Answered step by step

Verified Expert Solution

Question

1 Approved Answer

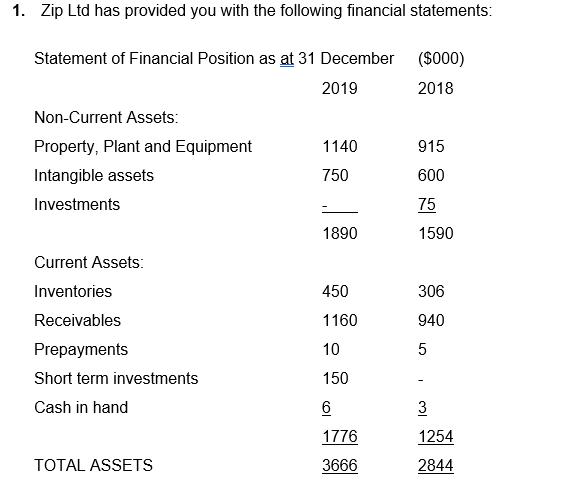

1. Zip Ltd has provided you with the following financial statements: Statement of Financial Position as at 31 December ($000) 2019 2018 Non-Current Assets:

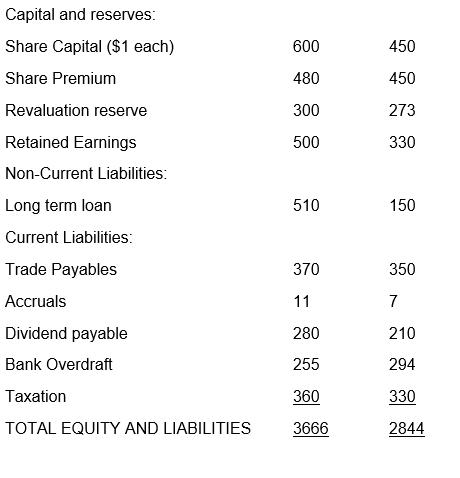

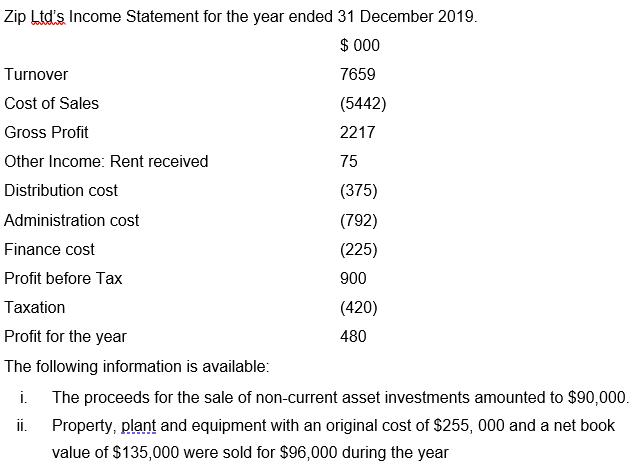

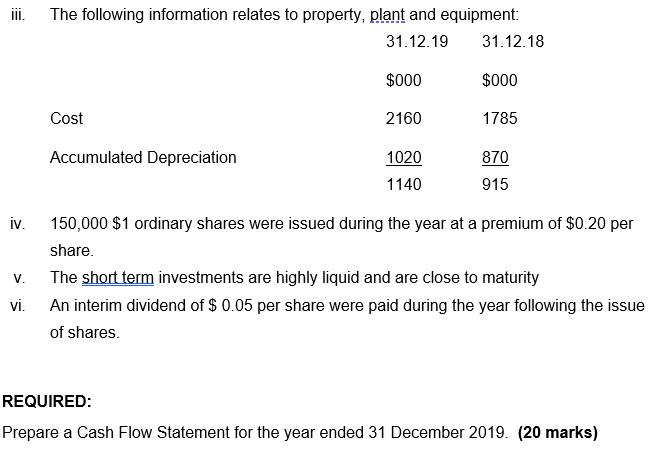

1. Zip Ltd has provided you with the following financial statements: Statement of Financial Position as at 31 December ($000) 2019 2018 Non-Current Assets: Property, Plant and Equipment 1140 915 Intangible assets 750 600 Investments 75 1890 1590 Current Assets: Inventories 450 306 Receivables 1160 940 Prepayments 10 Short term investments 150 Cash in hand 6 3 1776 1254 TOTAL ASSETS 3666 2844 LO Capital and reserves: Share Capital ($1 each) 600 450 Share Premium 480 450 Revaluation reserve 300 273 Retained Earnings 500 330 Non-Current Liabilities: Long term loan 510 150 Current Liabilities: Trade Payables 370 350 Accruals 11 7 Dividend payable 280 210 Bank Overdraft 255 294 Taxation 360 330 TOTAL EQUITY AND LIABILITIES 3666 2844 Zip Ltd's Income Statement for the year ended 31 December 2019. $ 000 Turnover 7659 Cost of Sales (5442) Gross Profit 2217 Other Income: Rent received 75 Distribution cost (375) Administration cost (792) Finance cost (225) Profit before Tax 900 Taxation (420) Profit for the year 480 The following information is available: i. The proceeds for the sale of non-current asset investments amounted to $90,000. i. Property, plant and equipment with an original cost of $255, 000 and a net book value of $135,000 were sold for $96,000 during the year iii. The following information relates to property, plant and equipment: 31.12.19 31.12.18 $000 $000 Cost 2160 1785 Accumulated Depreciation 1020 870 1140 915 iv. 150,000 $1 ordinary shares were issued during the year at a premium of $0.20 per share. The short term investments are highly liquid and are close to maturity V. vi. An interim dividend of $ 0.05 per share were paid during the year following the issue of shares. REQUIRED: Prepare a Cash Flow Statement for the year ended 31 December 2019. (20 marks)

Step by Step Solution

★★★★★

3.43 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Cash flow from operating activities Difference in retained earnings 170 Add Provision for tax 420 Ad...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started