Question

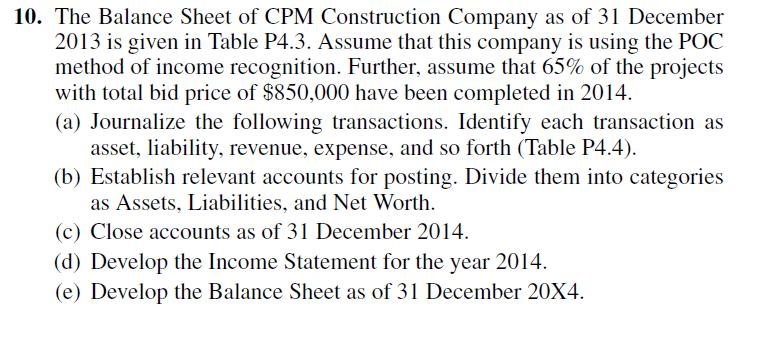

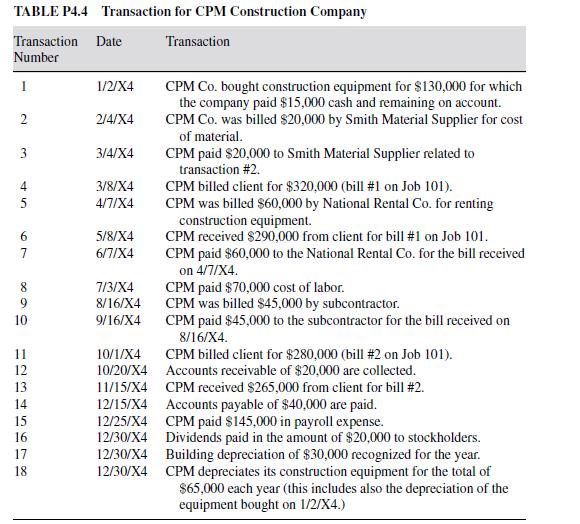

10. The Balance Sheet of CPM Construction Company as of 31 December 2013 is given in Table P4.3. Assume that this company is using

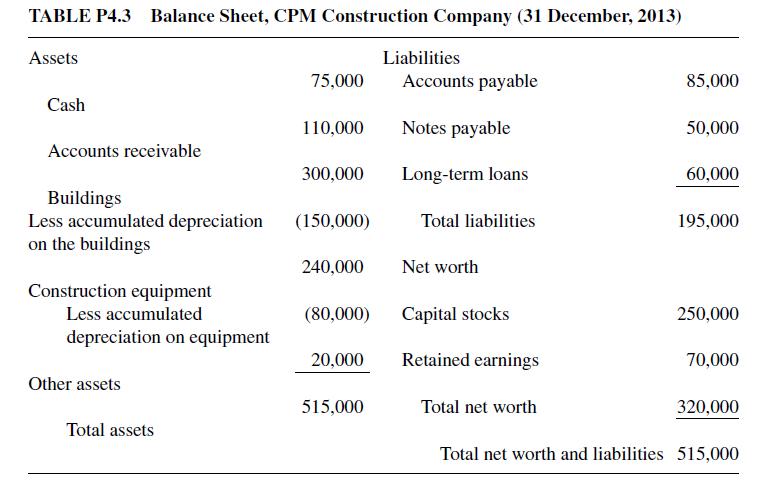

10. The Balance Sheet of CPM Construction Company as of 31 December 2013 is given in Table P4.3. Assume that this company is using the POC method of income recognition. Further, assume that 65% of the projects with total bid price of $850,000 have been completed in 2014. (a) Journalize the following transactions. Identify each transaction as asset, liability, revenue, expense, and so forth (Table P4.4). (b) Establish relevant accounts for posting. Divide them into categories as Assets, Liabilities, and Net Worth. (c) Close accounts as of 31 December 2014. (d) Develop the Income Statement for the year 2014. (e) Develop the Balance Sheet as of 31 December 20X4. TABLE P4.3 Balance Sheet, CPM Construction Company (31 December, 2013) Assets Cash Accounts receivable Buildings Less accumulated depreciation on the buildings Construction equipment Less accumulated depreciation on equipment Other assets Total assets 75,000 110,000 300,000 (150,000) 240,000 (80,000) 20,000 515,000 Liabilities Accounts payable Notes payable Long-term loans Total liabilities Net worth Capital stocks Retained earnings Total net worth 85,000 50,000 60,000 195,000 250,000 70,000 320,000 Total net worth and liabilities 515,000 TABLE P4.4 Transaction for CPM Construction Company Transaction Date Transaction Number 1 2 3 45 5 6 7 890 10 1113145516718 12 1/2/X4 2/4/X4 3/4/X4 3/8/X4 4/7/X4 5/8/X4 6/7/X4 7/3/X4 8/16/X4 9/16/X4 CPM Co. bought construction equipment for $130,000 for which the company paid $15,000 cash and remaining on account. CPM Co. was billed $20,000 by Smith Material Supplier for cost of material. CPM paid $20,000 to Smith Material Supplier related to transaction #2. CPM billed client for $320,000 (bill #1 on Job 101). CPM was billed $60,000 by National Rental Co. for renting construction equipment. CPM received $290,000 from client for bill #1 on Job 101. CPM paid $60,000 to the National Rental Co. for the bill received on 4/7/X4. CPM paid $70,000 cost of labor. CPM was billed $45,000 by subcontractor. CPM paid $45,000 to the subcontractor for the bill received on 8/16/X4. 10/1/X4 CPM billed client for $280,000 (bill # 2 on Job 101). 10/20/X4 Accounts receivable of $20,000 are collected. 11/15/X4 CPM received $265,000 from client for bill #2. 12/15/X4 Accounts payable of $40,000 are paid. 12/25/X4 CPM paid $145,000 in payroll expense. 12/30/X4 Dividends paid in the amount of $20,000 to stockholders. 12/30/X4 Building depreciation of $30,000 recognized for the year. 12/30/X4 CPM depreciates its construction equipment for the total of $65,000 each year (this includes also the depreciation of the equipment bought on 1/2/X4.)

Step by Step Solution

3.32 Ratings (101 Votes)

There are 3 Steps involved in it

Step: 1

a Establish relevant accounts for posting Divide them into categories as Assets Liabilities and Net Worth TransNo Date Name of the account DebitCredit ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started