Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2013, 31, Oh DEcemBer year 2015. for Carmack Company has credit sales of $2.6 million Problem 8-4A Aging accounts receivable and accounting for bad debts

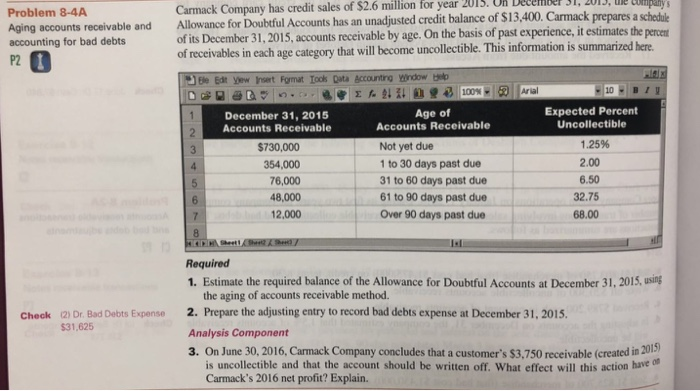

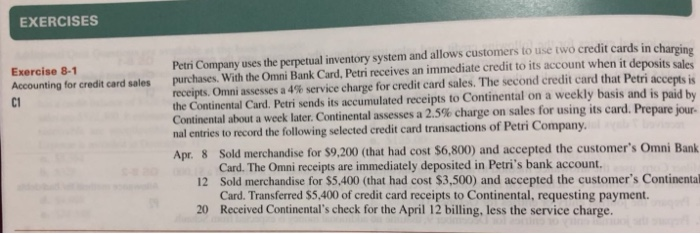

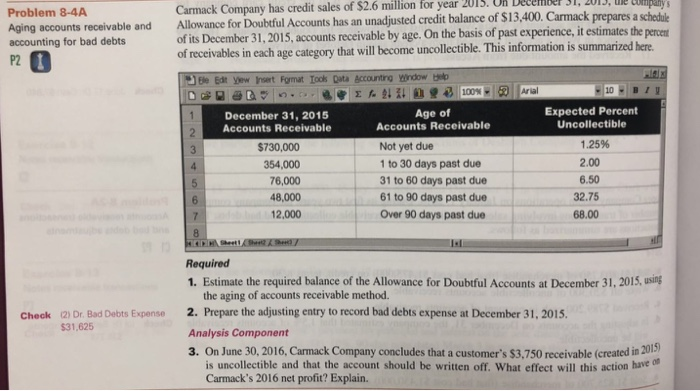

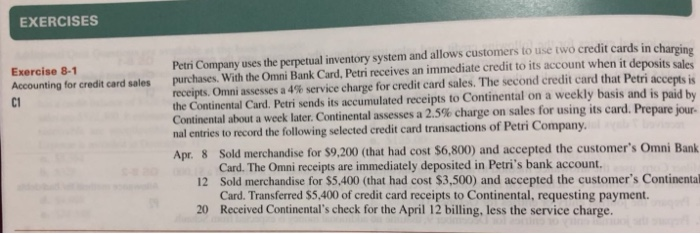

2013, 31, Oh DEcemBer year 2015. for Carmack Company has credit sales of $2.6 million Problem 8-4A Aging accounts receivable and accounting for bad debts P2 credit balance of $13,400. Carmack prepares a schedule ercent Allowance for Doubtful Accounts has an unadjusted of its December 31, 2015, accounts recei of past experience, it estimates the vable by age. On the basis of receivables in each age category that will become uncollectible. This information is summarized here Expected Percent Uncollectible Age of December 31, 2015 Accounts Receivable Accounts Receivable Not yet due to 30 days past due 31 to 60 days past due 61 to 90 days past due Over 90 days past due 1.25% $730,000 354,000 76,000 48,000 2,000 2.00 6.50 32.75 68.00 I.l Required 1. Estimate the required balance of the Allowance for Doubtful Accounts at December 31, 2015, using the aging of accounts receivable method. 2. Prepare the adjusting entry to record bad debts expense at December 31, 2015. Analysis Component 3. On June 30, 2016, Carmack Company concludes that a customer's $3,750 receivable (created in 201 12) Dr. Bad Debts Expense $31,625 Check is uncollectible and that the account should be written off. What effect will this action have of Carmack's 2016 net profit? Explain. EXERCISES purchases. With the Omni Bank Card, Petri receives an immediate credit to its account when it deposits sales epts is Petri Company uses the perpetual inventory system and allows customers to use two credit cards in chargine Exercise 8-1 receipts. Omni assesses a 4% service charge for credit card sales. The second credit card that Petri acc the Continental Card. Petri sends its accumulated receipts to Continental on a weekly basis and is paid by Continental about a week later. Continental assesses a 2.5% charge on salesfor using its can prepare yu. nal entries to record the following selected credit card transactions of Petri Company Apr. 8 Sold merchandise for $9,200 (that had cost $6,800) and accepted the customer's Omni Bank Accounting for credit card sales C1 Card. The Omni receipts are immediately deposited in Petri's bank account. 12 Sold merchandise for $5,400 (that had cost $3,500) and accepted the customer's Continental Card. Transferred $5,400 of credit card receipts to Continental, requesting payment. Received Continental's check for the April 12 billing, less the service charge. 20

2013, 31, Oh DEcemBer year 2015. for Carmack Company has credit sales of $2.6 million Problem 8-4A Aging accounts receivable and accounting for bad debts P2 credit balance of $13,400. Carmack prepares a schedule ercent Allowance for Doubtful Accounts has an unadjusted of its December 31, 2015, accounts recei of past experience, it estimates the vable by age. On the basis of receivables in each age category that will become uncollectible. This information is summarized here Expected Percent Uncollectible Age of December 31, 2015 Accounts Receivable Accounts Receivable Not yet due to 30 days past due 31 to 60 days past due 61 to 90 days past due Over 90 days past due 1.25% $730,000 354,000 76,000 48,000 2,000 2.00 6.50 32.75 68.00 I.l Required 1. Estimate the required balance of the Allowance for Doubtful Accounts at December 31, 2015, using the aging of accounts receivable method. 2. Prepare the adjusting entry to record bad debts expense at December 31, 2015. Analysis Component 3. On June 30, 2016, Carmack Company concludes that a customer's $3,750 receivable (created in 201 12) Dr. Bad Debts Expense $31,625 Check is uncollectible and that the account should be written off. What effect will this action have of Carmack's 2016 net profit? Explain. EXERCISES purchases. With the Omni Bank Card, Petri receives an immediate credit to its account when it deposits sales epts is Petri Company uses the perpetual inventory system and allows customers to use two credit cards in chargine Exercise 8-1 receipts. Omni assesses a 4% service charge for credit card sales. The second credit card that Petri acc the Continental Card. Petri sends its accumulated receipts to Continental on a weekly basis and is paid by Continental about a week later. Continental assesses a 2.5% charge on salesfor using its can prepare yu. nal entries to record the following selected credit card transactions of Petri Company Apr. 8 Sold merchandise for $9,200 (that had cost $6,800) and accepted the customer's Omni Bank Accounting for credit card sales C1 Card. The Omni receipts are immediately deposited in Petri's bank account. 12 Sold merchandise for $5,400 (that had cost $3,500) and accepted the customer's Continental Card. Transferred $5,400 of credit card receipts to Continental, requesting payment. Received Continental's check for the April 12 billing, less the service charge. 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started