Issue 1: On 3 September 2017, Mastertickets Limited (Mastertickets), a concert ticket agency, made a number of

Question:

Issue 1:

On 3 September 2017, Mastertickets Limited ("Mastertickets"), a concert ticket agency, made a number of concert reservations for customers, receiving 5,000 from them. The customers collected the concert tickets from the agency on the same day. Mastertickets remitted 4,500 to the concert promoter on 4 September 2017, retaining 500 as commis- sion. Mastertickets acts purely as an agent for the concert promoter and has no responsibility for the concert, which is taking place in July 2018.

Requirement:

How should Mastertickets reflect this transaction in its financial statements for the year ended 31 December 2017? Issue 2 Lagan Limited ("Lagan") operates an internet site from which it sells the products of various manufacturers. Customers, using the Internet site, select the products they wish to purchase, provide their credit card details and the address to which the goods are to be delivered. Once the credit card authorisation is received, Lagan passes the order details immediately to the relevant manufacturer. The manufacturer is responsible for delivering the goods directly to the customer, and is also responsible for any disputed credit card charges, product returns or warranty claims. Lagan charges each manufac- turer a fee of 8% of the product's selling price. During the year ended 31 December 2017, total product sales through the Internet site amounted to 500,000, earning Lagan commission of 40,000. Requirement How should Lagan reflect this transaction in its financial statements for the year ended 31 December 2017?

Issue 2:

Lagan Limited ("Lagan") operates an internet site from which it sells the products of various manufacturers. Customers, using the Internet site, select the products they wish to purchase, provide their credit card details and the address to which the goods are to be delivered. Once the credit card authorisation is received, Lagan passes the order details immediately to the relevant manufacturer. The manufacturer is responsible for delivering the goods directly to the customer, and is also responsible for any disputed credit card charges, product returns or warranty claims. Lagan charges each manufacturer a fee of 8% of the product's selling price. During the year ended 31 December 2017, total product sales through the Internet site amounted to 500,000, earning Lagan commission of 40,000.

Requirement:

How should Lagan reflect this transaction in its financial statements for the year ended 31 December 2017?

Issue 3:

Purple Limited ("Purple") provides mobile telephone services. Customers subscribing to Purple initially pay a non-refundable activation fee followed by a quarterly call usage charge. Only nominal costs are incurred by Purple to activate the telephone service, and the quarterly call usage charge is more than adequate to cover operating costs.

Requirement:

How should Purple reflect this transaction in its financial statements for the year ended 31 December 2017?

Issue 4:

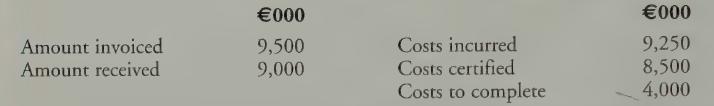

Nectar Limited ("Nectar"), on 1 February 2017, entered into a 15,000,000 fixed- price contract with no variable component to build a multistorey car park, with a comple- tion date of 30 June 2018. Nectar has not yet accounted for the contract in its financial statements for the year ended 31 December 2017. The contract is considered to contain only one performance obligation which will be satisfied over time. It has been determined that an input method that uses the percentage of completion, based on costs certified as a proportion of total estimated costs, appropriately predicts performance under the contract revenue. Further details in relation to the contract at 31 December 2017 are as follows:

Requirement:

How should Nectar reflect the contract in its financial statements for the year ended 31 December 2017?

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly