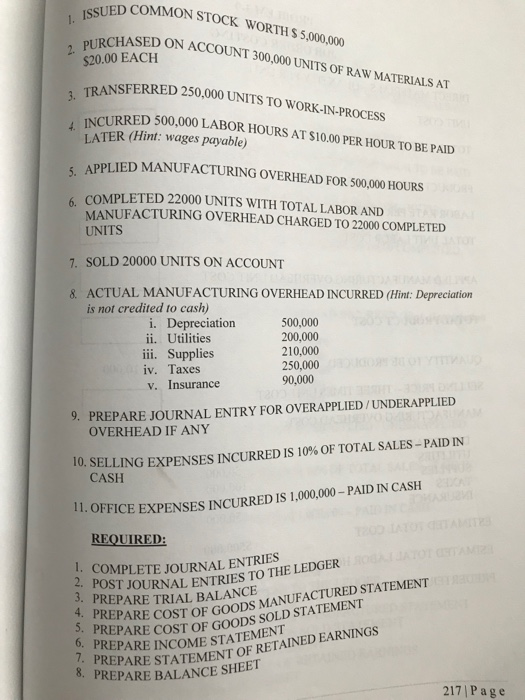

1. Post Journal entries to the ledger

2. Prepare trial balance

3. Prepare cost of goods manufactured statement

4. Prepare cost of goods sold statement

5. prepare income statement

6. Prepare statement of retained earnings

7. Prepare balance sheet

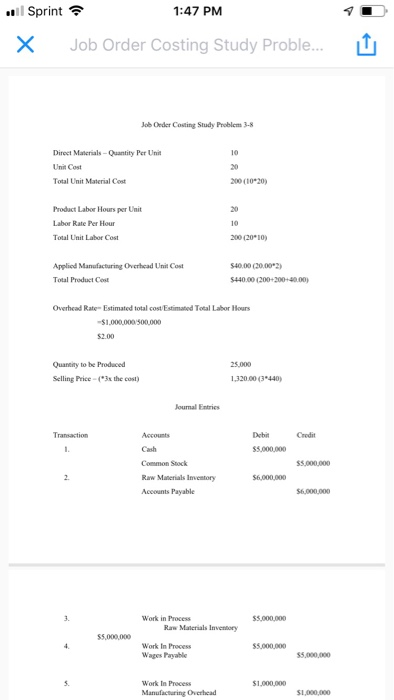

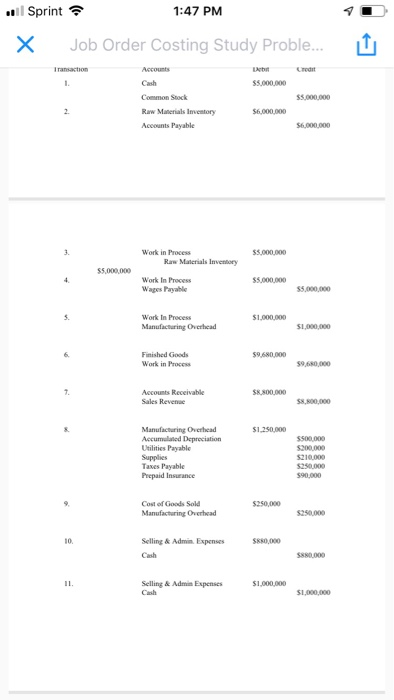

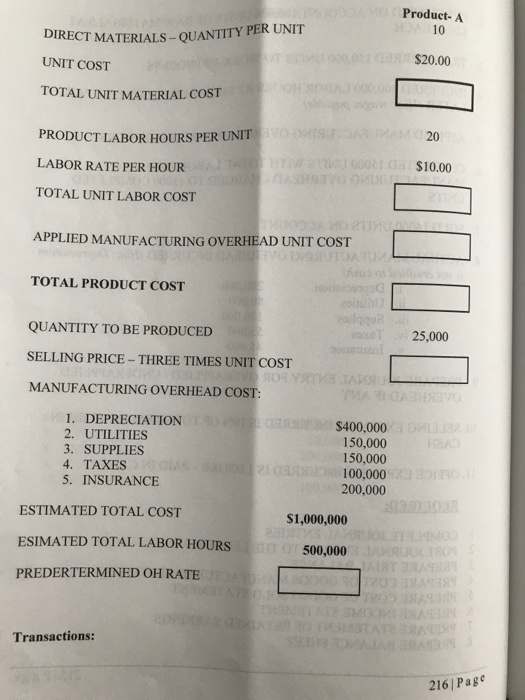

.'Il Sprint 1:47 PM X Job Order Costing Study Proble.... T Job Deder Costing Study Problem 3-8 Direct Materials-Quantity Per Unit Unit Cost Total Unit Material Cost 20 200 (10*20) Prodact Labor Hours per Unit 20 10 200 (2010) Labor Rate Per Hour Appliod Manufacturing Overhead Unit Cost 540.00 00.002) Total Product Cost 440.00 (200+200+40.00 Overhead Rate- Estimated total cost Estimated Total Labor Hours $2.00 Quamity to be Produced Selling Price- ("3s the cost) 25,000 1,320.00(3-440 Journal Entries Debit Credit Cash Common Stock Raw Manerials Imventory Accounts Payable Work in Process Raw Malerials Inventory Work In Process Wages Payable Work In Process Manufacturing Overhead 51,000,000 Product- A ER UNIT 10 DIRECT MATERIALS-QUANTITY P UNIT COST TOTAL UNIT MATERIAL COST $20.00 20 PRODUCT LABOR HOURS PER UNIT LABOR RATE PER HOUR TOTAL UNIT LABOR COST $10.00 APPLIED MANUFACTURING OVERHEAD UNIT COST TOTAL PRODUCT COST QUANTITY TO BE PRODUCED SELLING PRICE-THREE TIMES UNIT COST MANUFACTURING OVERHEAD COST 25,000 1, DEPRECIATION 2. UTILITIES 3. SUPPLIES 4. TAXES 5. INSURANCE $400,000 150,000 150,000 100,000 200,000 ESTIMATED TOTAL COST ESIMATED TOTAL LABOR HOURS PREDERTERMINED OH RATE $1,000,000 500,000 Transactions: 216/Page COMMON 1. ISSUED STOCK WORTH S 5,000,000 ED ON ACCOUNT 300,000 UNITS OF RAw MATERIALS AT $20.00 EACEH TRANSFERRED 250,000 UNITS TO WORK-IN-PROCESS INCURRED 500,000 LABOR HOURS AT $10.00 PER HOUR TO BE PAID LATER (Hint: wages payable) PPLIED MANUFACTURING OVERHEAD FOR 500,000 HOURS 5. A 6COMPLETED 22000 UNITS WITH TOTAL LABOR AND MANUFACTURING OVERHEAD CHARGED TO 22000 COMPLETED UNITS 7. SOLD 20000 UNITS ON ACCOUNT 8. ACTUAL MANUFACTURING OVERHEAD INCURRED (Hint: Depreciation is not credited to cash) i. Depreciation ii. Utilities iii. Supplies iv. Taxes V. Insurance 500,000 200,000 210,000 250,000 90,000 PREPARE JOURNAL ENTRY FOR OVERAPPLIED/UNDERAPPLIED OVERHEAD IF ANY 9. ELLING EXPENSES INCURRED IS 1 0% OF TOTAL SALES-PAID IN CASH 10. S IL OFFICE EXPENSES INCURRED IS 1,00,00- PAID IN CASH 1. COMPLETE JOURNAL ENTRIES 4. PREPARE COST OF GOODS REQUIRED: POST JOURNAL ENTRIES TO THE LEDGER PREPARE TRIAL BALANCE PREPARE COST OF GOODSSOLD STATEMENT PREPARE INCOME STATEMENT COST OF GOODS MANUFACTURED STATEMENT PREPARE STATEMENTOF PREPARE BALANCE SHEET T OF RETAINED EARNINGS 8. 217 Page .'Il Sprint 1:47 PM X Job Order Costing Study Proble.... T Job Deder Costing Study Problem 3-8 Direct Materials-Quantity Per Unit Unit Cost Total Unit Material Cost 20 200 (10*20) Prodact Labor Hours per Unit 20 10 200 (2010) Labor Rate Per Hour Appliod Manufacturing Overhead Unit Cost 540.00 00.002) Total Product Cost 440.00 (200+200+40.00 Overhead Rate- Estimated total cost Estimated Total Labor Hours $2.00 Quamity to be Produced Selling Price- ("3s the cost) 25,000 1,320.00(3-440 Journal Entries Debit Credit Cash Common Stock Raw Manerials Imventory Accounts Payable Work in Process Raw Malerials Inventory Work In Process Wages Payable Work In Process Manufacturing Overhead 51,000,000 Product- A ER UNIT 10 DIRECT MATERIALS-QUANTITY P UNIT COST TOTAL UNIT MATERIAL COST $20.00 20 PRODUCT LABOR HOURS PER UNIT LABOR RATE PER HOUR TOTAL UNIT LABOR COST $10.00 APPLIED MANUFACTURING OVERHEAD UNIT COST TOTAL PRODUCT COST QUANTITY TO BE PRODUCED SELLING PRICE-THREE TIMES UNIT COST MANUFACTURING OVERHEAD COST 25,000 1, DEPRECIATION 2. UTILITIES 3. SUPPLIES 4. TAXES 5. INSURANCE $400,000 150,000 150,000 100,000 200,000 ESTIMATED TOTAL COST ESIMATED TOTAL LABOR HOURS PREDERTERMINED OH RATE $1,000,000 500,000 Transactions: 216/Page COMMON 1. ISSUED STOCK WORTH S 5,000,000 ED ON ACCOUNT 300,000 UNITS OF RAw MATERIALS AT $20.00 EACEH TRANSFERRED 250,000 UNITS TO WORK-IN-PROCESS INCURRED 500,000 LABOR HOURS AT $10.00 PER HOUR TO BE PAID LATER (Hint: wages payable) PPLIED MANUFACTURING OVERHEAD FOR 500,000 HOURS 5. A 6COMPLETED 22000 UNITS WITH TOTAL LABOR AND MANUFACTURING OVERHEAD CHARGED TO 22000 COMPLETED UNITS 7. SOLD 20000 UNITS ON ACCOUNT 8. ACTUAL MANUFACTURING OVERHEAD INCURRED (Hint: Depreciation is not credited to cash) i. Depreciation ii. Utilities iii. Supplies iv. Taxes V. Insurance 500,000 200,000 210,000 250,000 90,000 PREPARE JOURNAL ENTRY FOR OVERAPPLIED/UNDERAPPLIED OVERHEAD IF ANY 9. ELLING EXPENSES INCURRED IS 1 0% OF TOTAL SALES-PAID IN CASH 10. S IL OFFICE EXPENSES INCURRED IS 1,00,00- PAID IN CASH 1. COMPLETE JOURNAL ENTRIES 4. PREPARE COST OF GOODS REQUIRED: POST JOURNAL ENTRIES TO THE LEDGER PREPARE TRIAL BALANCE PREPARE COST OF GOODSSOLD STATEMENT PREPARE INCOME STATEMENT COST OF GOODS MANUFACTURED STATEMENT PREPARE STATEMENTOF PREPARE BALANCE SHEET T OF RETAINED EARNINGS 8. 217 Page