Answered step by step

Verified Expert Solution

Question

1 Approved Answer

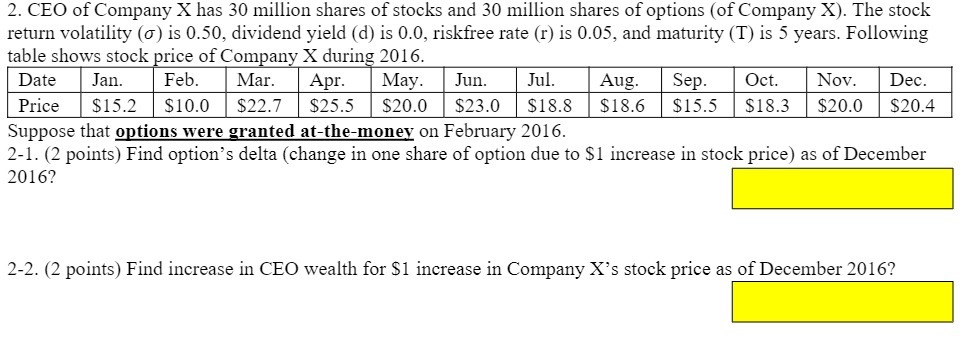

2. CEO of Company X has 30 million shares of stocks and 30 million shares of options (of Company X). The stock return volatility

2. CEO of Company X has 30 million shares of stocks and 30 million shares of options (of Company X). The stock return volatility (o) is 0.50, dividend yield (d) is 0.0, riskfree rate (r) is 0.05, and maturity (T) is 5 years. Following table shows stock price of Company X during 2016. Date Jan. Feb. Jul. Aug. Sep. Oct. Nov. Dec. $18.8 $18.6 $15.5 $18.3 $20.0 $20.4 Mar. Apr. May. Jun. Price $15.2 $10.0 $22.7 $25.5 $20.0 $23.0 Suppose that options were granted at-the-money on February 2016. 2-1. (2 points) Find option's delta (change in one share of option due to $1 increase in stock price) as of December 2016? 2-2. (2 points) Find increase in CEO wealth for $1 increase in Company X's stock price as of December 2016?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

21 To find the option delta as of December 2016 Options ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started