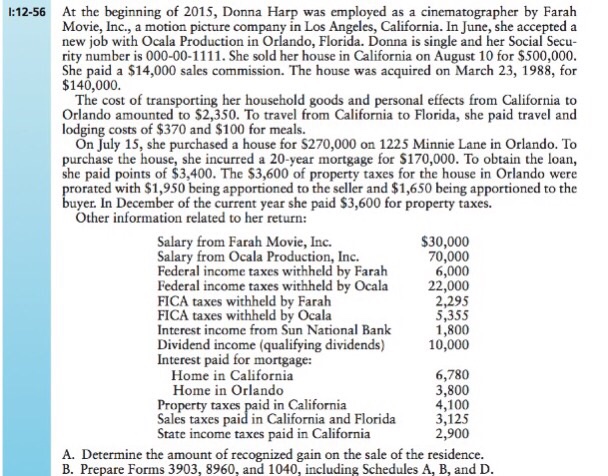

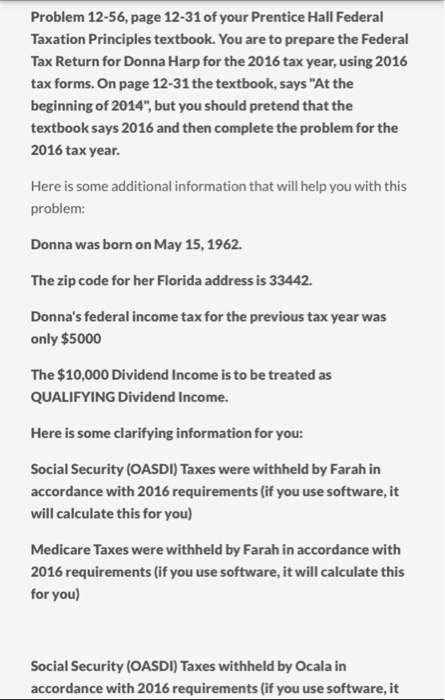

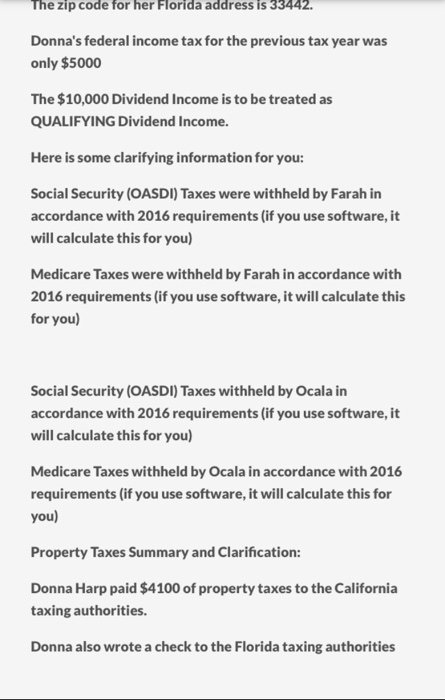

12-56 At the beginning of 2015, Donna Harp was employed as a cinematographer by Farah Movie, Inc., a motion picture company in Los Angeles, California. In June, she accepted a new job with Ocala Production in Orlando, Florida. Donna is single and her Social Secu rity number is 000-00-1111. She sold her house in California on August 10 for $500,000. She paid a $14,000 sales commission. The house was acquired on March 23, 1988, for $140,000. The cost of transporting her household goods and personal effects from California to Orlando amounted to $2,350. To travel from California to Florida, she paid travel and lodging costs of $370 and $100 for meals. On July 15, she purchased a house for S270,000 on 1225 Minnie Lane in Orlando. To purchase the house, she incurred a 20-year mortgage for S170,000. To obtain the loan, she paid points of $3,400. The S3,600 of property taxes for the house in Orlando were rorated with $1,950 being apportioned to the seller and $1,650 being apportioned to the uyer in of the year she paid S3,600 for property taxes. Other information related to her return: Salary from Farah Movie, Inc. $30,000 Salary from Ocala Production, Inc. 70,000 Federal income taxes withheld by Farah 6,000 Federal income taxes withheld by Ocala 22,000 FICA taxes withheld by Farah FICA taxes withheld by 2,295 5,355 Interest income from Sun National Bank 1,800 Dividend income (qualifying dividends 10,000 Interest paid for mortgage: Home in California 6,780 Home in Orlando 3,800 Property taxes paid in California 4,100 Sales taxes paid in California and Florida 3,125 State income taxes paid in California 2,900 A. Determine the amount of recognized gain on the sale of the residence. B. Prepare Forms 3903, 8960, and 1040, including Schedules A B, and D. 12-56 At the beginning of 2015, Donna Harp was employed as a cinematographer by Farah Movie, Inc., a motion picture company in Los Angeles, California. In June, she accepted a new job with Ocala Production in Orlando, Florida. Donna is single and her Social Secu rity number is 000-00-1111. She sold her house in California on August 10 for $500,000. She paid a $14,000 sales commission. The house was acquired on March 23, 1988, for $140,000. The cost of transporting her household goods and personal effects from California to Orlando amounted to $2,350. To travel from California to Florida, she paid travel and lodging costs of $370 and $100 for meals. On July 15, she purchased a house for S270,000 on 1225 Minnie Lane in Orlando. To purchase the house, she incurred a 20-year mortgage for S170,000. To obtain the loan, she paid points of $3,400. The S3,600 of property taxes for the house in Orlando were rorated with $1,950 being apportioned to the seller and $1,650 being apportioned to the uyer in of the year she paid S3,600 for property taxes. Other information related to her return: Salary from Farah Movie, Inc. $30,000 Salary from Ocala Production, Inc. 70,000 Federal income taxes withheld by Farah 6,000 Federal income taxes withheld by Ocala 22,000 FICA taxes withheld by Farah FICA taxes withheld by 2,295 5,355 Interest income from Sun National Bank 1,800 Dividend income (qualifying dividends 10,000 Interest paid for mortgage: Home in California 6,780 Home in Orlando 3,800 Property taxes paid in California 4,100 Sales taxes paid in California and Florida 3,125 State income taxes paid in California 2,900 A. Determine the amount of recognized gain on the sale of the residence. B. Prepare Forms 3903, 8960, and 1040, including Schedules A B, and D