Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Lynn made $97,500 in wages in 2022 . They are the head of a household with four qualifying children. They contributed $16,000 to an

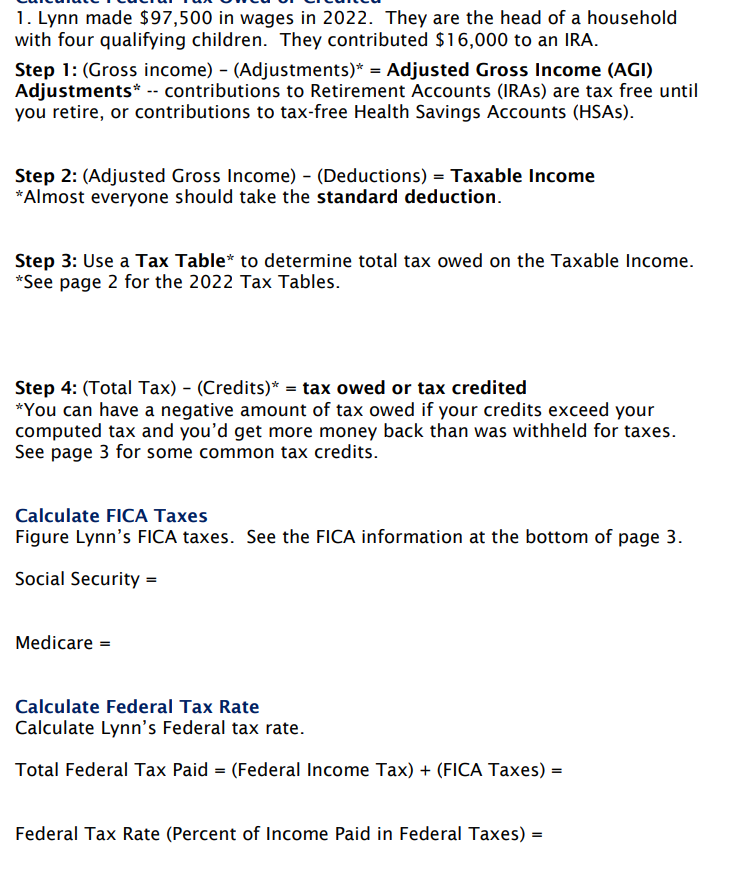

1. Lynn made $97,500 in wages in 2022 . They are the head of a household with four qualifying children. They contributed $16,000 to an IRA. Step 1: (Gross income) - (Adjustments)* = Adjusted Gross Income (AGI) Adjustments" -- contributions to Retirement Accounts (IRAs) are tax free until you retire, or contributions to tax-free Health Savings Accounts (HSAs). Step 2: (Adjusted Gross Income) - (Deductions) = Taxable Income "Almost everyone should take the standard deduction. Step 3: Use a Tax Table* to determine total tax owed on the Taxable Income. "See page 2 for the 2022 Tax Tables. Step 4: (Total Tax) - (Credits) = tax owed or tax credited "You can have a negative amount of tax owed if your credits exceed your computed tax and you'd get more money back than was withheld for taxes. See page 3 for some common tax credits. Calculate FICA Taxes Figure Lynn's FICA taxes. See the FICA information at the bottom of page 3. Social Security = Medicare = Calculate Federal Tax Rate Calculate Lynn's Federal tax rate. Total Federal Tax Paid =( Federal Income Tax )+( FICA Taxes )= Federal Tax Rate (Percent of Income Paid in Federal Taxes) =

1. Lynn made $97,500 in wages in 2022 . They are the head of a household with four qualifying children. They contributed $16,000 to an IRA. Step 1: (Gross income) - (Adjustments)* = Adjusted Gross Income (AGI) Adjustments" -- contributions to Retirement Accounts (IRAs) are tax free until you retire, or contributions to tax-free Health Savings Accounts (HSAs). Step 2: (Adjusted Gross Income) - (Deductions) = Taxable Income "Almost everyone should take the standard deduction. Step 3: Use a Tax Table* to determine total tax owed on the Taxable Income. "See page 2 for the 2022 Tax Tables. Step 4: (Total Tax) - (Credits) = tax owed or tax credited "You can have a negative amount of tax owed if your credits exceed your computed tax and you'd get more money back than was withheld for taxes. See page 3 for some common tax credits. Calculate FICA Taxes Figure Lynn's FICA taxes. See the FICA information at the bottom of page 3. Social Security = Medicare = Calculate Federal Tax Rate Calculate Lynn's Federal tax rate. Total Federal Tax Paid =( Federal Income Tax )+( FICA Taxes )= Federal Tax Rate (Percent of Income Paid in Federal Taxes) = Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started