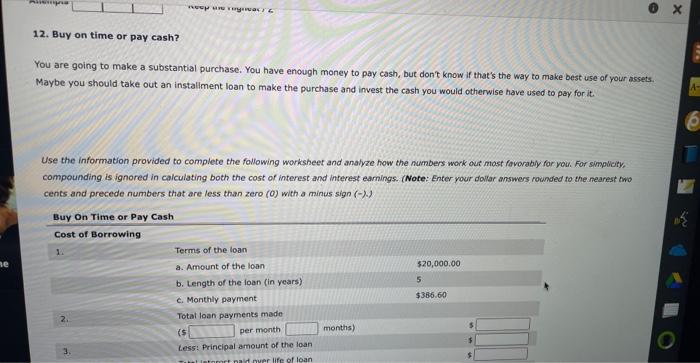

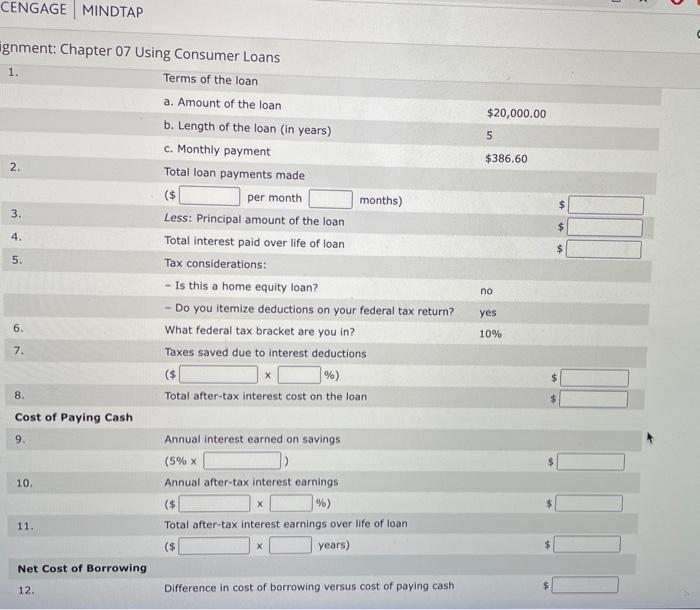

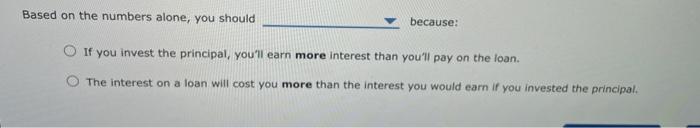

12. Buy on time or pay cash? You are going to make a substantial purchase. You have enough money to pay cash, but don't know if that's the way to make best use of your assets. Maybe you should take out an installment loan to make the purchase and invest the cash you would otherwise have used to pay for it: Use the information provided to complete the following worksheet and analize how the numbers work out most fovorabiy for you. For simplitity. compounding is ignored in calculating both the cost of interest and interest eamings. (Note: Enter your dallar answers rounded to the nearest owo cents and precede numbers that are less than zero (0) with o minus sign (). CENGAGE MINDTAP ignment: Chapter 07 Using Consumer Loans 1. Terms of the loan \begin{tabular}{ll} & a. Amount of the loan \\ b. Length of the loan (in years) \\ c. Monthly payment \\ 2. & Total loan payments made \\ \hline & (\$) pess: Principal amount of the loan \end{tabular} 9.10.Annualinterestearnedonsavings(5%)Annualafter-taxinterestearnings($ 11. Total after-tax interest earnings over iffe of loan ($ years ) Net Cost of Borrowing 12. Difference in cost of borrowing versus cost of paying cash $ Based on the numbers alone, you should because: If you invest the principal, you'll earn more interest than you'll pay on the loan. The interest on a loan will cost you more than the interest you would earn if you invested the principal. 12. Buy on time or pay cash? You are going to make a substantial purchase. You have enough money to pay cash, but don't know if that's the way to make best use of your assets. Maybe you should take out an installment loan to make the purchase and invest the cash you would otherwise have used to pay for it: Use the information provided to complete the following worksheet and analize how the numbers work out most fovorabiy for you. For simplitity. compounding is ignored in calculating both the cost of interest and interest eamings. (Note: Enter your dallar answers rounded to the nearest owo cents and precede numbers that are less than zero (0) with o minus sign (). CENGAGE MINDTAP ignment: Chapter 07 Using Consumer Loans 1. Terms of the loan \begin{tabular}{ll} & a. Amount of the loan \\ b. Length of the loan (in years) \\ c. Monthly payment \\ 2. & Total loan payments made \\ \hline & (\$) pess: Principal amount of the loan \end{tabular} 9.10.Annualinterestearnedonsavings(5%)Annualafter-taxinterestearnings($ 11. Total after-tax interest earnings over iffe of loan ($ years ) Net Cost of Borrowing 12. Difference in cost of borrowing versus cost of paying cash $ Based on the numbers alone, you should because: If you invest the principal, you'll earn more interest than you'll pay on the loan. The interest on a loan will cost you more than the interest you would earn if you invested the principal