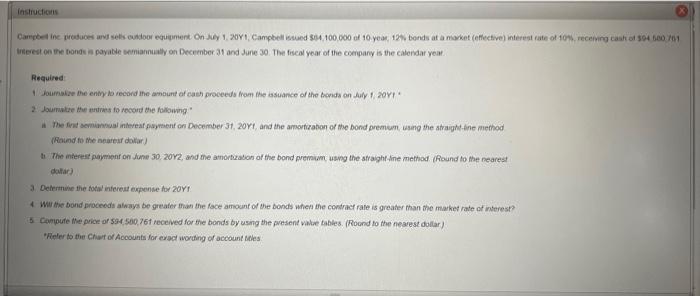

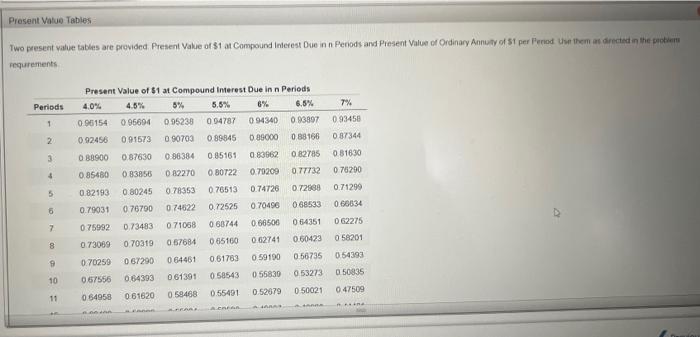

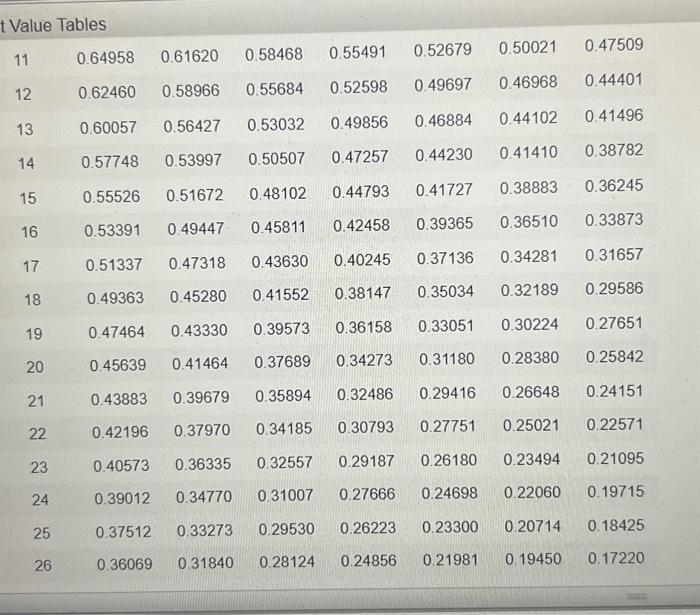

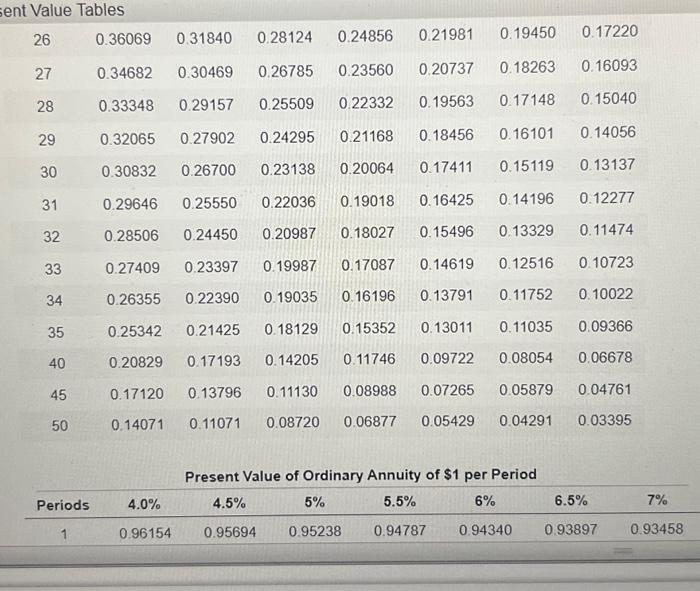

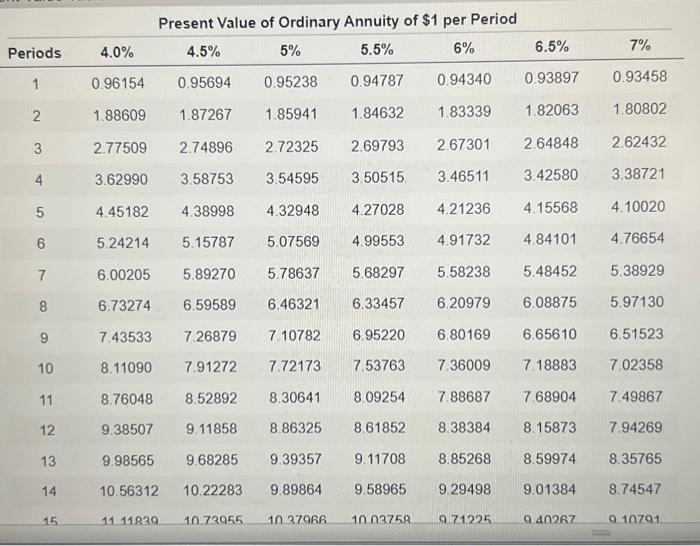

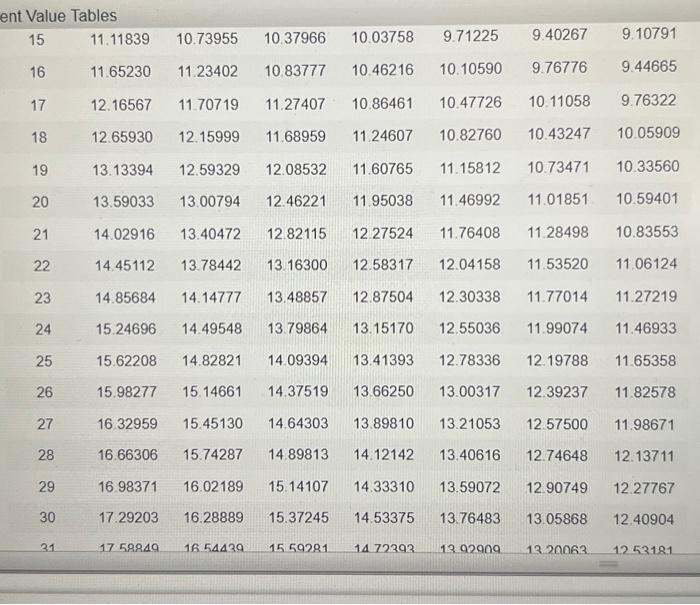

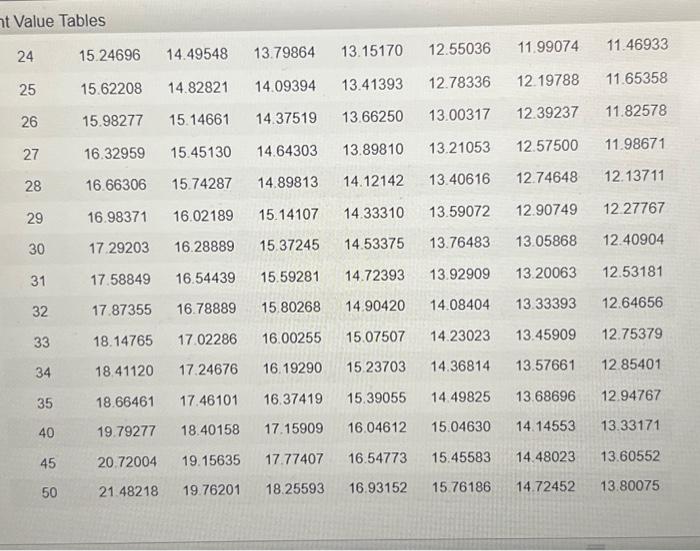

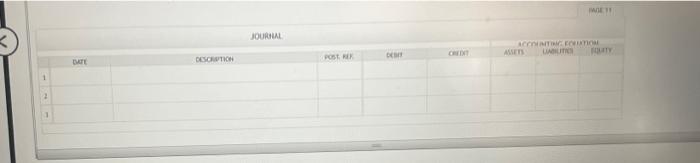

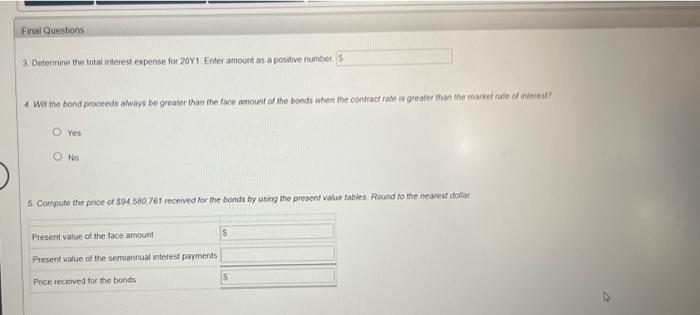

1. and 2 Joumalize the enties ta record the fransactions. Refer to the Chart of Accounts for exact worting of account hehs. Round to the nearrat ditar resent Value of Ordinary Annuity of $1 per Period Two present value tables are provided. Present Value of $1 at Compound Interest Due in n Penods and Present Value of Ordinary Annuty of 51 per Penod use then at derected in the photien pequrements sountes 14nH 11 Ineret on the bonds is payable semianualy on December 31 and June 30 . The fiscol year of the coenpany is the calendar year. Required 2 Jaumalte the erinies fo record the folloingng " (Foind to the hearear dolar) dalar) 3. Detremine the fotal intereat expense for zOYI 4 Wu the bond proceeds alcays be greater than the face amount or the bonds when the contract rate is greater than the maket rate of interes? 5 Conpute the price of 594500,761 receved for the bonds by using the present vilve tables. (Roond to the neavest dollar) "Feler bo the Chart of Acoounts for exact worting of account noles \begin{tabular}{|c|cccccccc} \hline 24 & 15.24696 & 14.49548 & 13.79864 & 13.15170 & 12.55036 & 11.99074 & 11.46933 \\ \hline 25 & 15.62208 & 14.82821 & 14.09394 & 13.41393 & 12.78336 & 12.19788 & 11.65358 \\ \hline 26 & 15.98277 & 15.14661 & 14.37519 & 13.66250 & 13.00317 & 12.39237 & 11.82578 \\ \hline 27 & 16.32959 & 15.45130 & 14.64303 & 13.89810 & 13.21053 & 12.57500 & 11.98671 \\ \hline 28 & 16.66306 & 15.74287 & 14.89813 & 14.12142 & 13.40616 & 12.74648 & 12.13711 \\ \hline 29 & 16.98371 & 16.02189 & 15.14107 & 14.33310 & 13.59072 & 12.90749 & 12.27767 \\ \hline 30 & 17.29203 & 16.28889 & 15.37245 & 14.53375 & 13.76483 & 13.05868 & 12.40904 \\ \hline 31 & 17.58849 & 16.54439 & 15.59281 & 14.72393 & 13.92909 & 13.20063 & 12.53181 \\ \hline 32 & 17.87355 & 16.78889 & 15.80268 & 14.90420 & 14.08404 & 13.33393 & 12.64656 \\ \hline 33 & 18.14765 & 17.02286 & 16.00255 & 15.07507 & 14.23023 & 13.45909 & 12.75379 \\ \hline 34 & 18.41120 & 17.24676 & 16.19290 & 15.23703 & 14.36814 & 13.57661 & 12.85401 \\ \hline 35 & 18.66461 & 17.46101 & 16.37419 & 15.39055 & 14.49825 & 13.68696 & 12.94767 \\ \hline 40 & 19.79277 & 18.40158 & 17.15909 & 16.04612 & 15.04630 & 14.14553 & 13.33171 \\ \hline 45 & 20.72004 & 19.15635 & 17.77407 & 16.54773 & 15.45583 & 14.48023 & 13.60552 \\ \hline 50 & 21.48218 & 19.76201 & 18.25593 & 16.93152 & 15.76186 & 14.72452 & 13.80075 \\ \hline \end{tabular} \begin{tabular}{lllllllll} ent Value Tables & & & & & & \\ 15 & 11.11839 & 10.73955 & 10.37966 & 10.03758 & 9.71225 & 9.40267 & 9.10791 \\ 16 & 11.65230 & 11.23402 & 10.83777 & 10.46216 & 10.10590 & 9.76776 & 9.44665 \\ 17 & 12.16567 & 11.70719 & 11.27407 & 10.86461 & 10.47726 & 10.11058 & 9.76322 \\ \hline 18 & 12.65930 & 12.15999 & 11.68959 & 11.24607 & 10.82760 & 10.43247 & 10.05909 \\ \hline 19 & 13.13394 & 12.59329 & 12.08532 & 11.60765 & 11.15812 & 10.73471 & 10.33560 \\ \hline 20 & 13.59033 & 13.00794 & 12.46221 & 11.95038 & 11.46992 & 11.01851 & 10.59401 \\ \hline 21 & 14.02916 & 13.40472 & 12.82115 & 12.27524 & 11.76408 & 11.28498 & 10.83553 \\ \hline 22 & 14.45112 & 13.78442 & 13.16300 & 12.58317 & 12.04158 & 11.53520 & 11.06124 \\ \hline 23 & 14.85684 & 14.14777 & 13.48857 & 12.87504 & 12.30338 & 11.77014 & 11.27219 \\ \hline 24 & 15.24696 & 14.49548 & 13.79864 & 13.15170 & 12.55036 & 11.99074 & 11.46933 \\ \hline 25 & 15.62208 & 14.82821 & 14.09394 & 13.41393 & 12.78336 & 12.19788 & 11.65358 \\ \hline 26 & 15.98277 & 15.14661 & 14.37519 & 13.66250 & 13.00317 & 12.39237 & 11.82578 \\ \hline 27 & 16.32959 & 15.45130 & 14.64303 & 13.89810 & 13.21053 & 12.57500 & 11.98671 \\ \hline 28 & 16.66306 & 15.74287 & 14.89813 & 14.12142 & 13.40616 & 12.74648 & 12.13711 \\ \hline 29 & 16.98371 & 16.02189 & 15.14107 & 14.33310 & 13.59072 & 12.90749 & 12.27767 \\ \hline 30 & 17.29203 & 16.28889 & 15.37245 & 14.53375 & 13.76483 & 13.05868 & 12.40904 \\ \hline 31 & 17.58949 & 16.54429 & 1559281 & 14.72392 & 12.929n9 & 12.2nn62 & 1253181 \end{tabular} 3. Detemine the total interest expense for 20Y1. Enter amount as a positve number. 4 Wr the bond proceeds ahways be greater than the face amount of the bonds when the contract rate a greater than the mavket rato of alerkat? Yes No 5 Compute the price of 594,560,761 received for the bonds by using the present vatue tables. Found to the neanst dollt