Answered step by step

Verified Expert Solution

Question

1 Approved Answer

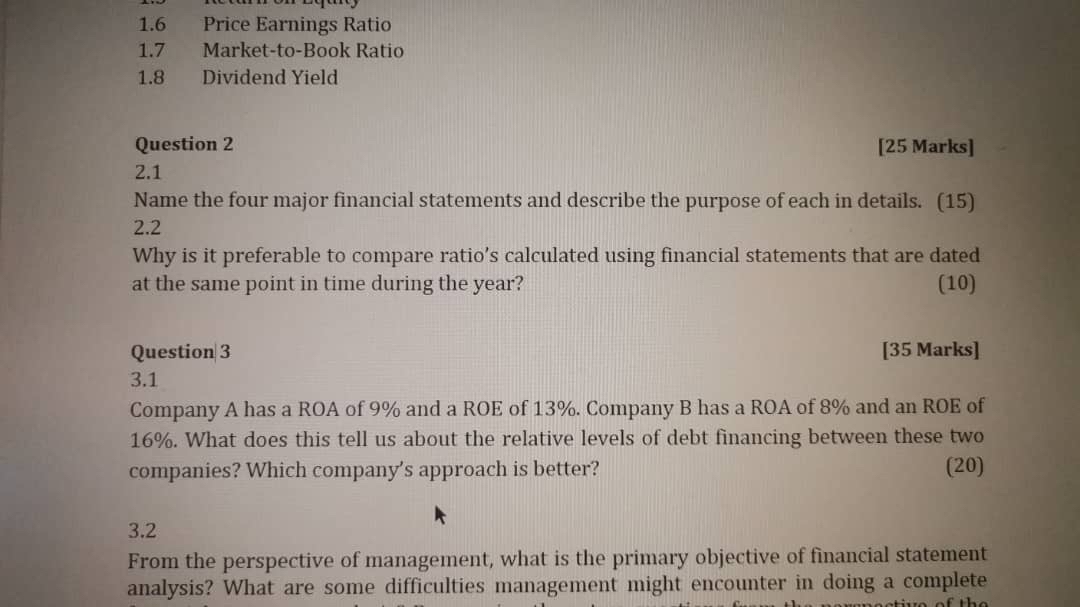

1 . 6 Price Earnings Ratio 1 . 7 Market - to - Book Ratio 1 . 8 Dividend Yield Question 2 [ 2 5

Price Earnings Ratio

MarkettoBook Ratio

Dividend Yield

Question

Marks

Name the four major financial statements and describe the purpose of each in details.

Why is it preferable to compare ratio's calculated using financial statements that are dated at the same point in time during the year?

Question

Marks

Company A has a ROA of and a ROE of Company B has a ROA of and an ROE of What does this tell us about the relative levels of debt financing between these two companies? Which company's approach is better?

From the perspective of management, what is the primary objective of financial statement analysis? What are some difficulties management might encounter in doing a complete

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started