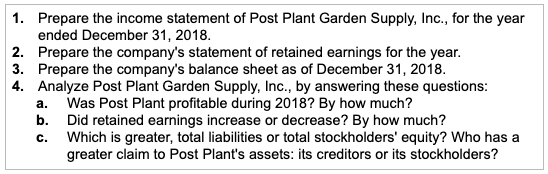

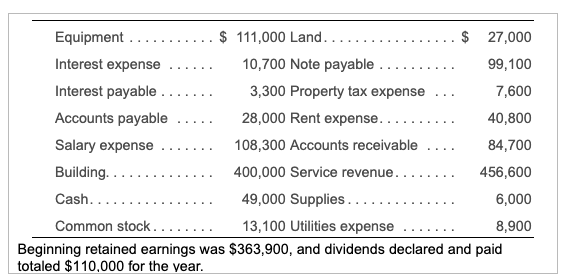

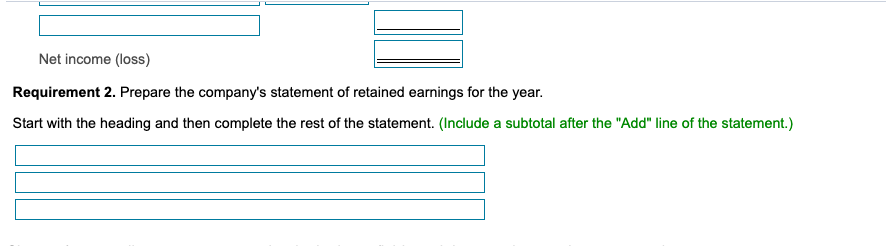

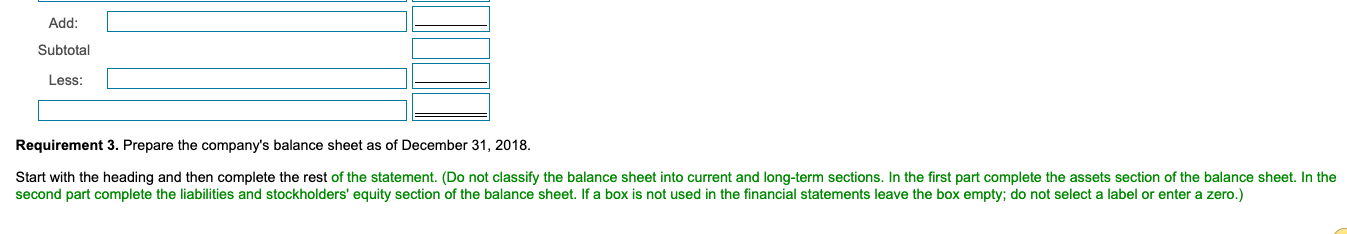

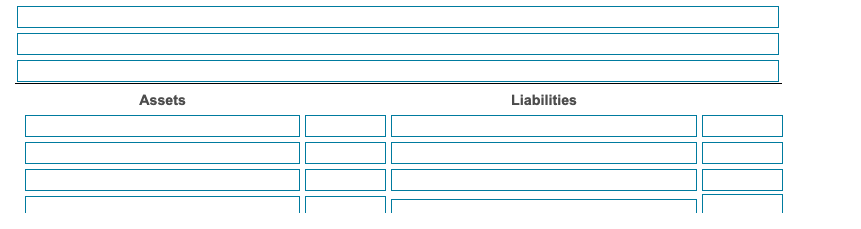

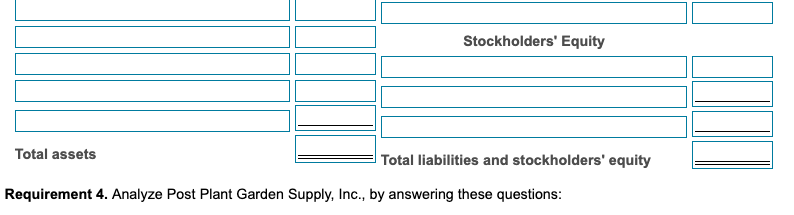

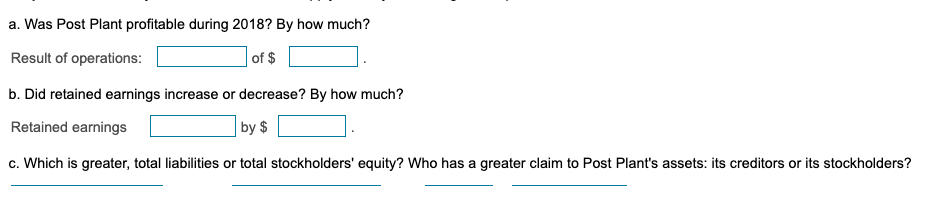

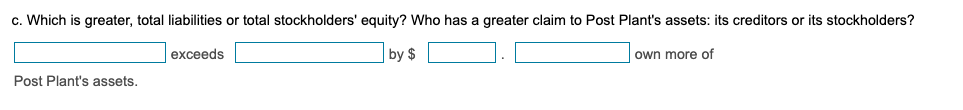

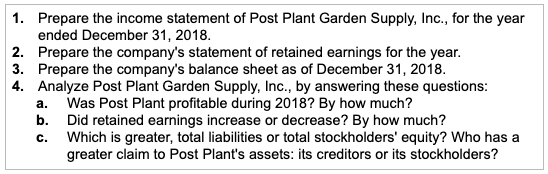

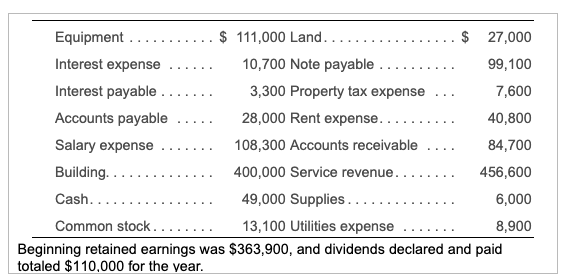

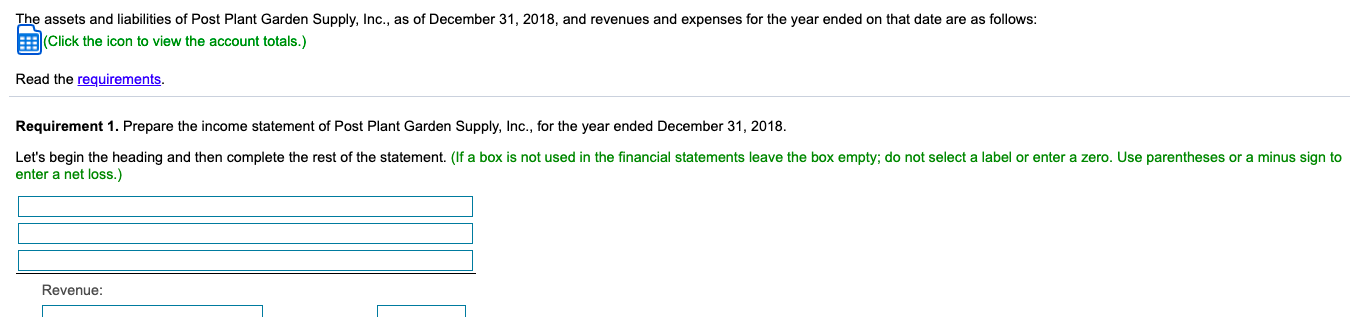

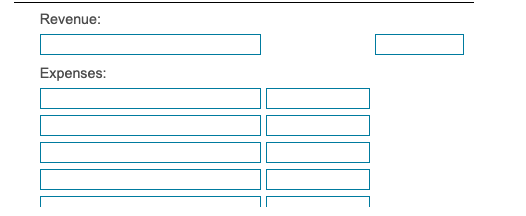

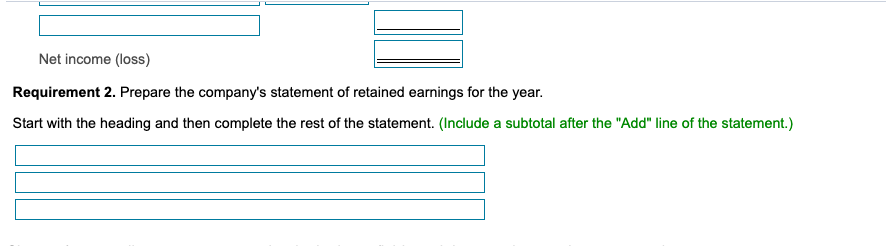

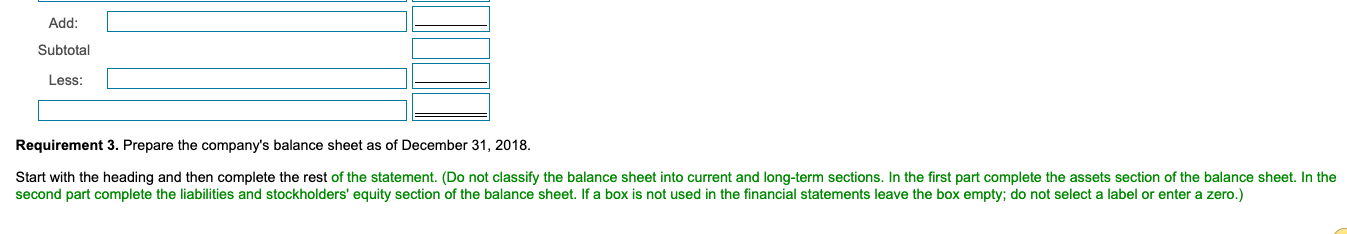

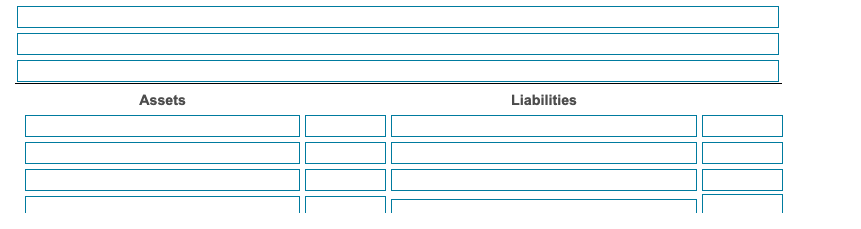

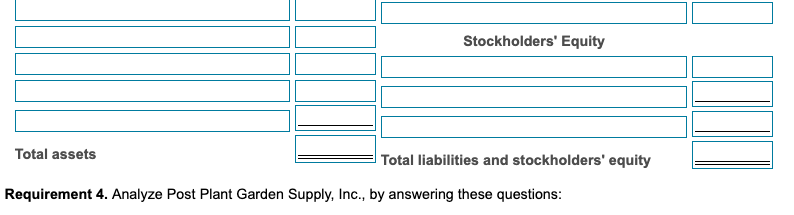

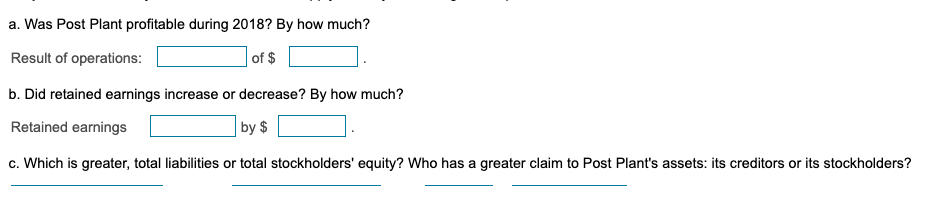

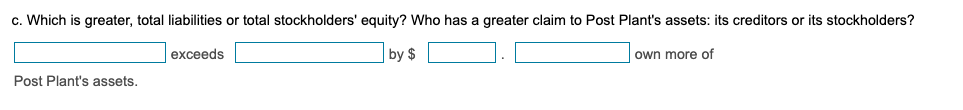

1. Prepare the income statement of Post Plant Garden Supply, Inc., for the year ended December 31, 2018. 2. Prepare the company's statement of retained earnings for the year. 3. Prepare the company's balance sheet as of December 31, 2018. 4. Analyze Post Plant Garden Supply, Inc., by answering these questions: a. Was Post Plant profitable during 2018? By how much? b. Did retained earnings increase or decrease? By how much? Which is greater, total liabilities or total stockholders' equity? Who has a greater claim to Post Plant's assets: its creditors or its stockholders? c. Equipment $ 111,000 Land.... $ 27,000 Interest expense 10,700 Note payable .. 99,100 Interest payable 3,300 Property tax expense 7,600 Accounts payable 28,000 Rent expense... 40,800 Salary expense 108,300 Accounts receivable 84,700 Building. 400,000 Service revenue. 456,600 Cash... 49,000 Supplies .... 6,000 Common stock........ 13,100 Utilities expense 8,900 Beginning retained earnings was $363,900, and dividends declared and paid totaled $110,000 for the year. The assets and liabilities of Post Plant Garden Supply, Inc., as of December 31, 2018, and revenues and expenses for the year ended on that date are as follows: (Click the icon to view the account totals.) Read the requirements. Requirement 1. Prepare the income statement of Post Plant Garden Supply, Inc., for the year ended December 31, 2018. Let's begin the heading and then complete the rest of the statement. (If a box is not used in the financial statements leave the box empty; do not select a label or enter a zero. Use parentheses or a minus sign to enter a net loss.) Revenue: Revenue: Expenses: Net income (loss) Requirement 2. Prepare the company's statement of retained earnings for the year. Start with the heading and then complete the rest of the statement. (Include a subtotal after the "Add" line of the statement.) Add: Subtotal Less: Requirement 3. Prepare the company's balance sheet as of December 31, 2018. Start with the heading and then complete the rest of the statement. (Do not classify the balance sheet into current and long-term sections. In the first part complete the assets section of the balance sheet. In the second part complete the liabilities and stockholders' equity section of the balance sheet. If a box is not used in the financial statements leave the box empty; do not select a label or enter a zero.) Assets Liabilities Stockholders' Equity ITE Total assets Total liabilities and stockholders' equity Requirement 4. Analyze Post Plant Garden Supply, Inc., by answering these questions: a. Was Post Plant profitable during 2018? By how much? Result of operations: of $ b. Did retained earnings increase or decrease? By how much? Retained earnings by $ c. Which is greater, total liabilities or total stockholders' equity? Who has a greater claim to Post Plant's assets: its creditors or its stockholders? c. Which is greater, total liabilities or total stockholders' equity? Who has a greater claim to Post Plant's assets: its creditors or its stockholders? exceeds by $ own more of Post Plant's assets