom presentations.

I have more than 2 years experience in tutoring students especially by using my note making strategies.

Especially adept at teaching methods of business functions and management through a positive, and flexible teaching style with the willingness to work beyond the call of duty.

Committed to ongoing professional development and spreading the knowledge within myself to the blooming ones to make them fly with a colorful wing of future.

I do always believe that more than being a teacher who teaches students subjects,...i rather want to be a teacher who wants to teach students how to love learning..

Subjects i handle :

Business studies

Management studies

Operations Management

Organisational Behaviour

Change Management

Research Methodology

Strategy Management

Economics

Human Resource Management

Performance Management

Training

International Business

Business Ethics

Business Communication

Things you can expect from me :

- A clear cut answer

- A detailed conceptual way of explanation

- Simplified answer form of complex topics

- Diagrams and examples filled answers

4.90+

46+ Reviews

54+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Tampa Tomatoes reports the following sales data for the year ended December 31. The company incurred the following joint costs for the year. Required 1. Use the value basis to allocate joint costs to...

-

The following cash data for the year ended December 31 were adapted from a recent annual report of Alphabet (GOOG), formerly known as Google. The cash balance as of January 1 was $18,347 (in...

-

The following cash data for the year ended December 31 were adapted from a recent annual report of Alphabet (GOOG), formerly known as Google. The cash balance as of January 1 was $12,918 (in...

-

George bought the following amounts of Stock A over the years: (Loss amounts should be indicated with a minus sign.) Number of Adjusted Basis $ 7,200 6,270 Date Purchased Shares Stock A 11/21/1993...

-

Water at 1.5 MPa, 150C, is throttled adiabatically through a valve to 200 kPa. The inlet velocity is 5 m/s, and the inlet and exit pipe diameters are the same. Determine the state (neglecting kinetic...

-

Assume that a bond is issued with the following characteristics: Date of bonds: January 1, 2005; maturity date: January 1, 2010; face value: $200,000; face interest rate: 10 percent paid semiannually...

-

The following legal claims exist for Kewa Co. Identify the accounting treatment for each claim as either (a) a liability that is recorded or (b) an item described in notes to its financial...

-

Do you believe Deloitte & Touche should have approved Livents decision to record the $12.5 million naming rights payment as revenue during the third quarter of 1997? Defend your answer. What broad...

-

On January 1, 2021, Larkspur Wholesale Ltd. has 26,300 common shared issued for a total of $65,750, and no other shares or contributed capital. During 2021, Larkspur had the following transactions:...

-

AccountantSea has recently increased its long-term borrowings to fund the acquisition of two new cruise ships. The bank approved the increase subject to a debt covenant of maintaining a debt-equity...

-

Gomez Company has two service departments (Personnel and Office) and two operating departments (Shoes and Clothing). Following are the direct expenses and square feet occupied by the four...

-

Renata Co. has four departments: Materials, Personnel, Manufacturing, and Packaging. Information follows. The four departments share the following indirect expenses for supervision, utilities, and...

-

In much the same way that they react with H 2 , alkenes also react with D 2 (deuterium is an isotope of hydrogen). Use this information to predict the product(s) of the following reaction: D2 Pt

-

Below are incomplete financial statements for Hurricane, Incorporated Required: Calculate the missing amounts. Complete this question by entering your answers in the tabs below. Income Statement Stmt...

-

TBTF Incorporated purchased equipment on May 1, 2021. The company depreciates its equipment using the double-declining balance method. Other information pertaining to the equipment purchased by TBTF...

-

Coco Ltd. manufactures milk and dark chocolate blocks. Below is the information relating to each type of chocolate. Milk Chocolate Selling price per unit $6 Variable cost per unit $3 Sales mix 4 Dark...

-

Data related to 2018 operations for Constaga Products, a manufacturer of sewing machines: Sales volume 5,000 units Sales price $300.00 per unit Variable production costs Direct materials 75.00 per...

-

6. (20 points) Sections 3.1-3.5, 3.7 Differentiate the following functions, state the regions where the functions are analytic. a. cos(e*) b. 1 ez +1 c. Log (z+1) (Hint: To find where it is analytic,...

-

Identify each of the following accounts of Liken Services Co. as asset, liability, stockholders equity, revenue, or expense, and state in each case whether the normal balance is a debit or a credit:...

-

The following exercises are not grouped by type. Solve each equation. x610x -9

-

Stein agrees to pay Choi and Amal $ 10,000 each for a one- third (331/ 3%) interest in the Choi and Amal partnership. Immediately prior to Steins admission, each partner had a $ 30,000 capital...

-

The Field, Brown & Snow partnership was begun with investments by the partners as follows: Field, $ 131,250; Brown, $ 165,000; and Snow, $ 153,750. The operations did not go well, and the partners...

-

Howe and Duleys company is organized as a partnership. At the prior year- end, partnership equity totaled $150,000 ($100,000 from Howe and $50,000 from Duley). For the current year, partnership net...

-

Describe how the following affect the valuation of PPE. a) Cash Discounts b) Deferred Payment Contracts

-

Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five - year period. His annual pay raises are determined by his division s...

-

Consider a 5 year debt with a 15% coupon rate paid semi-annually, redeemable at Php1,000 par. The bond is selling at 90%. The flotation cost is Php50 per bind. The firm's tax bracket is 30%.

Study smarter with the SolutionInn App