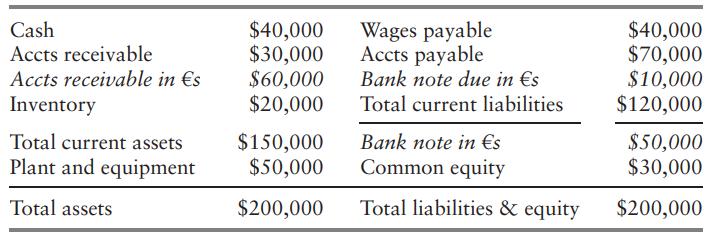

Consider the balance sheet of a U.S. firm exporting to Europe. Euro denominated accounts (shown in italics)

Question:

Consider the balance sheet of a U.S. firm exporting to Europe. Euro denominated accounts (shown in italics) have been translated into U.S. dollars at the current exchange rate.

This firm considers inventory to be a nonmonetary asset.

a. What is the dollar value of the firm’s monetary assets? What is the dollar value of the firm’s monetary liabilities? What is the dollar value of net monetary assets?

b. What is the dollar value of the firm’s monetary assets exposed to currency risk? Exposed monetary liabilities? Net exposed monetary assets (exposed monetary assets less exposed monetary liabilities)?

c. This firm has a bank note denominated in euros. Does this foreign currency liability increase or reduce the firm’s net monetary exposure to currency risk? Explain.

d. Is the operating performance of a U.S. exporter such as this likely to be improved or worsened by a real appreciation of the euro? Explain.

Step by Step Answer: