Answered step by step

Verified Expert Solution

Question

1 Approved Answer

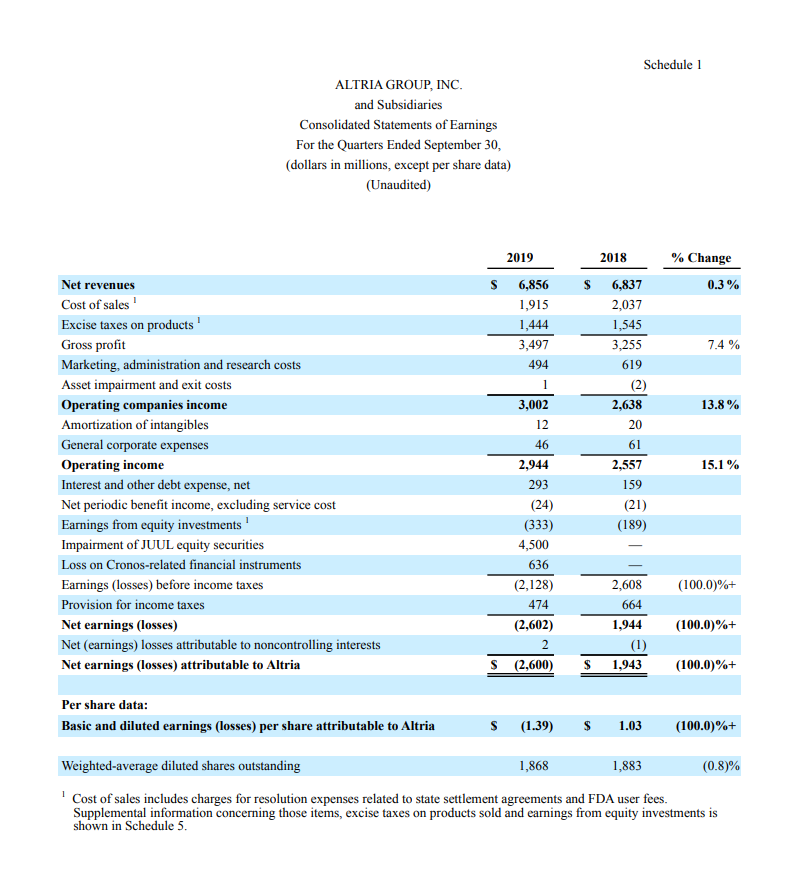

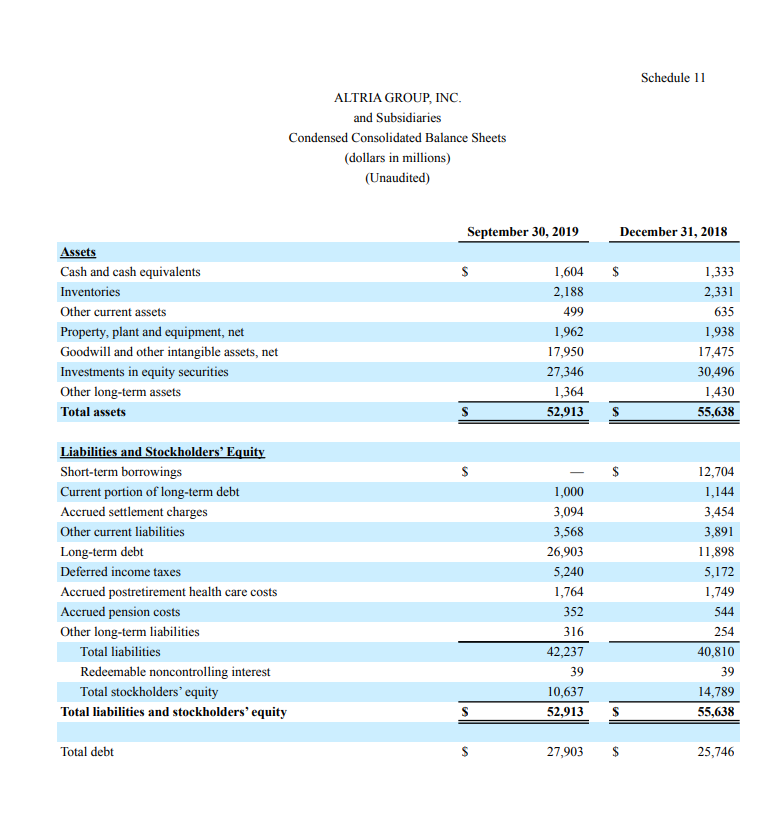

1)Note that certain expenses are not deductible for tax purposes. This is why Altria reported an income tax provision (i.e. expense) for the third quarter,

1)Note that certain expenses are not deductible for tax purposes. This is why Altria reported an income tax provision (i.e. expense) for the third quarter, even though they had negative pre-tax income. Which expense do you think was not deductible?

2)Reconstruct the journal entry that led to the large loss. Hint: look at the balance sheet.

Schedule 1 ALTRIA GROUP, INC. and Subsidiaries Consolidated Statements of Earnings For the Quarters Ended September 30, (dollars in millions, except per share data) (Unaudited) 2019 2018 % Change $ $ 0.3% 6,856 1,915 1,444 3,497 494 7.4% 3,002 6,837 2,037 1,545 3,255 619 (2) 2,638 20 61 2,557 159 (21) (189) 13.8% 12 46 2,944 Net revenues Cost of sales Excise taxes on products Gross profit Marketing, administration and research costs Asset impairment and exit costs Operating companies income Amortization of intangibles General corporate expenses Operating income Interest and other debt expense, net Net periodic benefit income, excluding service cost Earnings from equity investments Impairment of JUUL equity securities Loss on Cronos-related financial instruments Earnings (losses) before income taxes Provision for income taxes Net earnings (losses) Net (earnings) losses attributable to noncontrolling interests Net earnings (losses) attributable to Altria 15.1% 293 (24) (333) 4,500 636 (2,128) 474 (2,602) (100.0%+ 2,608 664 1,944 (100.0%+ (1) S (2,600) $ 1,943 (100.0%+ Per share data: Basic and diluted earnings (losses) per share attributable to Altria S (1.39) $ 1.03 (100.0%+ Weighted average diluted shares outstanding 1,868 1,883 (0.8)% Cost of sales includes charges for resolution expenses related to state settlement agreements and FDA user fees. Supplemental information concerning those items, excise taxes on products sold and earnings from equity investments is shown in Schedule 5. Schedule 11 ALTRIA GROUP, INC. and Subsidiaries Condensed Consolidated Balance Sheets (dollars in millions) (Unaudited) September 30, 2019 December 31, 2018 $ Assets Cash and cash equivalents Inventories Other current assets Property, plant and equipment, net Goodwill and other intangible assets, net Investments in equity securities Other long-term assets Total assets 1,604 2,188 499 1,962 17,950 27,346 1,364 52,913 1,333 2,331 635 1,938 17,475 30,496 1,430 55,638 S $ $ $ Liabilities and Stockholders' Equity Short-term borrowings Current portion of long-term debt Accrued settlement charges Other current liabilities Long-term debt Deferred income taxes Accrued postretirement health care costs Accrued pension costs Other long-term liabilities Total liabilities Redeemable noncontrolling interest Total stockholders' equity Total liabilities and stockholders' equity - 1,000 3,094 3,568 26,903 5,240 1,764 352 316 42,237 12,704 1,144 3,454 3,891 11,898 5,172 1,749 544 254 40,810 39 39 10,637 52,913 14,789 55,638 S S Total debt 27,903 $ 25,746 Schedule 1 ALTRIA GROUP, INC. and Subsidiaries Consolidated Statements of Earnings For the Quarters Ended September 30, (dollars in millions, except per share data) (Unaudited) 2019 2018 % Change $ $ 0.3% 6,856 1,915 1,444 3,497 494 7.4% 3,002 6,837 2,037 1,545 3,255 619 (2) 2,638 20 61 2,557 159 (21) (189) 13.8% 12 46 2,944 Net revenues Cost of sales Excise taxes on products Gross profit Marketing, administration and research costs Asset impairment and exit costs Operating companies income Amortization of intangibles General corporate expenses Operating income Interest and other debt expense, net Net periodic benefit income, excluding service cost Earnings from equity investments Impairment of JUUL equity securities Loss on Cronos-related financial instruments Earnings (losses) before income taxes Provision for income taxes Net earnings (losses) Net (earnings) losses attributable to noncontrolling interests Net earnings (losses) attributable to Altria 15.1% 293 (24) (333) 4,500 636 (2,128) 474 (2,602) (100.0%+ 2,608 664 1,944 (100.0%+ (1) S (2,600) $ 1,943 (100.0%+ Per share data: Basic and diluted earnings (losses) per share attributable to Altria S (1.39) $ 1.03 (100.0%+ Weighted average diluted shares outstanding 1,868 1,883 (0.8)% Cost of sales includes charges for resolution expenses related to state settlement agreements and FDA user fees. Supplemental information concerning those items, excise taxes on products sold and earnings from equity investments is shown in Schedule 5. Schedule 11 ALTRIA GROUP, INC. and Subsidiaries Condensed Consolidated Balance Sheets (dollars in millions) (Unaudited) September 30, 2019 December 31, 2018 $ Assets Cash and cash equivalents Inventories Other current assets Property, plant and equipment, net Goodwill and other intangible assets, net Investments in equity securities Other long-term assets Total assets 1,604 2,188 499 1,962 17,950 27,346 1,364 52,913 1,333 2,331 635 1,938 17,475 30,496 1,430 55,638 S $ $ $ Liabilities and Stockholders' Equity Short-term borrowings Current portion of long-term debt Accrued settlement charges Other current liabilities Long-term debt Deferred income taxes Accrued postretirement health care costs Accrued pension costs Other long-term liabilities Total liabilities Redeemable noncontrolling interest Total stockholders' equity Total liabilities and stockholders' equity - 1,000 3,094 3,568 26,903 5,240 1,764 352 316 42,237 12,704 1,144 3,454 3,891 11,898 5,172 1,749 544 254 40,810 39 39 10,637 52,913 14,789 55,638 S S Total debt 27,903 $ 25,746Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started