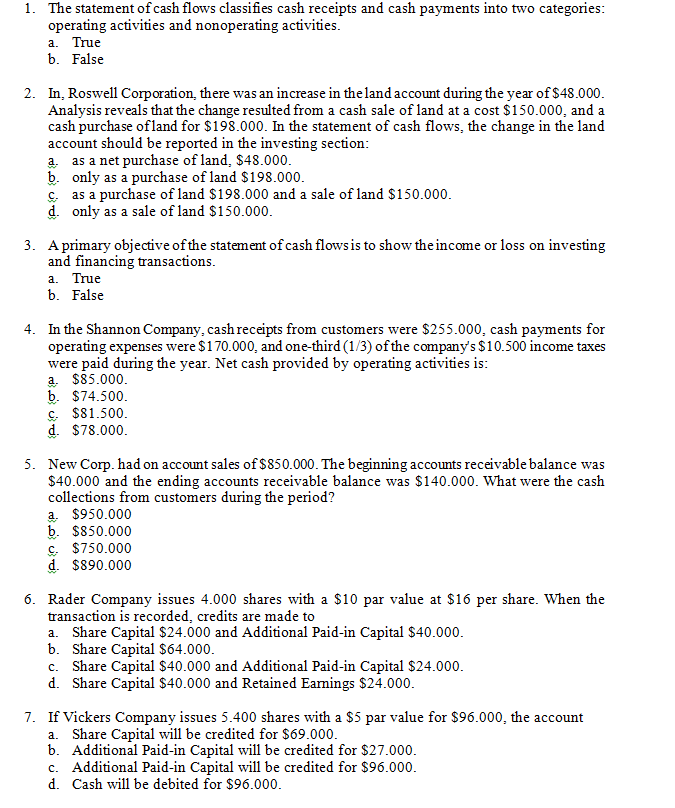

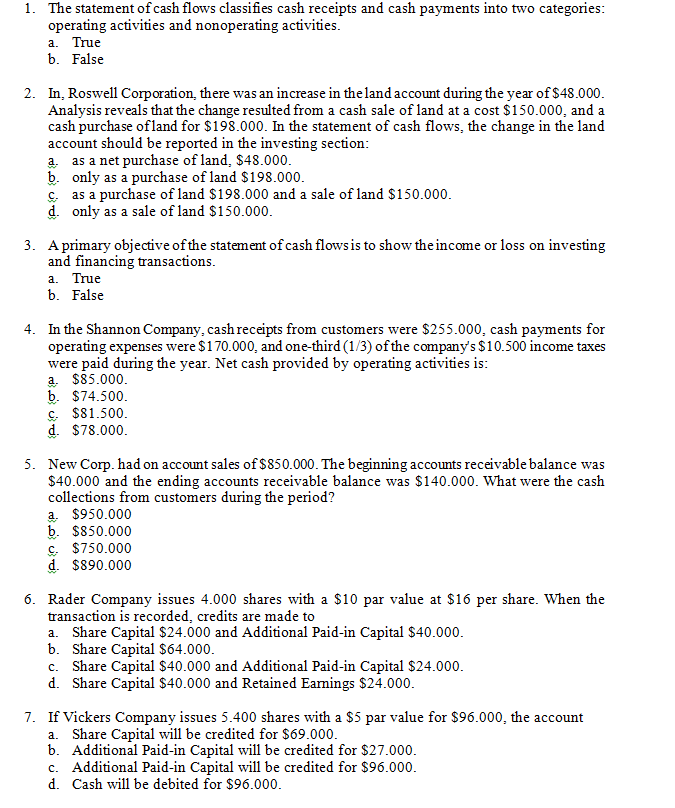

1. The statement of cash flows classifies cash receipts and cash payments into two categories: operating activities and nonoperating activities. a. True b. False a. 2. In, Roswell Corporation, there was an increase in the land account during the year of $48.000. Analysis reveals that the change resulted from a cash sale of land at a cost $150.000, and a cash purchase ofland for $198.000. In the statement of cash flows, the change in the land account should be reported in the investing section: as a net purchase of land, $48.000. b. only as a purchase of land $198.000. c. as a purchase of land $198.000 and a sale of land $150.000. d. only as a sale of land $150.000. 3. A primary objective of the statement of cash flows is to show the income or loss on investing and financing transactions. a. True b. False 4. In the Shannon Company, cash receipts from customers were $255.000, cash payments for operating expenses were $170.000, and one-third (1/3) of the company's $10.500 income taxes were paid during the year. Net cash provided by operating activities is: a $85.000. b. $74.500. c. $81.500. d. $78.000 5. New Corp. had on account sales of $850.000. The beginning accounts receivable balance was $40.000 and the ending accounts receivable balance was $140.000. What were the cash collections from customers during the period? a $950.000 b. $850.000 , $750.000 d. $890.000 6. Rader Company issues 4.000 shares with a $10 par value at $16 per share. When the transaction is recorded, credits are made to a. Share Capital $24.000 and Additional Paid-in Capital $40.000. b. Share Capital $64.000. c. Share Capital $40.000 and Additional Paid-in Capital $24.000. d. Share Capital $40.000 and Retained Earings $24.000. 7. If Vickers Company issues 5.400 shares with a $5 par value for $96.000, the account a. Share Capital will be credited for $69.000. b. Additional Paid-in Capital will be credited for $27.000. C. Additional Paid-in Capital will be credited for $96.000. d. Cash will be debited for $96.000