Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What is your assessment of the different business models being used by Google and Microsoft? 2. What recommendations would you give to Satya

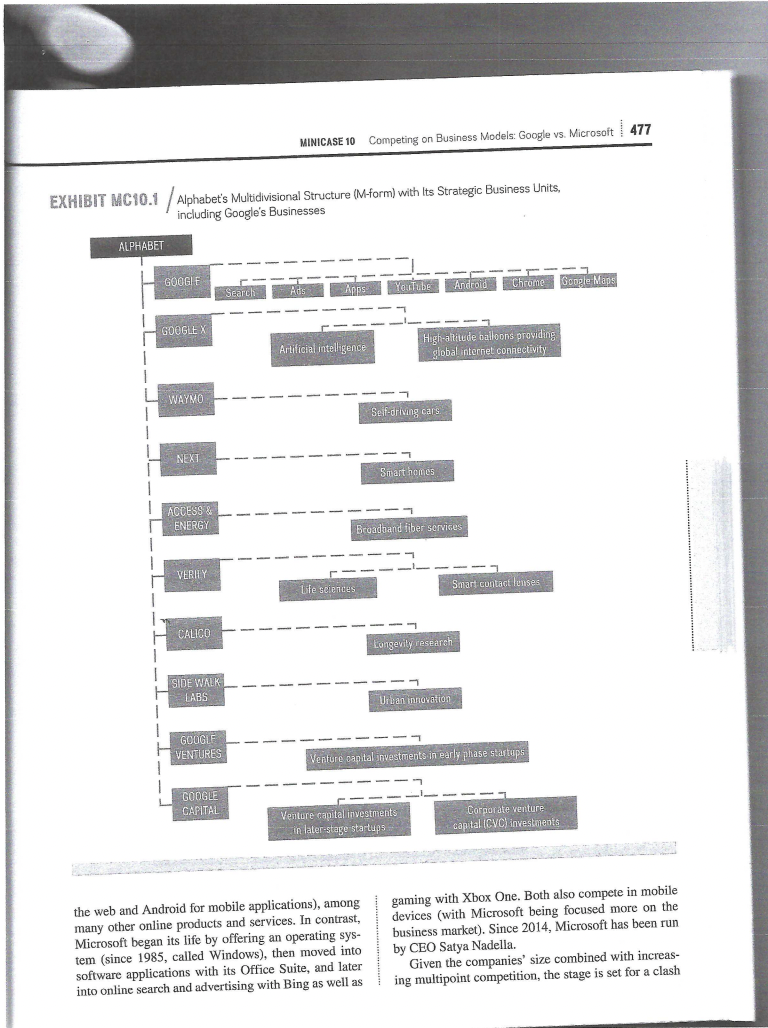

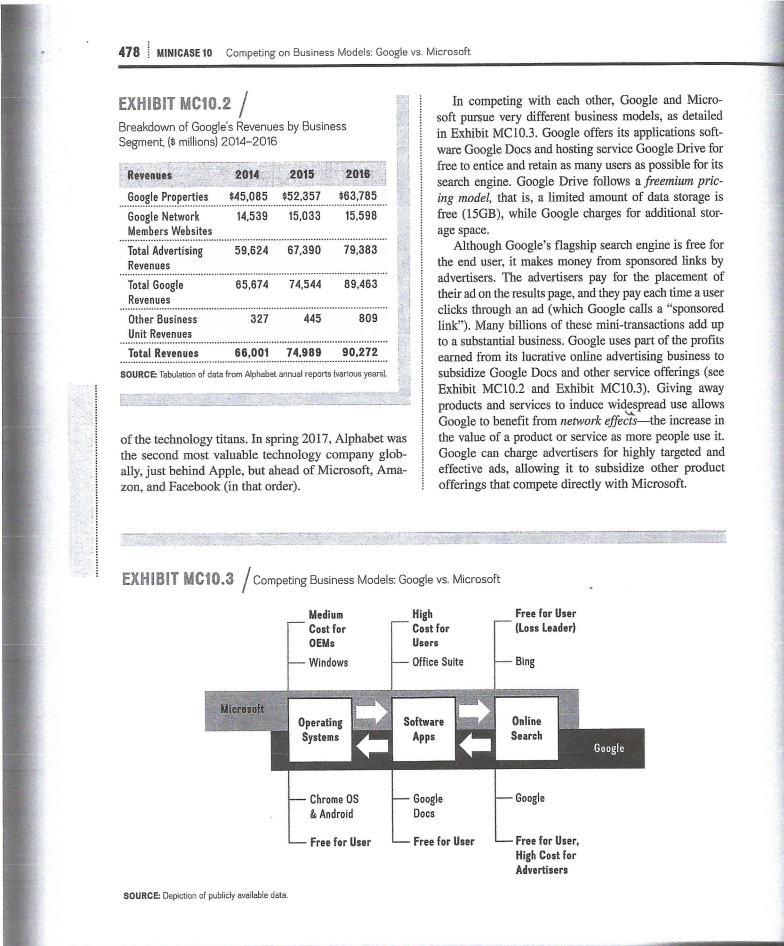

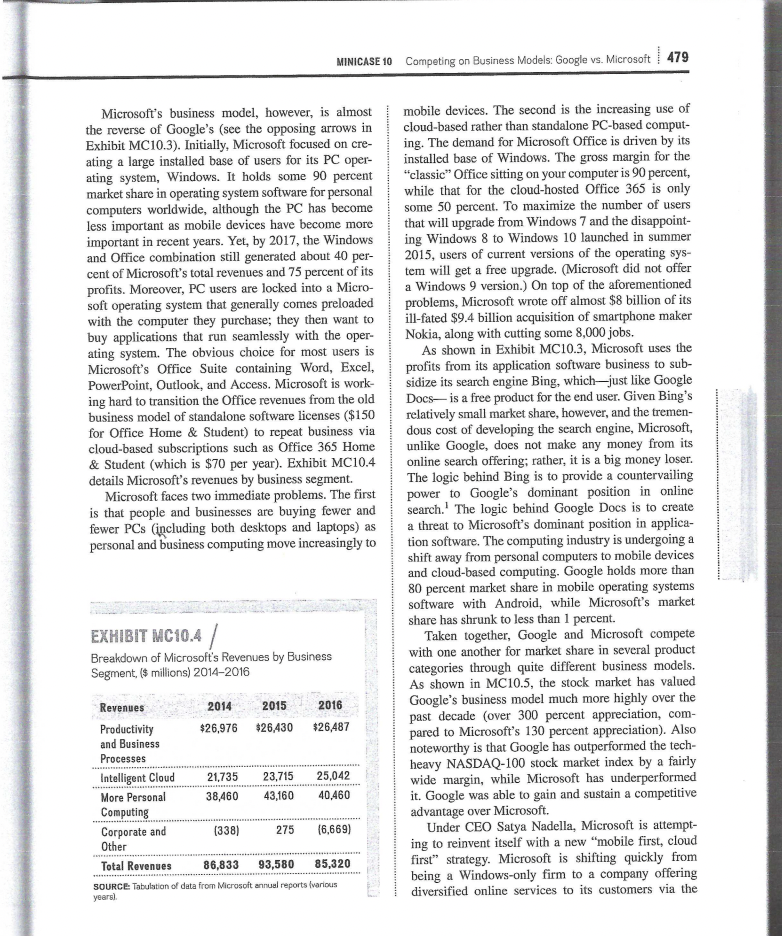

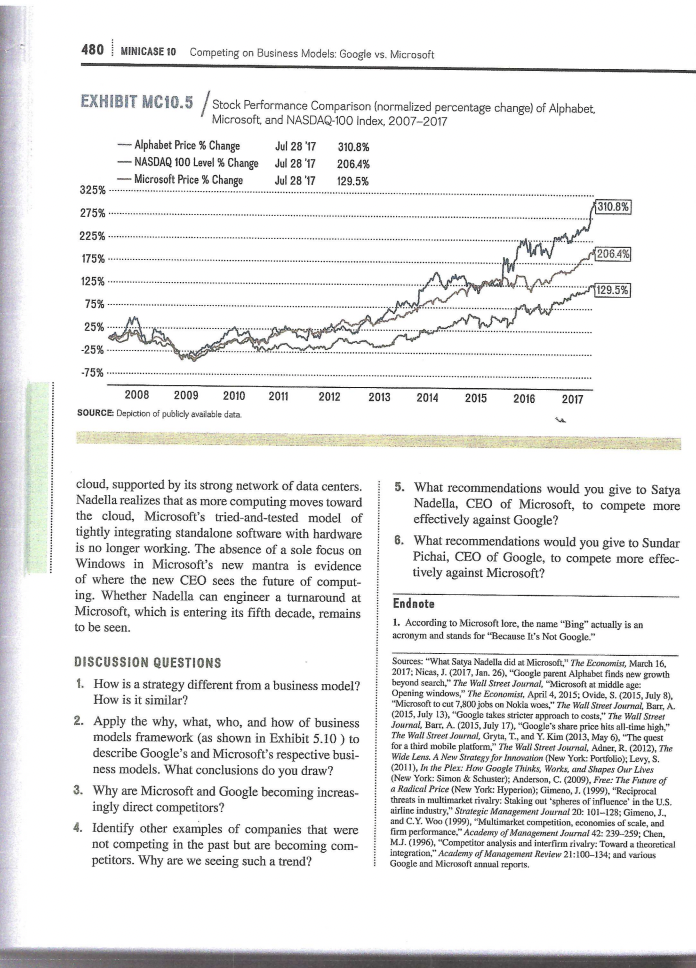

1. What is your assessment of the different business models being used by Google and Microsoft? 2. What recommendations would you give to Satya Nadella, CEO of Microsoft, to compete more effectively against Google? 3. What recommendations would you give to Sundar Pichai, CEO of Google, to compete more effectively against Microsoft? MiniCase 10 Competing on Business Models: Google vs. Microsoft RIVALS OFTEN USE different business models to com- pete with one another. Because of competitive dynam- ics and industry convergence, Google (since 2015 a subsidiary of Alphabet) and Microsoft progressively move on to the other's turf. In many areas, Google and Microsoft are now direct competitors. This represents multipoint competition, as Google and Microsoft are rivals in many different markets. Both companies are about the same size in terms of revenues. In 2016, Microsoft had $87 billion in revenues and Google $89.5 billion. In an attempt to manage its high degree of unrelated diversification more effectively, Google put in place a multidivisional structure overseen by Alphabet, a cor- porate holding company. Alphabet's 10 business units start with Google's core businesses (search, ads, apps, YouTube, Android, Chrome, and Google maps) in a single unit joined by Google X (artificial intelligence, high-altitude balloons providing global internet con- nectivity), Waymo (self-driving cars), Nest (smart homes), Access & Energy (broadband fiber services), Verily (life sciences, smart contact lenses), Calico (lon- gevity research), Side Walk Labs (urban innovation), Google Ventures (venture capital investments in early phase startups), and Google Capital (venture capital investments in later-stage startups, similar to corporate venture capital investments). (See Exhibit MC10.1.) This sweeping restructuring allows the sprawling conglomerate to separate its highly profitable search and advertising business from its "moon shots," such as providing wireless internet connectivity via high- altitude balloons or developing contact lenses that double as a computer monitor and provide real-time information to the wearer. Google continues to dominate the revenue streams for Alphabet-accounting for more than 99 percent of total revenues (see Exhibit MC10.2). Google is a standalone strategic business unit within Alphabet and has its own profit and loss responsibility. Google is run by CEO Sundar Pichai. Although Google started 476 Google Microsoft Sundar Pichai, Google CEO (top), and Satya Nadella, Microsoft CEO (bottom) (top) CAP Images/Tsering Topgyal (bottom): Justin Sullivan/Getty Images as an online search and advertising company, it now offers software applications (Google Docs, word pro- cessing, spreadsheet, e-mail, interactive calendar, and presentation software) hosted on the cloud (Google Drive), and also operating systems (Chrome OS for Frank T. Rothaermel prepared this MiniCase from public sources. He gratefully acknowledges research assistance by Amey Sahasrabuddhe. This MiniCase is developed for the purpose of class discussion. It is not intended to be used for any kind of endorsement, source of data, or depiction of efficient or inefficient management. All opinions expressed, all errors and omissions are entirely the author's. Revised and updated: June 1, 2017. OFrank T. Rothaermel. MINICASE 10 Competing on Business Models: Google vs. Microsoft 477 EXHIBIT MC10.1 Alphabet's Multidivisional Structure (M-form) with Its Strategic Business Units, including Google's Businesses ALPHABET GOOGLE Search Ads Apps YouTube Android Chrome Google Maps GOOGLE X WAYMO NEXT ACCESS & ENERGY Artificial intelligence High-altitude balloons providing global internet connectivity VERITY Life sciences CALICO SIDE WALKT LABS GOOGLE VENTURES Self-driving cars Smart homes Broadband fiber services Longevity research Urban innovation Smart contact lenses Venture capital investments in early phase startups - GOOGLE CAPITAL Venture capital investments in later-stage startups Corporate venture capital (CVC) investments the web and Android for mobile applications), among many other online products and services. In contrast, Microsoft began its life by offering an operating sys- tem (since 1985, called Windows), then moved into software applications with its Office Suite, and later into online search and advertising with Bing as well as gaming with Xbox One. Both also compete in mobile devices (with Microsoft being focused more on the business market). Since 2014, Microsoft has been run by CEO Satya Nadella. Given the companies' size combined with increas- ing multipoint competition, the stage is set for a clash 478 MINICASE 10 Competing on Business Models: Google vs. Microsoft EXHIBIT MC10.2/ Breakdown of Google's Revenues by Business Segment, ($ millions) 2014-2016 Revenues 014 201 2016 Google Properties $45,085 $52,357 $63,785 Google Network 14,539 15,033 15,598 Members Websites Total Advertising 59,624 67,390 79,383 Revenues Total Google 65,674 74,544 89,463 Revenues Other Business 327 445 Unit Revenues 809 90,272 Total Revenues 66,001 74,989 SOURCE: Tabulation of data from Alphabet annual reports (various years). of the technology titans. In spring 2017, Alphabet was the second most valuable technology company glob- ally, just behind Apple, but ahead of Microsoft, Ama- zon, and Facebook (in that order). In competing with each other, Google and Micro- soft pursue very different business models, as detailed in Exhibit MC10.3. Google offers its applications soft- ware Google Docs and hosting service Google Drive for free to entice and retain as many users as possible for its search engine. Google Drive follows a freemium pric- ing model, that is, a limited amount of data storage is free (15GB), while Google charges for additional stor- age space. Although Google's flagship search engine is free for the end user, it makes money from sponsored links by advertisers. The advertisers pay for the placement of their ad on the results page, and they pay each time a user clicks through an ad (which Google calls a "sponsored link"). Many billions of these mini-transactions add up to a substantial business. Google uses part of the profits earned from its lucrative online advertising business to subsidize Google Docs and other service offerings (see Exhibit MC10.2 and Exhibit MC10.3). Giving away products and services to induce widespread use allows Google to benefit from network effects-the increase in the value of a product or service as more people use it. Google can charge advertisers for highly targeted and effective ads, allowing it to subsidize other product offerings that compete directly with Microsoft. EXHIBIT MC10.3/Competing Business Models: Google vs. Microsoft Medium Cost for OEMs High Cost for Users Free for User (Loss Leader) -Windows Office Suite Bing Microsoft Operating Systems Software Online Apps Search Google SOURCE: Depiction of publicly available data. -Chrome OS & Android Google Docs - Google - Free for User Free for User -Free for User, High Cost for Advertisers MINICASE 10 Competing on Business Models: Google vs. Microsoft 479 Microsoft's business model, however, is almost the reverse of Google's (see the opposing arrows in Exhibit MC10.3). Initially, Microsoft focused on cre- ating a large installed base of users for its PC oper- ating system, Windows. It holds some 90 percent market share in operating system software for personal computers worldwide, although the PC has become less important as mobile devices have become more important in recent years. Yet, by 2017, the Windows and Office combination still generated about 40 per- cent of Microsoft's total revenues and 75 percent of its profits. Moreover, PC users are locked into a Micro- soft operating system that generally comes preloaded with the computer they purchase; they then want to buy applications that run seamlessly with the oper- ating system. The obvious choice for most users is Microsoft's Office Suite containing Word, Excel, PowerPoint, Outlook, and Access. Microsoft is work- ing hard to transition the Office revenues from the old business model of standalone software licenses ($150 for Office Home & Student) to repeat business via cloud-based subscriptions such as Office 365 Home & Student (which is $70 per year). Exhibit MC10.4 details Microsoft's revenues by business segment. Microsoft faces two immediate problems. The first is that people and businesses are buying fewer and fewer PCs (including both desktops and laptops) as personal and business computing move increasingly to EXHIBIT MC10.4/ Breakdown of Microsoft's Revenues by Business Segment, ($ millions) 2014-2016 Revenues 2014 2015 2016 Productivity $26,976 $26,430 $26,487 and Business Processes Intelligent Cloud More Personal 21,735 23,715 25,042 38,460 43,160 40,460 Computing Corporate and (338) Other Total Revenues 86,833 93,580 275 (6,669) 85,320 SOURCE: Tabulation of data from Microsoft annual reports (various years). mobile devices. The second is the increasing use of cloud-based rather than standalone PC-based comput- ing. The demand for Microsoft Office is driven by its installed base of Windows. The gross margin for the "classic" Office sitting on your computer is 90 percent, while that for the cloud-hosted Office 365 is only some 50 percent. To maximize the number of users that will upgrade from Windows 7 and the disappoint- ing Windows 8 to Windows 10 launched in summer 2015, users of current versions of the operating sys- tem will get a free upgrade. (Microsoft did not offer a Windows 9 version.) On top of the aforementioned problems, Microsoft wrote off almost $8 billion of its ill-fated $9.4 billion acquisition of smartphone maker Nokia, along with cutting some 8,000 jobs. As shown in Exhibit MC10.3, Microsoft uses the profits from its application software business to sub- sidize its search engine Bing, which-just like Google Docs is a free product for the end user. Given Bing's relatively small market share, however, and the tremen- dous cost of developing the search engine, Microsoft, unlike Google, does not make any money from its online search offering; rather, it is a big money loser. The logic behind Bing is to provide a countervailing power to Google's dominant position in online search. The logic behind Google Docs is to create a threat to Microsoft's dominant position in applica- tion software. The computing industry is undergoing a shift away from personal computers to mobile devices and cloud-based computing. Google holds more than 80 percent market share in mobile operating systems software with Android, while Microsoft's market share has shrunk to less than 1 percent. Taken together, Google and Microsoft compete with one another for market share in several product categories through quite different business models. As shown in MC10.5, the stock market has valued Google's business model much more highly over the past decade (over 300 percent appreciation, com- pared to Microsoft's 130 percent appreciation). Also noteworthy is that Google has outperformed the tech- heavy NASDAQ-100 stock market index by a fairly wide margin, while Microsoft has underperformed it. Google was able to gain and sustain a competitive advantage over Microsoft. Under CEO Satya Nadella, Microsoft is attempt- ing to reinvent itself with a new "mobile first, cloud first" strategy. Microsoft is shifting quickly from being a Windows-only firm to a company offering diversified online services to its customers via the 480 MINICASE 10 Competing on Business Models: Google vs. Microsoft EXHIBIT MC10.5 Stock Performance Comparison (normalized percentage change) of Alphabet, Microsoft, and NASDAQ-100 Index, 2007-2017 - Alphabet Price % Change Jul 28 '17 310.8% -NASDAQ 100 Level % Change Jul 28 '17 206.4% - -Microsoft Price % Change Jul 28 '17 129.5% 325% 275% 225% 175% 125% 75% 25% -25% -75% 2008 2009 310.8% 206.4% 129.5% www 2010 2011 2012 2013 2014 2015 2016 2017 SOURCE: Depiction of publicly available data. cloud, supported by its strong network of data centers. Nadella realizes that as more computing moves toward the cloud, Microsoft's tried-and-tested model of tightly integrating standalone software with hardware is no longer working. The absence of a sole focus on Windows in Microsoft's new mantra is evidence of where the new CEO sees the future of comput- ing. Whether Nadella can engineer a turnaround at Microsoft, which is entering its fifth decade, remains to be seen. DISCUSSION QUESTIONS 1. How is a strategy different from a business model? How is it similar? 2. Apply the why, what, who, and how of business models framework (as shown in Exhibit 5.10 ) to describe Google's and Microsoft's respective busi- ness models. What conclusions do you draw? 3. Why are Microsoft and Google becoming increas- ingly direct competitors? 4. Identify other examples of companies that were not competing in the past but are becoming com- petitors. Why are we seeing such a trend? 5. What recommendations would you give to Satya Nadella, CEO of Microsoft, to compete more effectively against Google? 6. What recommendations would you give to Sundar Pichai, CEO of Google, to compete more effec- tively against Microsoft? Endnote 1. According to Microsoft lore, the name "Bing" actually is an acronym and stands for "Because It's Not Google." Sources: "What Satya Nadella did at Microsoft," The Economist, March 16, 2017: Nicas, J. (2017, Jan. 26), "Google parent Alphabet finds new growth beyond search," The Wall Street Journal, "Microsoft at middle age: Opening windows," The Economist, April 4, 2015; Ovide, S. (2015, July 8), "Microsoft to cut 7,800 jobs on Nokia woes," The Wall Street Journal, Barr, A. (2015, July 13), "Google takes stricter approach to costs," The Wall Street Journal, Barr, A. (2015, July 17). "Google's share price hits all-time high," The Wall Street Journal, Gryta, T., and Y. Kim (2013, May 6), "The quest for a third mobile platform," The Wall Street Journal, Adner, R. (2012), The Wide Lens. A New Strategy for Innovation (New York: Portfolio); Levy, S. (2011), In the Plex: How Google Thinks, Works, and Shapes Our Lives (New York: Simon & Schuster); Anderson, C. (2009), Free: The Future of a Radical Price (New York: Hyperion); Gimeno, J. (1999), "Reciprocal threats in multimarket rivalry: Staking out 'spheres of influence' in the U.S. airline industry," Strategic Management Journal 20: 101-128; Gimeno, J., and C.Y. Woo (1999), "Multimarket competition, economies of scale, and firm performance." Academy of Management Journal 42: 239-259; Chen, M.J. (1996), "Competitor analysis and interfirm rivalry: Toward a theoretical integration," Academy of Management Review 21:100-134; and various Google and Microsoft annual reports.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started