Advanced: Investigation of variances The Brio Biscuit Company has a weekly cost variance reporting system for each

Question:

Advanced: Investigation of variances The Brio Biscuit Company has a weekly cost variance reporting system for each of its production lines. An adverse raw materials cost variance is reported when the materials content of a product exceeds the standard cost allowed. At this stage, the plant manager has to decide whether to call out an engineer to investigate whether the machine which weighs out the raw materials is still working within its design tolerances. Such an Investigation will take one hour and requires that all production on the line concerned is halted. If a fault is found it will take a further two hours to reset the machine to its correct tolerances. During any stoppage the production line operatives will be idle, and the maintenance engineer will be charged at £10 per hour. If the machine is allowed to continue to operate when it should have been reset, it is estimated that the materials variance in the following week will be twice that reported in the current week.

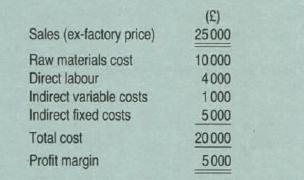

The crunchy biscuit line is currently working at full capacity (100 hours per week) in order to satisfy the demand for this new product, and the management accounting system indicates its weekly performance is as follows

Requirements

(a) How should the manager decide whether to investigate further an adverse raw materials cost variance of (i) £250 (ii) £100? (10 marks)

(b) The manager believes that a zero materials cost variance indicates that the process is certainly in control, and that a £600 variance indicates it is certainly out-of-control.

Between those two values h1s belief that the process is out-of-control varies in direct proportion to the size of the variance. What should be his decision rule for investigating a variance, and what is the expected cost of implementing it? (10 marks)

(c) How would your above analysis be affected if resetting the machine was not certain to cure the problem, but to have only a 75% chance of so doing?

Step by Step Answer: